GBP/USD takes a hard rejection from fresh highs, but holds on the bullish side

- GBP/USD briefly rallied to new six-months highs on Thursday before settling back.

- Despite facing a technical rejection from 1.3200, Pound Sterling remains in a firmly bullish stance.

- Trump tariffs and softening US data have pummeled the US Dollar this week.

GBP/USD briefly clipped the 1.3200 handle for the first time in six months on Thursday, climbing into fresh highs as the Greenback turns sour across the board. The Trump administration’s “reciprocal” tariffs and a flat tariff have kicked the legs out from beneath market sentiment, despite a delayed reaction to tariff announcements that came after US markets closed on Wednesday.

Forex Today: US NFP will be in the limelight

This week, the UK economic data release schedule is relatively sparse, but a new report on US Nonfarm Payrolls (NFP) will be published on Friday. This NFP data could significantly influence markets as the US economy transitions to a post-tariff landscape, with March’s labor figures expected to serve as a “bellwether” for the effects of the Trump administration’s tariff strategies.

US ISM Services Purchasing Managers Index (PMI) figures through March further hampered investor sentiment on Thursday, falling to a nine-month low of 50.8 and declining at one of its fastest month-on-month rates since the pandemic. Business activity and consumer confidence evaporated in the run-up to the Trump administration’s tariffs, and post-tariff realities are unlikely to see sentiment recover quickly.

- Fed's Jefferson warns Fed is not in a rush to change rates

- Fed's Cook expects inflation progress to stall after tariffs

The Trump administration’s “Liberation Day” tariff proposals have ignited global backlash, with former US Treasury Secretary Larry Summers claiming the government calculated tariffs without proper data. This claim aligns with the Trump team’s publications, which explain that their reciprocal tariffs are computed by dividing a country’s net exports to the US by imports from the US and then halving that figure, with a minimum tariff of 10%. As a result of the Trump administration’s tariff “methodology”, the US has imposed a 10% “reciprocal” tariff on Heard Island and McDonald Islands, A territory that remains entirely uninhabited by humans.

US President Donald Trump approved a 10% tariff on all imports effective April 5, with calculated “reciprocal” tariffs starting on April 9. According to Fitch Ratings, US economic growth will dip below the downgraded forecast from March. The Fitch Ratings agency has warned that the effects of Trump's tariffs will also reach the Federal Reserve (Fed), which may delay interest rate cuts as it monitors the inflation and employment impacts of these tariffs.

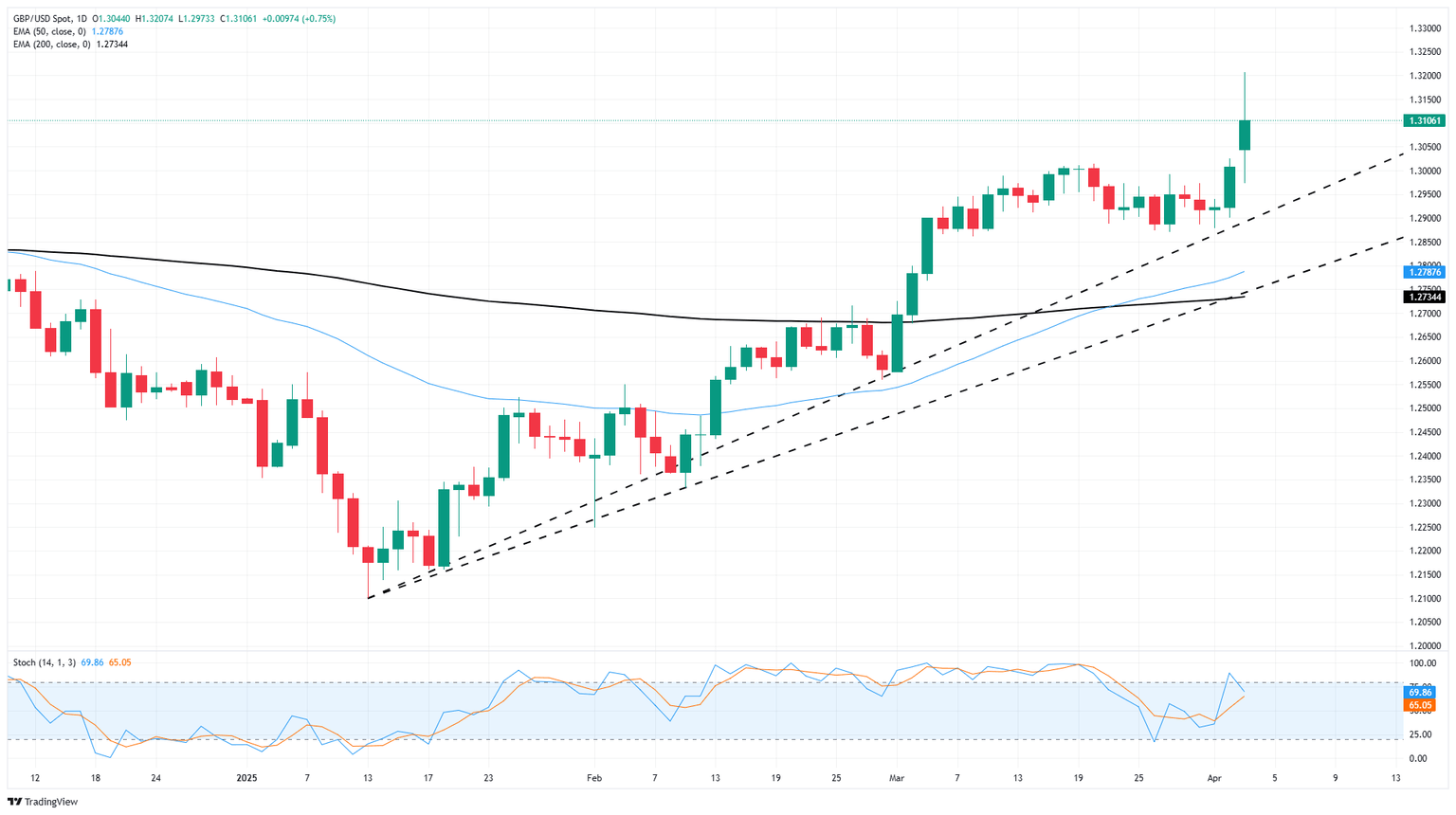

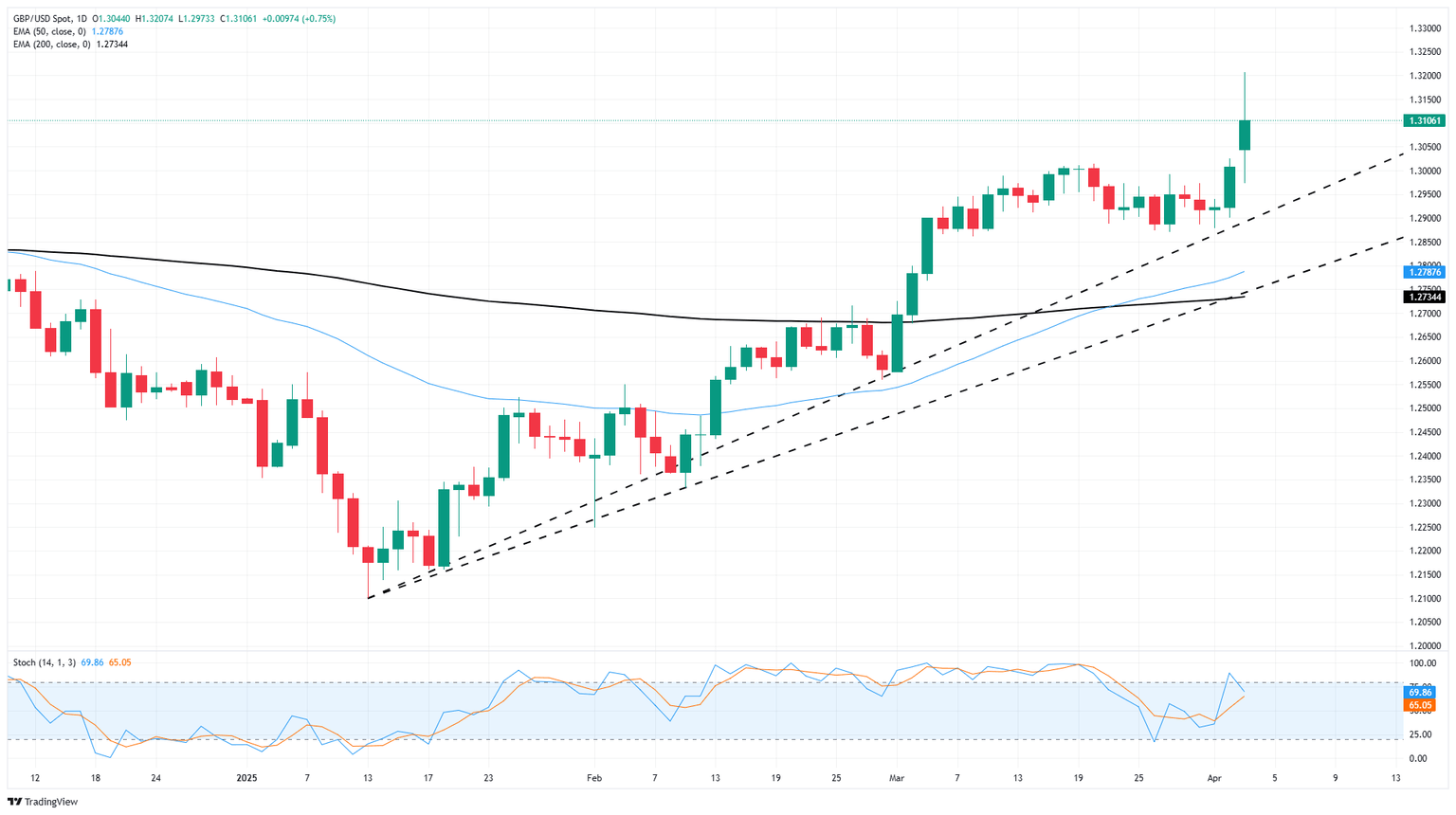

GBP/USD price forecast

GBP/USD caught a firm bid on Thursday on the back of weakening Greenback flows. However, Pound Sterling bulls caught a firm technical rejection from the 1.3200 handle and pushed bids back to the 1.3100 region.

Despite a flubbed bullish extension, Cable has broken out of a near-term consolidation range and is poised for further upside as the pair continues to trade north of the 200-day Exponential Moving Average (EMA) at 1.2735.

GBP/USD daily chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.