Slower spending amid a pullback in goods outlays in April

Summary

Consumers cut back on goods outlays in April after pulling forward demand in prior months, which was offset by sustained demand for services, mostly housing, utilities and healthcare. At this early stage, inflation appears largely un-impacted by tariffs. Social Security payments boosted income.

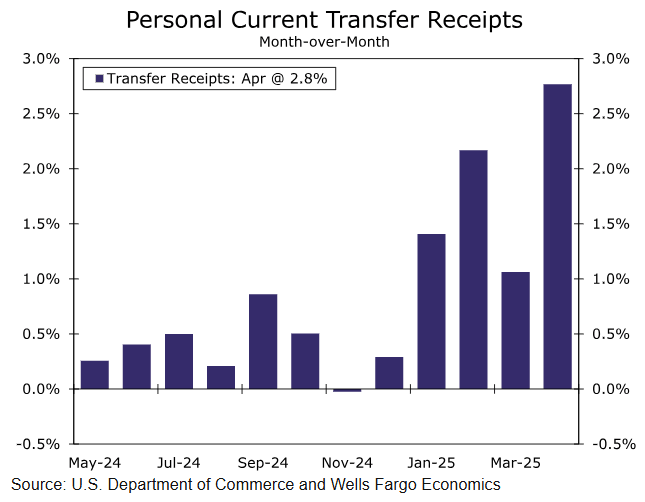

In all fairness, social security drove the jump in income

Personal income shot higher in April rising 0.8%, well north of the 0.3% that had been expected. The fact that it comes on the heels of an upwardly revised increase the prior month makes the gain all the more impressive. Looking at the underlying details, a standout was a surge in transfer payments from the U.S. government.

The increase in government social benefits was driven mostly by Social Security payments, reflecting payments associated with the Social Security Fairness Act. This act, passed in December, granted benefits to more than three million retirees from a variety of sectors including teachers, law-enforcement officers and other workers receiving public pensions who had not previously been receiving full benefits for a variety of reasons.

Note that the saving rate jumped to 4.9%, the highest in nearly a year. Take that with a grain of salt as it is driven partly by this one-off jump in income.

Consumer spending rose 0.2% in April, but for the most part, the gains were in services categories, the largest of which were non-discretionary categories such as housing and utilities as well as health care. Consumers cut back on spending in most goods categories in April after having pulled forward demand to get ahead of tariffs earlier in the year. The retreat was led by non-durable goods and motor vehicles as well as clothing and recreational goods. The only two goods categories that were meaningfully positive in April were household furnishings which notched a $1.1 billion gain and gasoline where the gain was mostly attributable to rising prices at the pump.

We got a glimpse of downward revisions in yesterday's second-estimate of first-quarter GDP growth. While overall GDP was revised up, consumer spending was revised down; real personal consumption expenditures advanced at just a 1.2% annualized pace in Q1, or the slowest in a year and a half.

Author

Wells Fargo Research Team

Wells Fargo