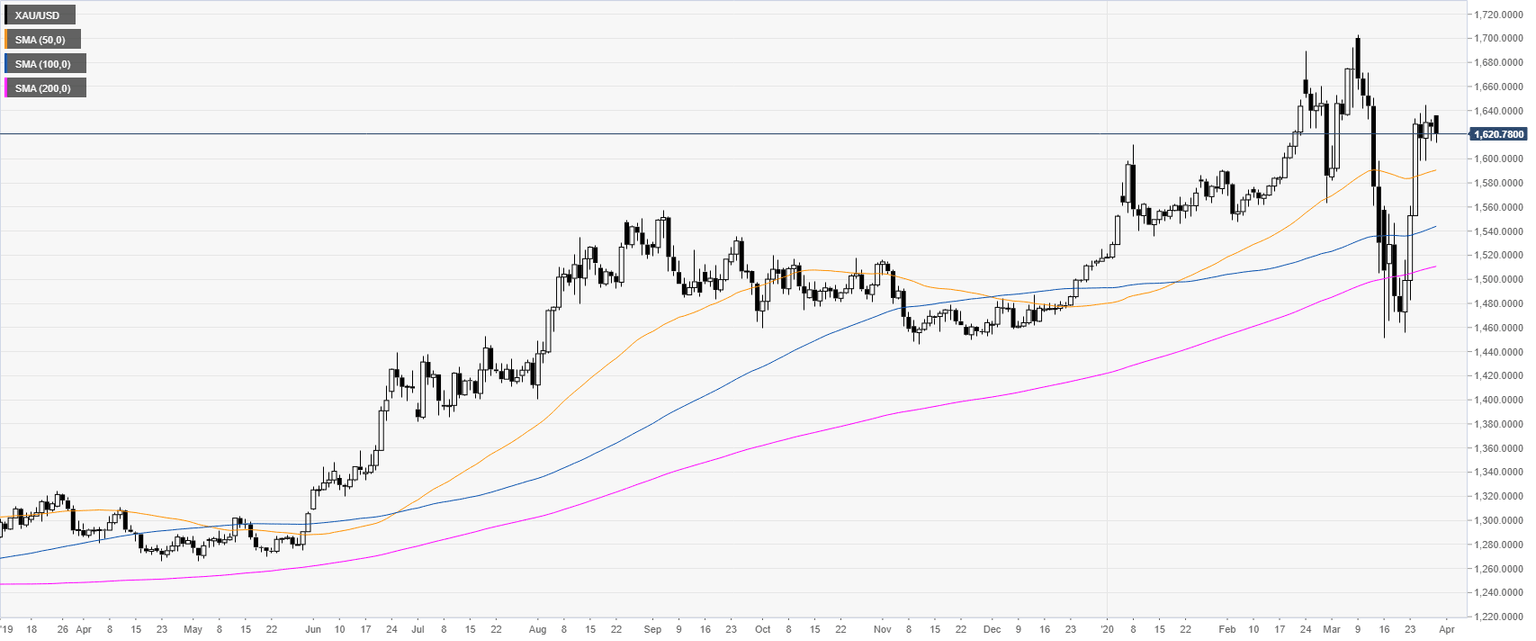

Gold Price Analysis: XAU/USD bounces from 2020 lows, hovering near $1600/oz

- XAU/USD rose considerably last week as the Fed announced a limitless bond-buying scheme.

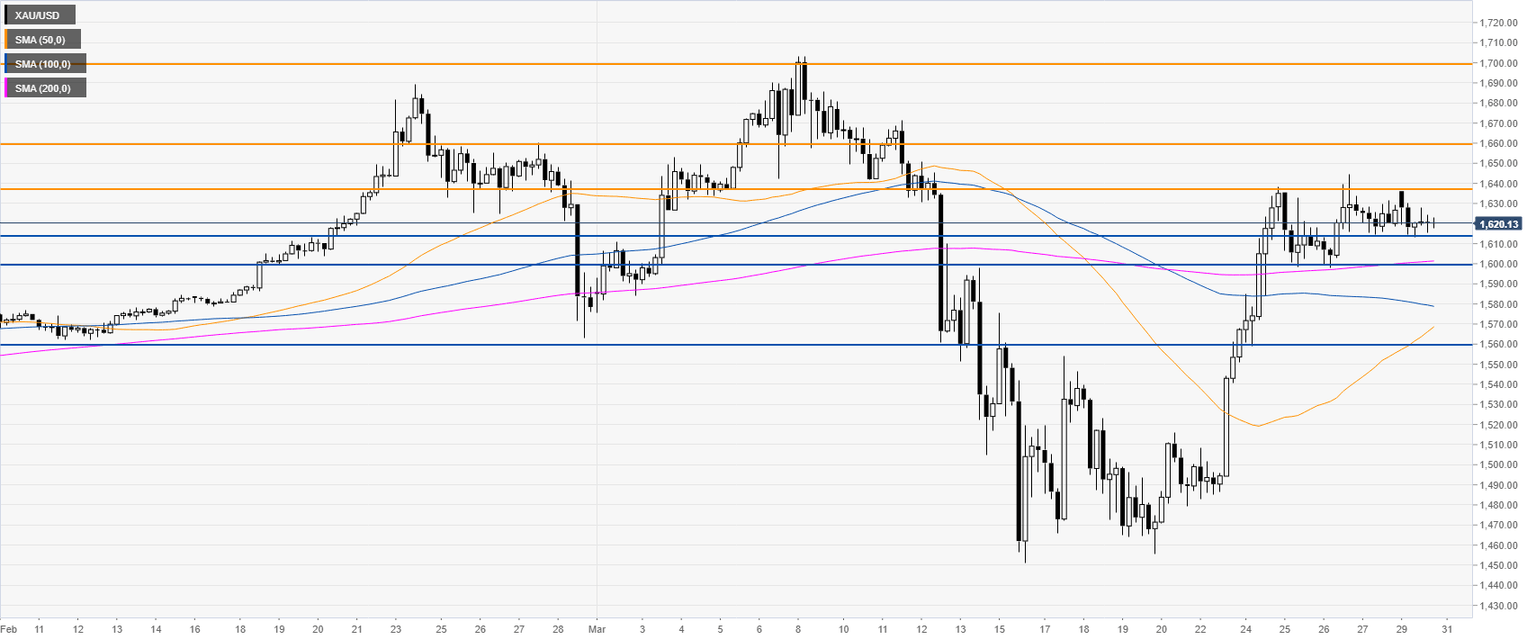

- The level to beat for bulls is the 1636 level.

XAU/USD daily chart

XAU/USD four-hour chart

Additional key levels

Author

Flavio Tosti

Independent Analyst