GBP/USD Technical Analysis: Constrained in a sluggishly bearish chart pattern, lacking a major trend

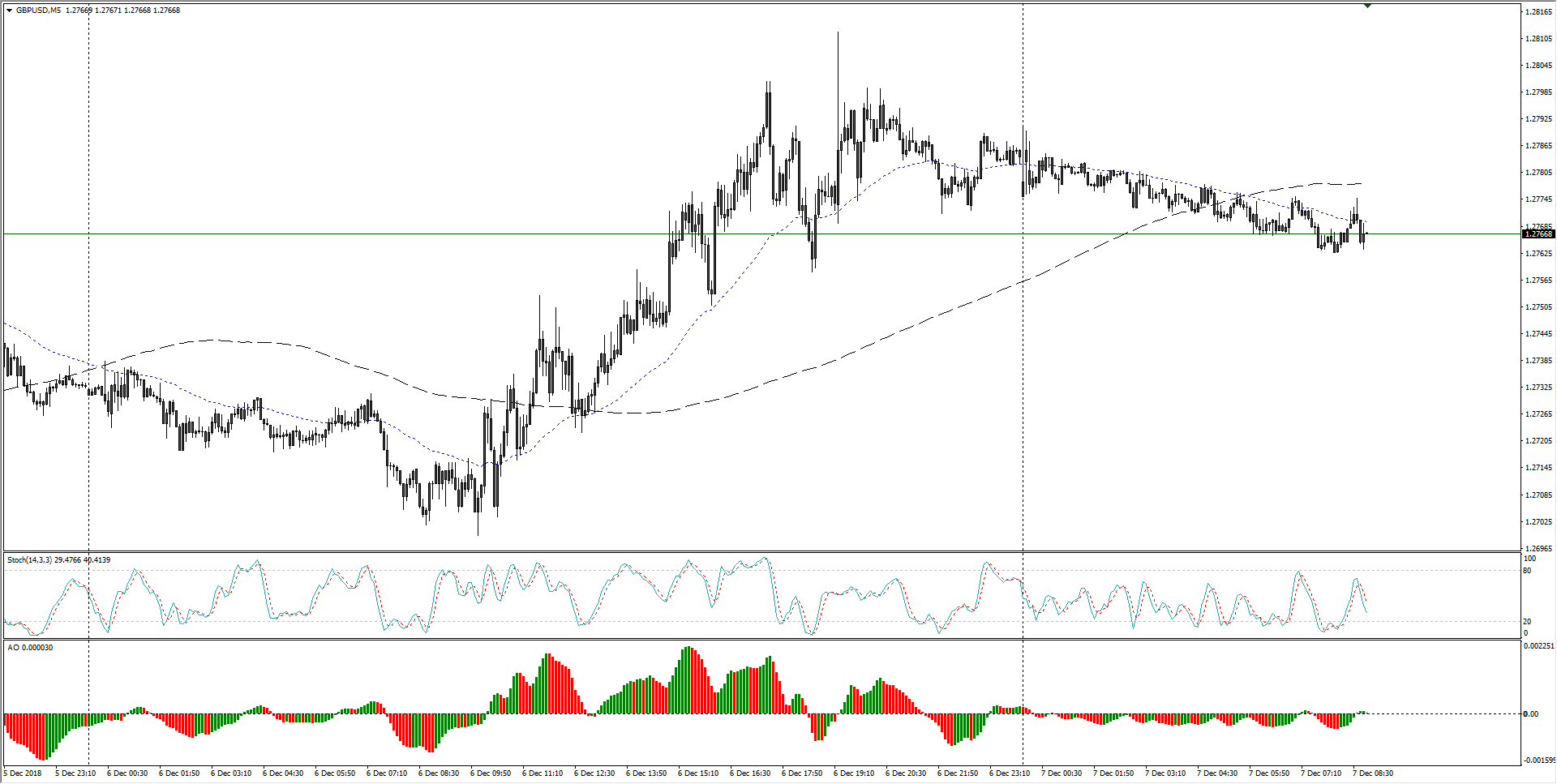

- GBP/USD is seeing apprehensive drift ahead of Friday's major market sessions, knocking into 1.2750 but remaining trapped firmly within

GBP/USD, 5-Minute

- The past couple of weeks have been a ranging affair for the Cable, but swing highs remain capped off at the 1.2800 handle while swing lows continue to tread into fresh territory.

GBP/USD, 30-Minute

- Indecision has marked the Cable for the past couple of months as the major chart pattern squeezes into a sideways pattern, and current action is getting clamped between the 50-period MA at 1.2770 and major support from the 1.2700 handle, but bidders face the field disadvantage with the 200-period MA capping off any breaks to the upside from 1.2850.

GBP/USD, 4-Hour

GBP/USD

Overview:

Today Last Price: 1.2771

Today Daily change: -17 pips

Today Daily change %: -0.133%

Today Daily Open: 1.2788

Trends:

Previous Daily SMA20: 1.2818

Previous Daily SMA50: 1.2938

Previous Daily SMA100: 1.2962

Previous Daily SMA200: 1.3293

Levels:

Previous Daily High: 1.2812

Previous Daily Low: 1.2699

Previous Weekly High: 1.2864

Previous Weekly Low: 1.2725

Previous Monthly High: 1.3176

Previous Monthly Low: 1.2723

Previous Daily Fibonacci 38.2%: 1.2769

Previous Daily Fibonacci 61.8%: 1.2742

Previous Daily Pivot Point S1: 1.272

Previous Daily Pivot Point S2: 1.2653

Previous Daily Pivot Point S3: 1.2607

Previous Daily Pivot Point R1: 1.2833

Previous Daily Pivot Point R2: 1.2879

Previous Daily Pivot Point R3: 1.2947

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.