Gold Price Analysis: XAU/USD jumps 1% to fresh monthly high above $1880 amid USD sell-off

- DXY sell-off extends amid US stimulus optimism, boosts gold.

- Dovish Fed also offers fresh zest to the XAU bulls.

- All eyes on stimulus talks and US jobs data for fresh impetus.

Gold (XAU/USD) has quickly retraced from fresh monthly highs of $1883, although remains strongly bid amid persistent weakness in the US dollar across the board.

Progress on a potential US fiscal stimulus deal dented the US dollar’s safe-haven allure, bolstering gold’s big break above the $1850 level. Also, adding to gold’s upside is the Fed’s pledge to continue its bond purchase program until its inflation and employment objectives are achieved.

Ample liquidity in the markets renders positive for gold, as it perks up the demand for the metal as a hedge against inflation and currency debasement.

Also, its worth noting that the US real yields have resumed their declining trend, strengthening the bullish case for gold.

“The 10-year real yield fell to -0.98% on Monday, having started the month at -0.89%, according to data provided by the US Department of The Treasury. The nine-basis point decline in the US real yield seems to have put a bid under the yellow metal this month,” FXStreet’s Analyst Omkar Godbole explained.

Looking ahead, the bright metal will remain at the mercy of the dollar dynamics and the market mood while awaiting the US stimulus updates and weekly jobless claims data.

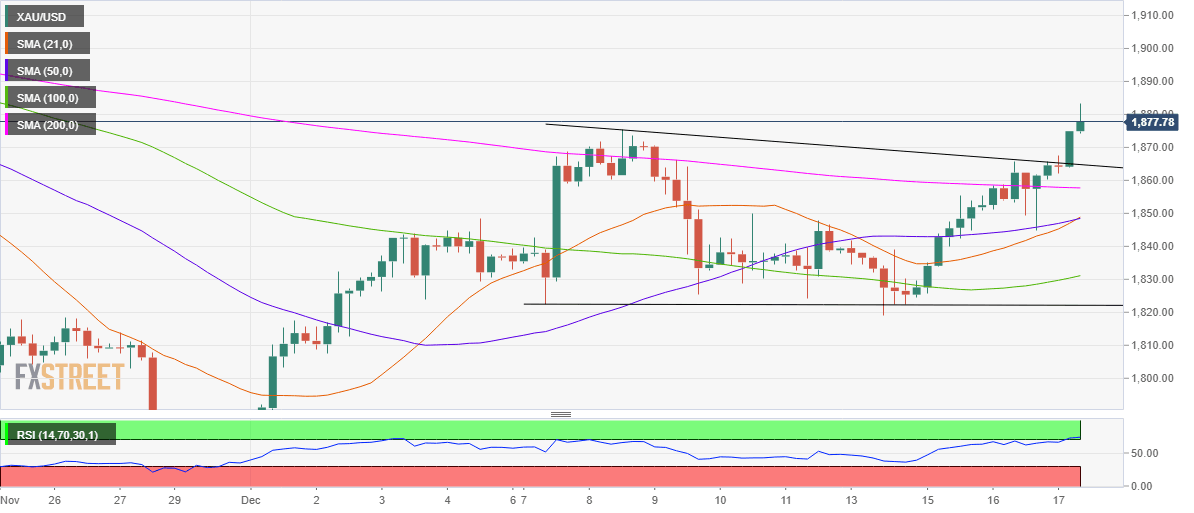

Gold Price Chart: Four-hour

The four-hour chart for the metal shows that the price has broken out from a descending triangle formation earlier today.

The latest leg higher could be attributed to the bullish crossover confirmed over the last hours. The 21-simple moving average (SMA) pierced the 50-SMA from below, validating a bull crossover.

However, the overbought condition on the Relative Strength Index (RSI) warrants caution for XAU bulls. Therefore, a brief retracement towards the pattern resistance now support at $1865 cannot be ruled out in the session ahead.

Further south, the horizontal 200-SMA at $1858 could be back in play.

Alternatively, recapturing the $1900 level would be inevitable if the bulls defy the warning on the RSI.

Gold Additional levels

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.