GBP/USD Technical Analysis: Looking for a fresh break into 1.2800

- This week opens with GBP/USD riding a couple of higher lows to continue intraday bullish moves, but the pairing is quickly running into immediate resistance from 1.2770 and the 1.2800 handle.

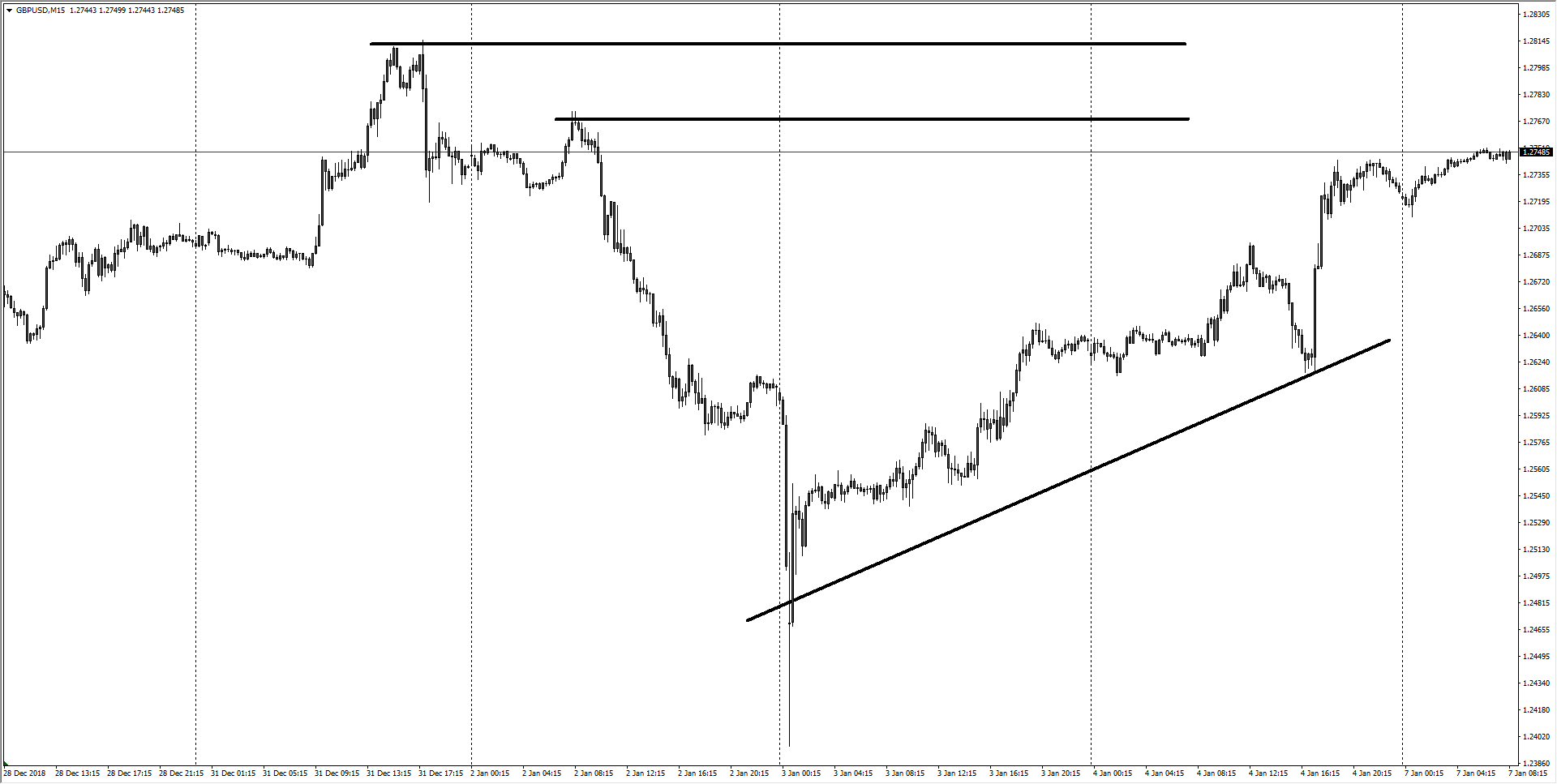

GBP/USD, 15-Minute

- Near-term action on the Cable shows the pair maintaining a skewed stance towards the middle, with rough breaks to either side routinely getting faded back into the median as 1.2650 - 1.2700 remains a key congestion zone.

GBP/USD, 1-Hour

- The 1.2750 region has proven to be a consistent tipping point for GBP/USD in recent months, and failure to break higher above the key level could see the Cable break lower once again.

GBP/USD, 4-Hour

GBP/USD

Overview:

Today Last Price: 1.2745

Today Daily change: 7.0 pips

Today Daily change %: 0.0550%

Today Daily Open: 1.2738

Trends:

Previous Daily SMA20: 1.265

Previous Daily SMA50: 1.2773

Previous Daily SMA100: 1.2898

Previous Daily SMA200: 1.3155

Levels:

Previous Daily High: 1.2746

Previous Daily Low: 1.2615

Previous Weekly High: 1.2815

Previous Weekly Low: 1.2438

Previous Monthly High: 1.284

Previous Monthly Low: 1.2477

Previous Daily Fibonacci 38.2%: 1.2696

Previous Daily Fibonacci 61.8%: 1.2665

Previous Daily Pivot Point S1: 1.2653

Previous Daily Pivot Point S2: 1.2569

Previous Daily Pivot Point S3: 1.2523

Previous Daily Pivot Point R1: 1.2784

Previous Daily Pivot Point R2: 1.283

Previous Daily Pivot Point R3: 1.2914

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.