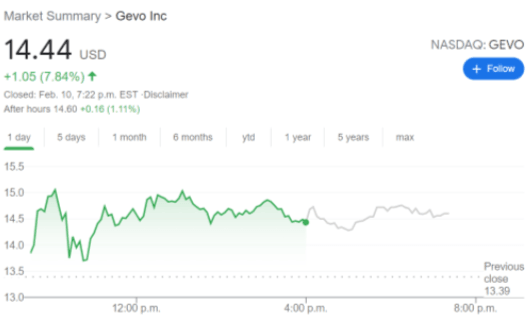

GEVO Stock Price and News: Bullish trend continues as future momentum builds

- NASDAQ:GEVO gains 7.84% despite a broader market selloff on Wednesday.

- GEVO has mostly recovered from its short-term correction following its public stock offering.

- GEVO offers a disruptive new clean energy technology that is in its infancy in terms of global usage.

NASDAQ:GEVO has had a stellar start to the new year as the stock has returned well over 200% to investors, even despite a sizable selloff after the company announced a public stock offering in January. On Wednesday, the Colorado-based clean energy firm jumped by 7.84% to close the trading session at $14.44 as the stock rapidly climbs back towards its 52-week high price of $15.24. Gevo is just the latest company to graduate from a penny stock to a near large-cap valuation as it now boasts a market cap that is above $2 billion.

Perhaps a lot of the upside has already been baked into Gevo at this juncture, as with many companies attempting to disrupt an industry, it is far from being a profitable enterprise. Additionally, some investors may be lumping Gevo’s status as a clean energy company within the red-hot electric vehicle sector. Gevo actually produces clean-burning fuel for vehicles, something that is not applicable to electric vehicles at all. Using its patented GIFT or Gevo’s Integrated Fermentation Technology, to produce isobutanol, a flexible component that can be used in anything from clean-burning fuels to plastic and rubber products.

GEVO stock prediction

It is always difficult to predict how a speculative stock will move, especially after it has already run up so far so fast. With the new Biden administration in the White House, it is anticipated that clean energy legislation could be introduced in the near future, which would further provide bullish momentum behind Gevo’s stock trajectory. This year could prove to be an interesting one as 2022 will see the opening of Gevo’s Net Zero 1 processing plant which should really drive up production.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet