Gold Price Analysis: XAU/USD eyes $1695 and $1690 as the next downside targets – Confluence Detector

Gold (XAU/USD) is extending Monday’s over 1% sell-off, as the revival of buying interest in the US Treasury yields continues to exert downward pressure on the non-yielding metal. The Treasury yields made an impressive comeback, as inflation risks remerge on expectations of a massive infrastructure spending plan likely to be unveiled by US President Joe Biden on Wednesday.

Rising rates on the market continue to power the US dollar, which now sits at new four-month highs across its main competitors. The blow-up of the Archegos fund has also spooked investors, bolstering the dollar’s safe-haven demand.

Let’s see how is gold positioned technically amid a holiday-shortened week.

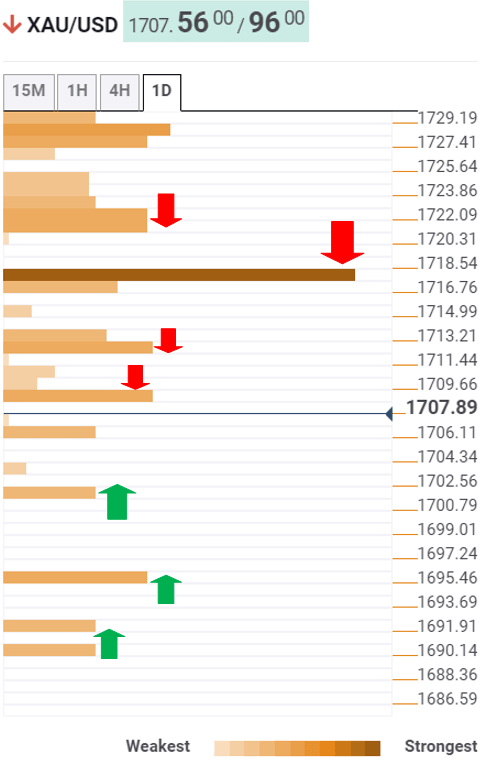

Gold Price Chart: Key resistance and support levels

The Technical Confluences Detector shows that gold is awaiting a firm break below the fierce support around $1701-$1700, which is the convergence of the round figure and the pivot point one-day S1.

The next downside target is seen at the pivot point one-week S3 at $1695, below which the last line of defense for the XAU bulls await at $1690.

At that level, the Bollinger Band one-day Lower coincides with the pivot point one-day S2.

On the flip side, gold faces immediate resistance at $1709, the pivot point one-week S2.

The confluence of the Fibonacci 23.6% one-day and previous high on four at $1712 could be challenged.

Recapturing the powerful resistance at $1717 is critical for the XAU bulls to stage a meaningful recovery. That level is the confluence of the previous month low and SMA5 four-hour.

The previous week low at $1722 could then test the bullish commitments.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.