Gold Price Analysis: Bulls back in town through critical resistance

- Gold bulls take control in thin markets, testing key weekly resistance.

- Old daily resistance would ow be expected to act as support for a continuation to the upside.

The price of gold has been lively on Monday, exceeding through meanwhile resistances as the greenback retreated while investors brace for more critical US data.

Meanwhile, the start of the week's analysis has been challenged by an abnormally large spike despite quite Asian holiday markets.

European investors piled into gold during an exodus from the US dollar which has created a secondary resistance target on the weekly charts as follows:

Prior analysis

''From a weekly chart, the price is testing prior weekly lows to test a 50% mean reversion.

However, the weekly W-formation is a bearish chart pattern, at least to the prior highs and neckline of the formation.''

Live market, weekly chart

As seen, the price did make a retracement to the W-formation's neckline, but only to the wick.

However, there was a confluence with the 61.8% Fibonacci that reinforced the support.

This is equated to a fresh wave to the upside.

A -272% Fibo comes in at 1,810 and a -61.8% Fibo is located at 1,820 as the next upside targets that have a confluence with resistances.

Daily chart analysis

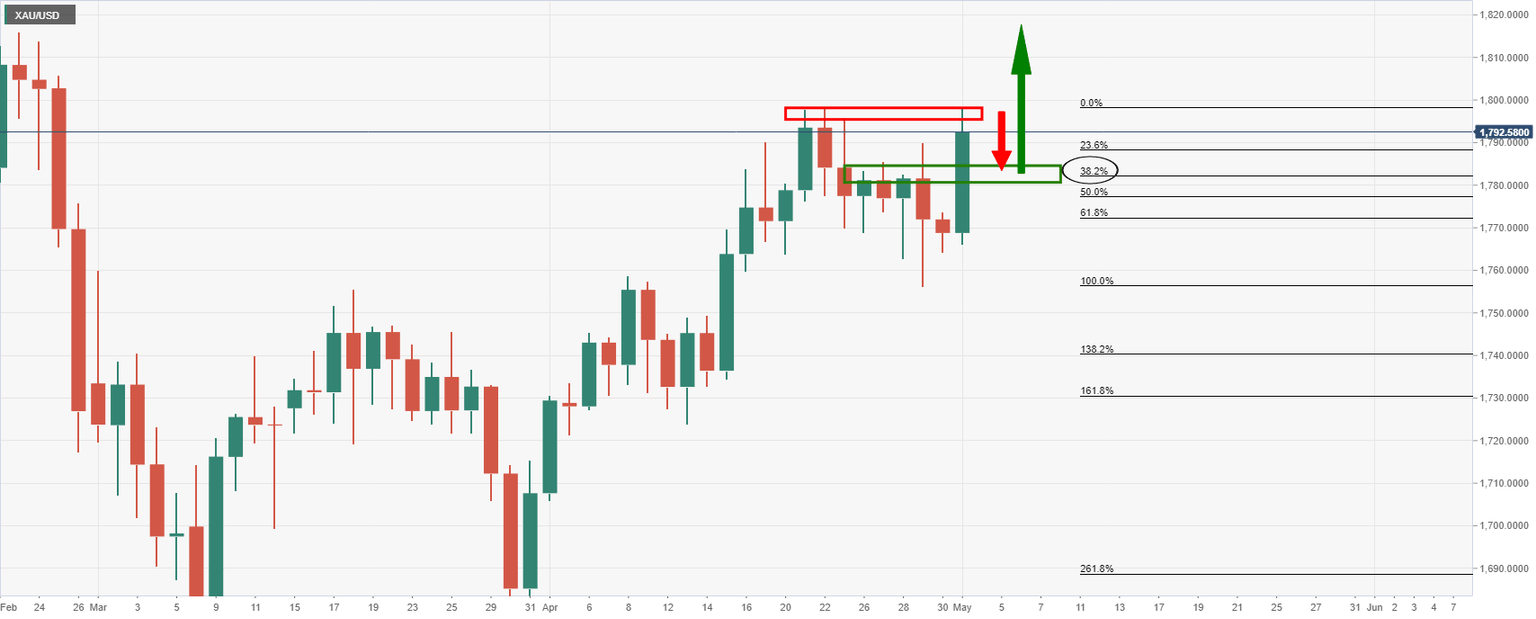

The daily chart is showing that the price has broken daily resistance as follows:

Prior analysis, daily chart

''As illustrated, the price has formed new resistance where old support was.

The bulls might be inclined to take on the bearish commitments for a restest of the structure for the opening sessions of the week.''

Live market, daily chart

As illustrated, the price did indeed go to test the resistance but burst right through it, against the grain of the longer-term charts.

A correction to the old resistance would be expected to hold at least to the structure if not just slightly above it near the 38.2% Fibo.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.