Gold declines despite renewed US-China trade tensions

- Gold price slumps to near $3,280 despite trade tensions between the US and China have renewed.

- US Appeals court lifts the ban on Trump’s tariffs temporarily.

- The US core PCE inflation grew moderately by 2.5%, as expected, on year in April.

Gold price (XAU/USD) slides to near $3,280 during North American trading hours on Friday, following a strong upside move the previous day. The yellow metal faces selling pressure as the US Dollar (USD) gains ground despite trade tensions between the United States (US) and China have renewed after President Donald Trump signaled in a post on Truth.Social that Beijing has violated trade agreement.

The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, rises to near 99.60. Typically, higher US Dollar makes the Gold price an expensive bet for investors.

"The bad news is that China, perhaps not surprisingly to some, HAS TOTALLY VIOLATED ITS AGREEMENT WITH US," Trump wrote.

Historically, the demand of safe-haven assets increases amid heightened geopolitical tensions.

The US Dollar (USD) was already reflecting stable performance after the US Court of Appeals suspends the federal trade court’s decision to ban the majority of tariffs announced by President Donald Trump, potentially diminishing hopes of permanent invalidation of import duties.

On Wednesday, the US court of International Trade quoted most of the tariffs announced by Trump as “illegal”, citing that large trade imbalances don’t constitute a “national emergency” under the International Emergency Economic Powers Act (IEEPA).

Using the IEEPA law, Trump announced reciprocal tariffs on all of his trading partners, a fentanyl duty on China, Canada and Mexico, and border negligence levies on his North American peers.

Daily digest marker movers: Gold price slumps on soft US PCE Inflation data

- Gold price remains on backfoot after a slowdown in the US Personal Consumption Expenditure Price Index (PCE) data for April. Theoretically, Gold price underperforms in a low-inflation environment.

- The report showed that the core US PCE inflation data, which is the Federal Reserve’s (Fed) preferred inflation gauge, rose at a moderate pace of 2.5% on year, as expected, compared to 2.7% in March, revised lower from 2.6%. In the same period, the PCE inflation data rose by 2.1%, slower than expectations of 2.2% and the prior release of 2.3%. On a monthly basis, both the headline and the core inflation data grew by 0.1%, as expected.

- However, the impact of the US PCE inflation data is likely to be limited in shaping market views on the Federal Reserve’s (Fed) monetary policy outlook, as officials are more concerned about consumer inflation expectations amid uncertainty over Trump’s tariff policy.

- On Thursday, Chicago Fed Bank President Austan Goolsbee stated that elevated uncertainty surrounding Trump’s tariff policy has held back US business. "If people can’t count on consistent policy, then they’re just going to slow down and not act," Goolsbee said, Reuters reported. Regarding the court ruling against the tariff policy, he added that the uncertainty would increase if the administration goes the other way to keep import duties in existence. Goolsbee also signaled that policymakers could bring interest rates down if “tariffs are avoided by a deal or otherwise”.

- The White House stated on Thursday that it will manage to keep tariffs in any way. “You can assume that even if we lose [in court], we will do it [tariffs] another way,” Washington trade negotiator Peter Navarro said, Reuters reported.

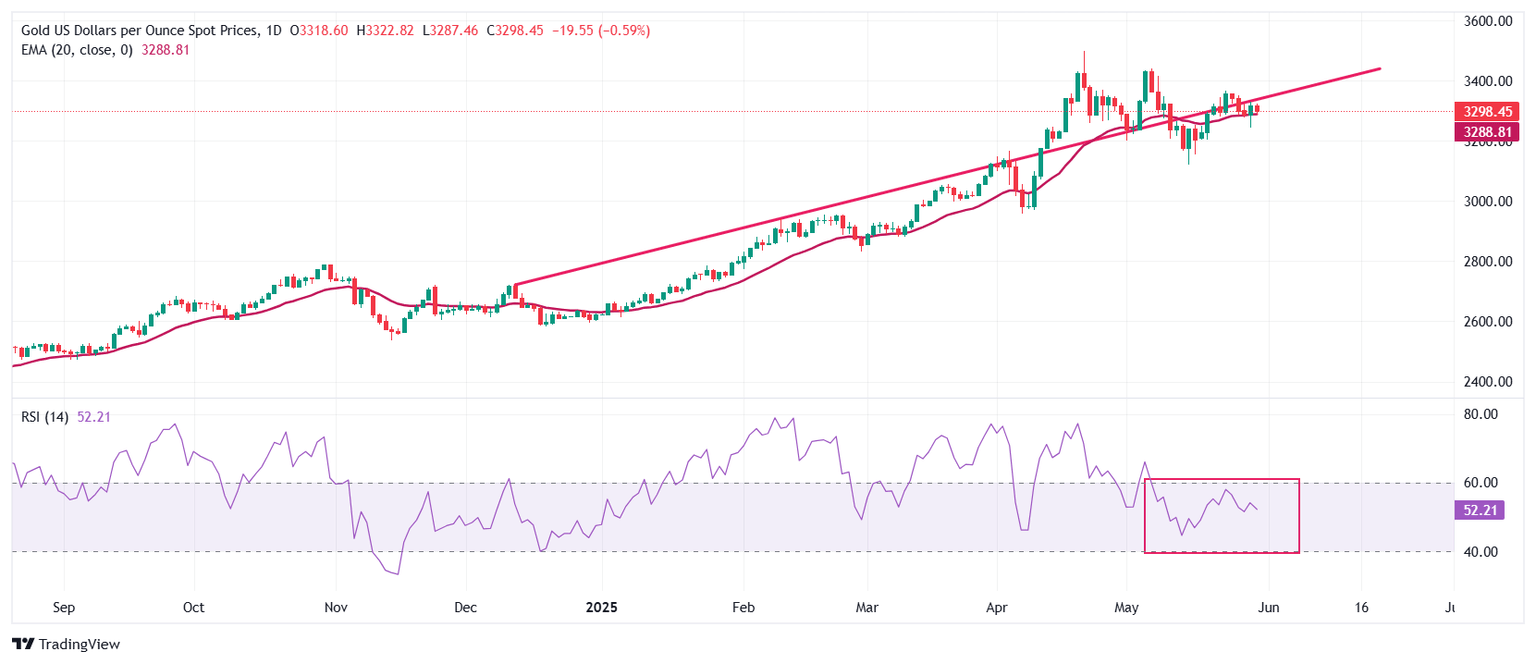

Technical Analysis: Gold price struggles around $3,300

Gold price continues to struggle near the upward-sloping trendline on a daily timeframe around $3,335, which is plotted from the December 12 high of $2,726. The near-term trend of the precious metal is uncertain as it wobbles around the 20-day Exponential Moving Average (EMA), which trades near $3,290.

The 14-day Relative Strength Index (RSI) oscillates inside the 40.00-60.00 range, suggesting indecisiveness among market participants.

Looking up, the May 7 high around $3,440 will act as key resistance for the metal. On the downside, the May 15 low at $3,120 will be the key support zone.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.