Gold Weekly Forecast: US employment data could trigger next directional move

- Gold failed to make a decisive move in either direction as markets digested US tariff news and mixed data releases.

- May employment data from the US could trigger the next big action in XAU/USD.

- The technical outlook suggests that Gold is closing in on the next breakout.

Gold (XAU/USD) failed to build on the impressive gains it recorded in the week of May 19 as markets navigated through mixed macroeconomic data releases from the United States (US) and tariff headlines. The upcoming US May employment report could trigger the next big action in the pair and pave the way for a breakout.

Gold struggles to find direction

Over the weekend, US President Donald Trump announced that he had agreed to extend the tariff deadline on European imports until July 9 after holding a phone conversation with European Commission President Ursula von der Leyen. This development helped the risk mood improve at the beginning of the week and caused Gold to lose interest as a safe-haven asset. Nevertheless, with financial markets in the US remaining closed in observance of the Memorial Day holiday on Monday, XAU/USD’s losses remained limited.

On Tuesday, the data from the US showed that the Conference Board (CB) Consumer Confidence Index rose to 98.0 in May from 85.7 in April. Stephanie Guichard, Senior Economist, Global Indicators at The Conference Board, noted that the recovery in consumer sentiment was already visible before the May 12 US-China trade deal, but added that it gained momentum afterward. “Consumers were less pessimistic about business conditions and job availability over the next six months and regained optimism about future income prospects,” Guichard added. The US Dollar (USD) benefited from the upbeat data, causing XAU/USD to push lower.

The minutes of the Federal Reserve’s (Fed) May policy meeting showed on Wednesday that officials saw elevated uncertainty about the economic outlook. "Participants noted they may face difficult trade-offs if inflation proved more persistent, while outlooks for growth and employment weakened," the publication noted. Meanwhile, the Court of International Trade announced that President Trump's reciprocal tariffs will be blocked from going into effect, explaining that Trump overstepped his authority by imposing across-the-board duties on imports from the US's trading partners, per Reuters. In response, the Trump administration has filed a notice of appeal, questioning the court's authority. With this headline boosting the USD with the immediate reaction, XAU/USD extended its weekly slide and touched its lowest level in over a week below $3,250 in the Asian session on Thursday.

Later in the day, the Court of Appeals for the Federal Circuit decided to reinstate tariffs during the review process, causing the USD to lose its strength. Additionally, the US Department of Labor reported that there were 240,000 first-time applications for unemployment benefits in the week ending May 24. This print followed the previous week's 226,000 applications and came in worse than the market expectation of 230,000. The renewed USD weakness allowed XAU/USD to end the day in positive territory.

The final data release of the week from the US showed that the annual inflation in the US, as measured by the change in the Personal Consumption Expenditures (PCE) Price Index, declined to 2.1% in April from 2.3% in March. The core PCE Price Index, which excludes volatile food and energy prices, rose 2.5% on a yearly basis in this period, matching analysts' estimates. Gold largely ignored this data and remained in the lower half of the weekly range below $3,300.

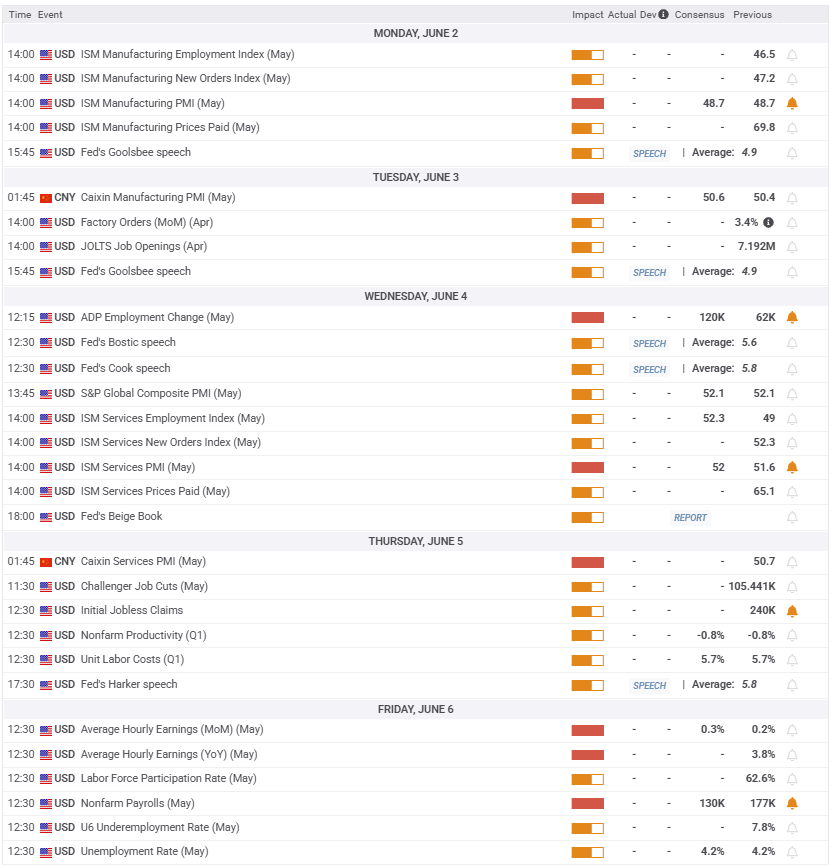

Gold investors will scrutinize US data releases

The US economic calendar will offer several data releases that could influence investors’ assessment of the Fed’s policy outlook and the USD’s valuation.

The Institute for Supply Management (ISM) will publish the Manufacturing Purchasing Managers’ Index (PMI) and Services PMI data for May on Monday and Wednesday, respectively. The market reaction to these data should be straightforward and remain short-lived, with upbeat headline PMI figures supporting the USD and disappointing readings weighing on the currency.

On Friday, the US Bureau of Labor Statistics will publish the May employment report, which will feature Nonfarm Payrolls (NFP), Unemployment Rate and wage inflation figures. In April, NFP rose by 177,000, beating the market expectation of 130,000 and easing concerns over a worsening labor market outlook. Another positive surprise in May’s data, with an NFP print of 170,000 or higher, could highlight relatively healthy conditions in the labor market and support the view that the Fed could afford to remain patient with regard to policy-easing. In this scenario, investors could also gain confidence about a hawkish revision to the dot plot, which will be published after the June meeting. Hence, the USD could gather strength heading into the weekend and cause XAU/USD to push lower. Conversely, a weak NFP print of 100,000 or lower could revive expectations for a Fed rate cut in July and weigh heavily on the USD.

According to the CME FedWatch Tool, markets are currently pricing in about a 25% probability of a 25 basis points (bps) rate cut in July.

Market participants will pay close attention to comments from Fed officials throughout the week. The Fed’s blackout period will start on June 7, and policymakers could look to steer expectations in a certain direction. If Fed commentaries hints that the central bank prefers to cut the policy rate just once in 2025, the USD could gather sustained strength and open the door for an extended decline in Gold prices. The CME FedWatch Tool shows that markets still see a nearly 70% chance of the Fed opting for at least two 25-bps interest rate cuts this year.

In between all the data releases and Fed commentaries, headlines surrounding US trade relations could affect the risk mood. A positive shift in sentiment, with the US announcing new deals with partners, could cause Gold to stay under selling pressure. On the flip side, the precious metal could benefit from safe-haven flows if Trump adopts an aggressive tone and extends his tariff threats to the EU and other nations.

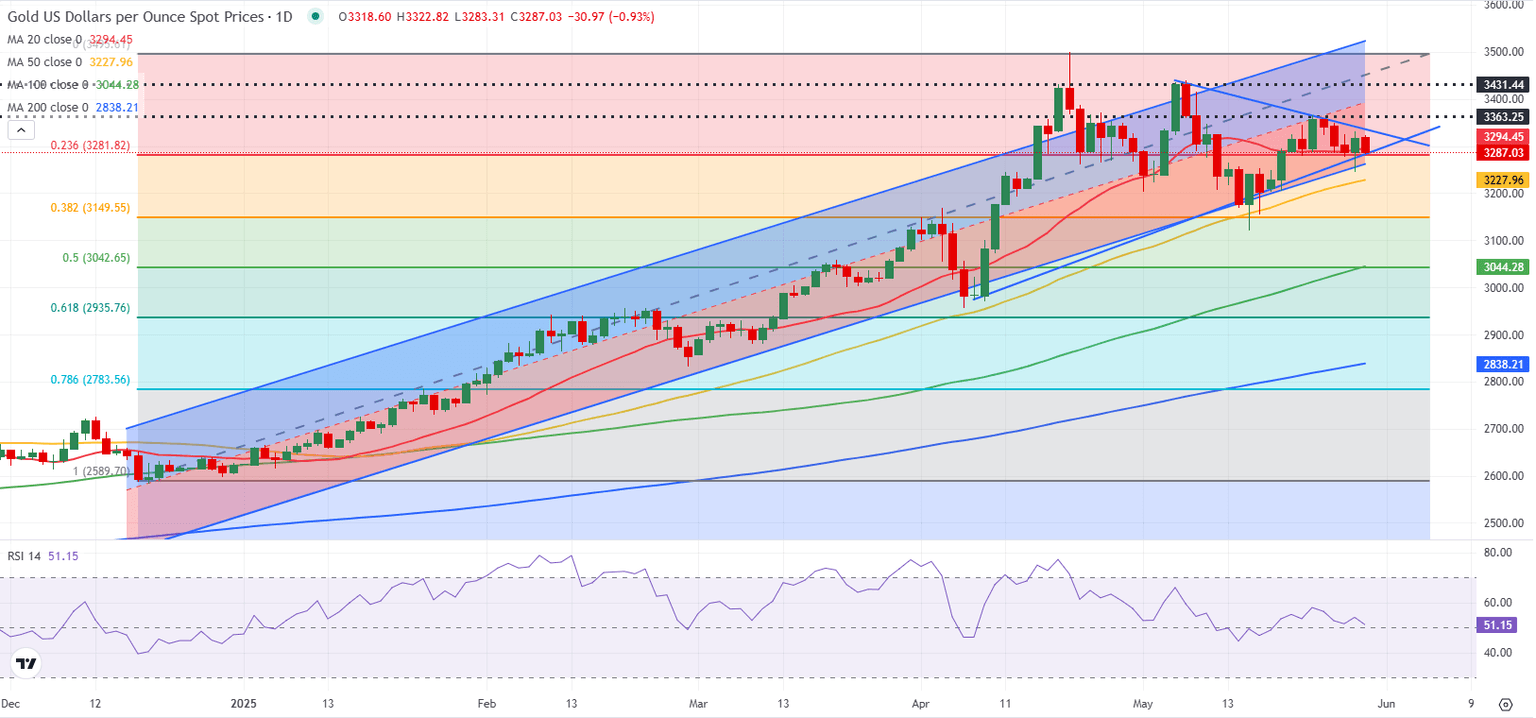

Gold technical analysis

Gold’s trading range continues to narrow within a symmetrical triangle, suggesting that the consolidation phase could soon end. Meanwhile, the Relative Strength Index (RSI) indicator on the daily chart continues to fluctuate in a tight channel at around 50, reflecting a lack of directional momentum.

A pivot area seems to have formed at $3,280-$3,260, where the lower limit of the ascending channel meets the Fibonacci 23.6% retracement level of the five-month-old uptrend. In case Gold falls below this area and starts using it as resistance, technical sellers could show interest. In this case, the 50-day Simple Moving Average (SMA) could act as interim support at $3,230 before $3,150 (Fibonacci 38.2% retracement) and $3,040 (Fibonacci 50% retracement).

If Gold manages to stabilize above $3,280-$3,260, then $3,360 (static level) could be seen as the next resistance level before $3,500 (all-time high, end-point of the uptrend).

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.