GME Stock News: Heading for a bearish weekly close, resisted at a 38.2% Daily Fibo retracement

- NYSE:GME added 2.6% on Tuesday as growth stocks battled back against Wall Street.

- The gaming industry rose after two promising earning reports from a couple of newly public companies.

- GameStop still has a lot of work to do before it can compete with other eCommerce platforms.

Update: Gamestop (GME) shares were down 1% early Wednesday but have since started to correct as the New York day progresses. The stock is catching up with most other stocks supported by Reddit investors that were flat or nearly flat in early trading activity. However, GME is still trading down some 0.37% on the day so far and has travelled between a range of $150.50 to a low of $142.23 with low volumes of $1.529m compared to an average $3.571m. The price also remains well below the 52-week range of between $3.77 and $483. From a technical standpoint, the price is on course for a lower weekly close at this rate given the resistance at the 38.2% Fibonacci retracement of the prior bearish daily impulse. A 61.8% Fibo retracement of the current bullish correction's range comes in at $127.73 ahead of $116.90 March 25 lows.

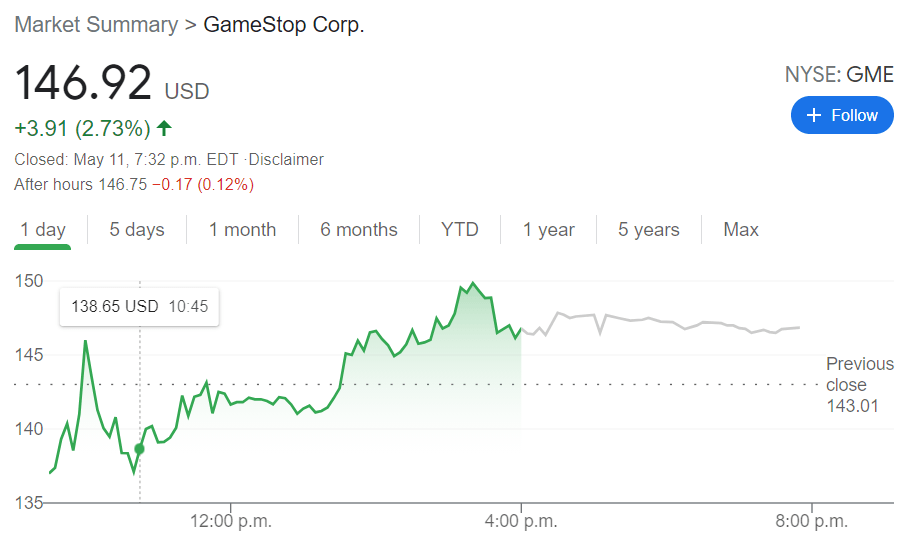

NYSE:GME is still managing to hang around at price levels that seem way too inflated for the brick and mortar gaming retailer. On Tuesday, GameStop reversed its decline and added 2.6% to close the day at $146.92, as the stock had another session of low trading volume overall. Shares continue to trade below the 50-day moving average, as the stock has lost much of its meme momentum following Redditor Roarking Kitty exercising his call options back in the middle of April.

Stay up to speed with hot stocks' news!

The gaming industry was buoyed by a couple of impressive earnings reports from Roblox (NYSE:RBLX) and Unity Software (NYSE:U). Roblox soared by 21% after reporting that it massively beat on revenue expectations although it fell flat on the losses per share. Still, Roblox had a 79% growth in daily active users year-over-year and 111% year-over-year growth in users over 13 years of age. Unity rose a modest 3.83% on 41% year-over-year revenue growth and dollar based net expansion rate of 140% compared to 133% in the first quarter of 2020.

GME stock forecast

GameStop has made it well known that it is aiming to move away from the brick and mortar retail industry and become an eCommerce driven company. While Chewy (NYSE:CHWY) CEO Ryan Cohen is trying his best to rebrand GameStop, there are still 4,816 retail locations in operation today, and much work will need to be done to shift the focus of the company to a primarily online gaming retailer.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet