GBP/USD soaring into 1.24, set for its best trading day since March

- The GBP/USD is accelerating recent gains, set to end the week near 1.2400.

- The Pound Sterling is on track to chalk in its single best trading day since March.

- US NFP data miss is sending the Greenback broadly lower, giving a hand to riskier assets.

The GBP/USD is climbing into the 1.2400 handle to cap off a trading week that saw the pair mostly flounder around the averages.

After US Nonfarm Payrolls (NFP) came in well below expectations the Pound Sterling (GBP) climbed 1.6% from Friday's opening bids near 1.2190, and the GPB/USD is up almost 2.5% from the week's lows of 1.2095.

US Nonfarm Payrolls increase by 150,000 in October vs. 180,000 forecast

US NFP figures came in below expectations, printing at its worst headline figure in almost three years. The US added 150K new jobs in October, missing the market forecast of 180K and coming in well below September's print of 297K, which was revised downwards from the initial print of 336K.

The US NFP jobs miss is sending the US Dollar (USD) lower across the broader market as investors splurge on risk assets with souring US labor data counter-intuitively inspiring investors to move out of safe havens. Softening US data will give the Federal Reserve (Fed) cause for pause on interest rates as investors look for signs that the Fed will begin accelerating the schedule for eventual rate cuts.

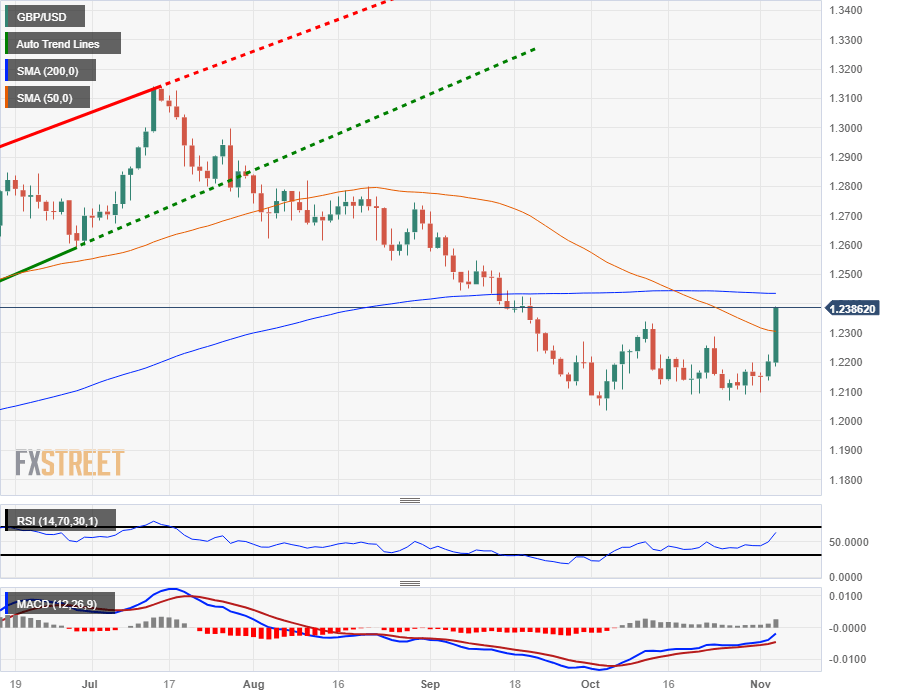

GBP/USD Technical Outlook

The Sterling's NFP-fueled climb sees the GBP/USD climbing straight through the 50-day Simple Moving Average (SMA), aimed directly at the 1.2400 handle and set for a challenge of the 200-day SMA currently grinding sideways from 1.2435.

The GBP/USD has been cycling between 1.2300 and 1.2100 recently, and a bearish fallback will see the pair slumping back into multi-month lows towards the 1.2000 major handle.

GBP/USD Daily Chart

GBP/USD Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.