Gold Price Analysis: XAU/USD accelerates losses into $1,850

- The collapse in Gold prices continued on Friday with the XAU/USD down to $1,850.00.

- Gold is set to close in the red for the fifth straight day as losses accelerate.

- XAU/USD is on pace to erase all of 2023's gains, only 1.5% away from the year's opening prices.

The XAU/USD saw ongoing losses accelerate through Friday trading, dipping to $1,850.00 and continuing to churn out new lows for the day to cap off a trading week that has seen only losses for Gold.

Gold spot prices are down almost 4% for the week and continuing to grind lower. The XAU/USD is in the red over 5% from the mid-September swing high just shy of $1,950.00.

The Federal Reserve (Fed) continues to make statements affirming their dedication to tighter policy moving forward, and tight monetary policy coupled with price pressures in US Treasury yields is seeing Gold prices utterly deflate on the charts.

Inflation pressures continue to ease in the US, with the Personal Consumption Expenditure (PCE) Price Index printing at 0.1% for the month of August, and the inflation that Gold was meant to serve as a hedge against is rapidly evaporating, leaving XAU/USD bulls in the lurch.

Read More:

XAU/USD unlikely to regain any significant ground – Commerzbank

Door open for even more declines – TDS

XAU/USD technical outlook

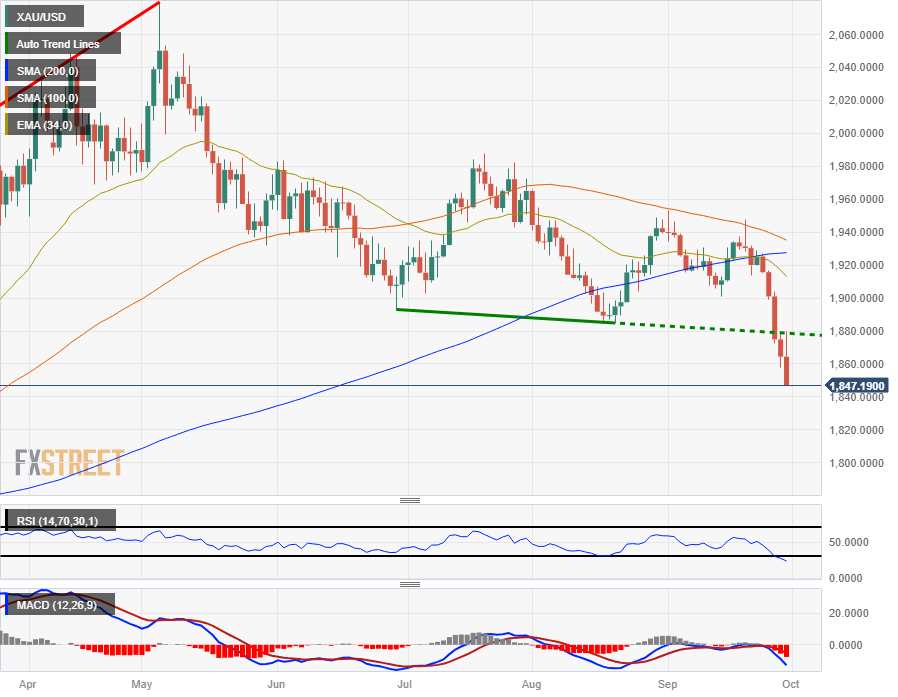

XAU/USD prices saw a firm rejection from the 34-hour Exponential Moving Average (EMA) near $1,870.00 in Friday's intraday action.

On the daily candlesticks Gold prices are in freefall, accelerating away from the 200-day Simple Moving Average (SMA) far above current price action near $1,930.00.

Continued downside will see XAU/USD set to erase 2023's gains and set a new yearly low near $1,800.00.

XAU/USD daily chart

XAU/USD technical levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.