Gold Price Analysis: XAU/USD stays pressured below $1,806 on firmer Treasury yields– Confluence Detector

Gold prints three-day losing streak despite recent bounce-off intraday low around $1,794 to $1,797.63, down 0.28% on a day, during early Thursday. In doing so, the yellow metal fails to cheer the US dollar weakness, also the market optimism portrayed by the stock futures, as bond yields across the globe, mainly in the West remain on the front foot.

Following the central bankers’ failed efforts to tame the bond bears, gold buyers have rather changed their minds to join the rally in the Treasury yields than to stick to the bullion as the safe-haven. That said, US Treasury yields are currently near the one-year top while those from Australia and New Zealand are at the highest levels since May 2019.

While the Fed policymakers and the RBNZ members were the latest to suggest further easy money and bolster market sentiment, upbeat vaccine news concerning Moderna and Pfizer-BioNtech offered an extra boost to the trading sentiment.

Even so, traders are cautious ahead of today’s preliminary reading of the US Q4 GDP.

Read: US January Durable Goods and Q4 GDP Preview: Consumers worry but they spend

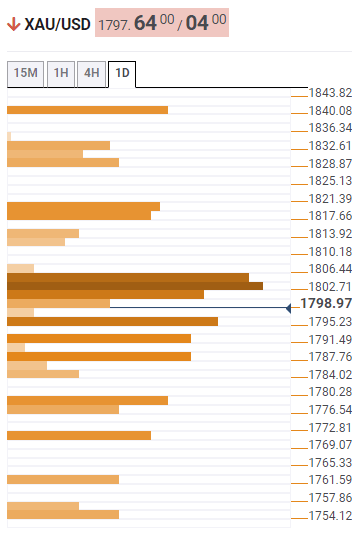

Gold: Key levels to watch

The Technical Confluences Indicator suggests the uphill battle for the gold prices unless providing a clear break above $1,807 as multiple hurdles test the bulls.

Among them, Fibonacci 61.8% on daily (1D) and weekly (1W) formations join the middle band of the four-hour (4H) Bollinger and SMA100 on 15M guard the immediate upside $1,803.

Following that, the previous month’s low, SMA 10 on 4H and prior top of 4H can test the gold buyers, around $1,806.50.

If at all, the bullion prices cross the $1,807 upside barrier, the upper band of the Bollinger on 4H and first resistance on a weekly pivot, near $1,820 will be in the spotlight.

Alternatively, multiple lows around $1,795 can offer nearby support to the precious metal during further weakness.

Also likely to check the short-term gold sellers are 23.6% Fibonacci retracement on 1D and 38.2% Fibonacci retracement on 1W, respectively around $1,791 and $1,788.

In a case where the commodity crosses the bumpy road to the south, the first support on the monthly pivot close to $1,778 should return to the charts.

Overall, gold is up for further weakness but bears don’t have much to cheer.

Here is how it looks on the tool

About Confluence Detector

The TCI (Technical Confluences Indicator) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.