GME Stock News: GameStop Corp tumbles as meme stocks close the week lower

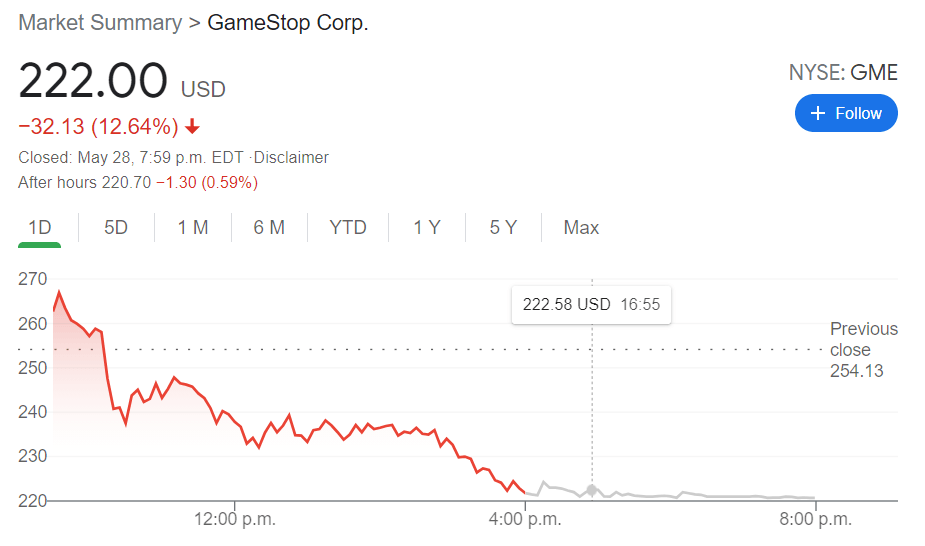

- NYSE:GME fell by 12.64% on Friday as meme stocks took a breather from the recent rally.

- GameStop and AMC both tank as diamond hands soften.

- GameStop remains wildly overpriced, but shorting it remains a risky endeavor.

NYSE:GME may be suffering from momentum traders with paper hands coming along for the ride, taking advantage of the Reddit movement against Wall Street. On Friday, GameStop reversed its recent rally and plummeted by 12.64% to close the tumultuous week at $222.00. As strong as the short squeeze has looked over the past few days, it seems as though the stock has gained plenty of followers who are in it purely for the quick profits. After gaining over 40% since Monday, some investors took the opportunity to take their profits on Friday, heading into the long weekend.

Stay up to speed with hot stocks' news!

It wasn’t just GameStop that suffered on Friday, as squeeze leader AMC (NYSE:AMC) also slumped following a rise of nearly 200% this week. This decline comes following another day of over 655 million shares of AMC being traded, blowing away the stock’s average daily trading volume. Interestingly enough, the other meme stocks mostly rose on Friday, including Beyond Meat (NASDAQ:BYND), BlackBerry (NYSE:BB), and Koss Corporation (NASDAQ:KOSS). Is this the end of this current short squeeze? Unlikely. The recent discussions on Reddit state June 18th as a pivotal day when many in the money call options will expire.

GME stock forecast

While history doesn’t always necessarily repeat itself, there is a good chance that this current short squeeze will end in the same way the previous one did: with many retail investors holding the bag. Savvy investors may be looking ahead to buy puts and short GameStop and AMC, as both companies remain wildly overvalued given their current enterprise situations. For now, the safest play is probably to stay on the sidelines, as increased volatility brings with it increased risk.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet