Gold Price Analysis: XAU/USD eyes $1709 support after strong NFP boosts yields –Confluence Detector

Gold (XAU/USD) is holding onto the recent recovery gains at around $1730 on Easter Monday, with thin trades offering little incentives. Meanwhile, strong US NFP jobs reported-led spike in the shorter-duration Treasury yields weigh on the non-yielding bright metal.

The Fed is expected to increases rates sooner than previously anticipated after the US jobs blowout strengthened the prospects of faster economic recovery amidst higher vaccination rates.

Stepping into a fresh week, the investors remain on the edge ahead of US Services PMI and FOMC minutes. However, gold remains at risk of witnessing some wild moves amid holiday-thinned market conditions.

How is gold positioned technically?

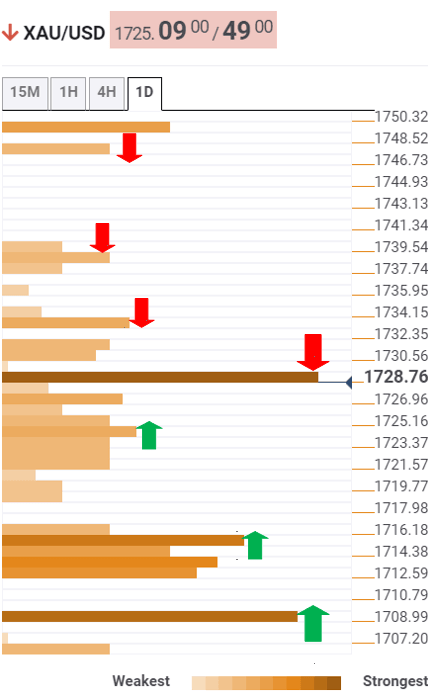

Gold Price Chart: Key resistance and support levels

The Technical Confluences Detector shows that gold needs a firm break above $1729, the Fibonacci 61.8% one-month, to extending the two-day recovery momentum.

The previous week high at $1733 could challenge the bulls’ commitments. The next crucial hurdle awaits at $1738, the pivot point one-day R1.

Acceptance above the latter is likely to fuel a sharp rally towards $1747, the pivot point one-day R2.

Alternatively, the SMA5 four-hour at $1726 guards the immediate downside.

Further south, a stack of healthy support levels is seen around $1724, where the SMA10 one-day coincides with the Bollinger Band one-hour Middle.

The Fibonacci 61.8% one-day at $1715 could offer some respite to the XAU bulls.

A breach of the Fibonacci 38.2% one-month at $1709 could revive the bearish sentiment.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.