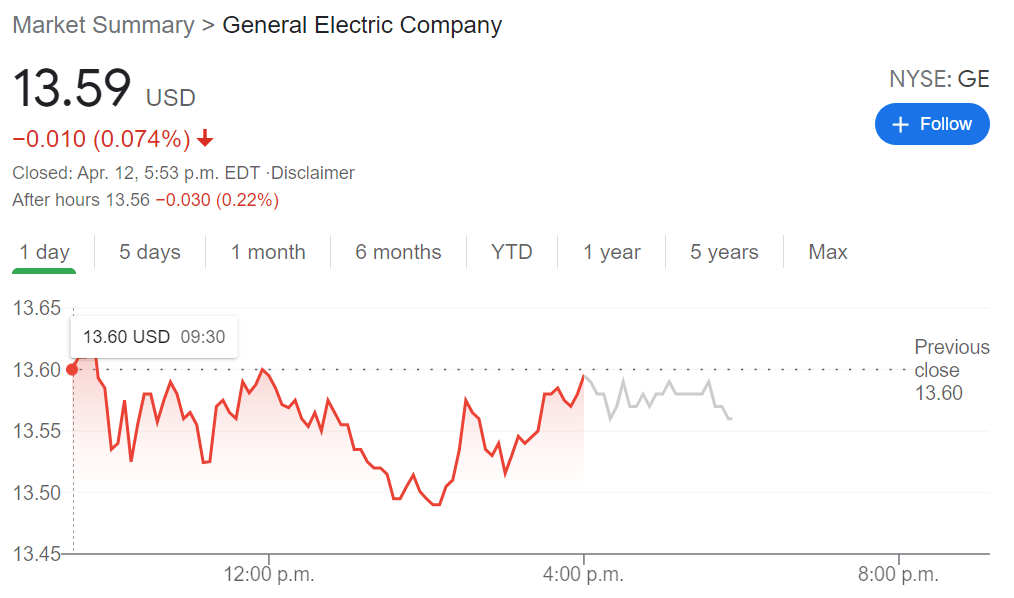

GE Stock Price Forecast: General Electric Company trades flat after analyst price upgrade

- NYSE:GE dipped by 0.07% amidst another rocky day for the global markets as the S&P 500 ended lower.

- General Electric receives a generous price target upgrade from UBS.

- General Electric’s healthcare segment developed a COVID-19 sensor for mobile phones.

NYSE:GE has continued its upward trajectory after shares jumped on Friday following another analyst upgrade of the iconic industrial conglomerate. General Electric, led by CEO Larry Culp, has been on a turnaround mission over the past couple of years to bring the once great company back to prominence on the global stage. On Monday, shares of General Electric traded flat as the broader markets continued the choppy behavior from March, as it fell by 0.07% to close the first trading day of the week at $13.59. The stock is trading firmly above its 50-day and 200-day moving averages, and is creeping back up toward the 52-week high price of $14.42 set in early March.

Stay up to speed with hot stocks' news!

Another Wall Street analyst has added his bullish target for General Electric, joining several others with the same sentiment. Markus Mittermaier of UBS maintained his previous buy rating for the stock and upgraded his price target from $15 to $17 per share. Mittermaier cited the recent sale of AerCap Holdings for $30 billion, as well as other initiatives that Culp has undertaken to right the ship. General Electric continues to be hammered on the rollercoaster of news that comes from the aerospace industry, including another report of issues with the Boeing 737 MAX, for which GE builds the engines.

Is GE a good stock to buy?

There are certainly tailwinds for 2021 that make General Electric seem like a good buy right now. The healthcare segment even announced it had designed a COVID-19 sensor that can be integrated into mobile phones and smart watches as a way of dealing with the virus in the future. If you believe in Culp and his turnaround strategy, now may be the time to buy the news with General Electric, ahead of its April 27th earnings call.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet