- The Sterling is lifting ahead of another UK parliamentary vote on PM May's new Brexit strategy.

- The UK's economic calendar is empty for Monday, but US Retail Sales and Tuesday's UK Average Earnings promise to bring some market volatility to the mix.

The GBP/USD is moving tentatively into 1.3250, though today's Brexit vote in the UK parliament could see Prime Minister Theresa May facing further setbacks in her negotiations with the EU.

PM May's recent Brexit strategy proposal will now face a vote in the UK's parliament, and if a majority of May's own party decide to make changes to the PM's proposals, it could further weaken her negotiating strategy with EU leaders in Brussels, who have been stalwart in providing little or no leeway in negotiations thus far, and PM May has had a tough time wrangling support from hard-line Brexiteers within her own party.

The economic calendar is decidedly thin for Monday, and Sterling traders will be looking ahead to Tuesday's Average Earnings figures, though Monday's upcoming US session could throw markets as US Retail Sales are expected to come in soft, with June's m/m Retail Sales (excluding autos) forecast to decline from 0.9% to 0.4%.

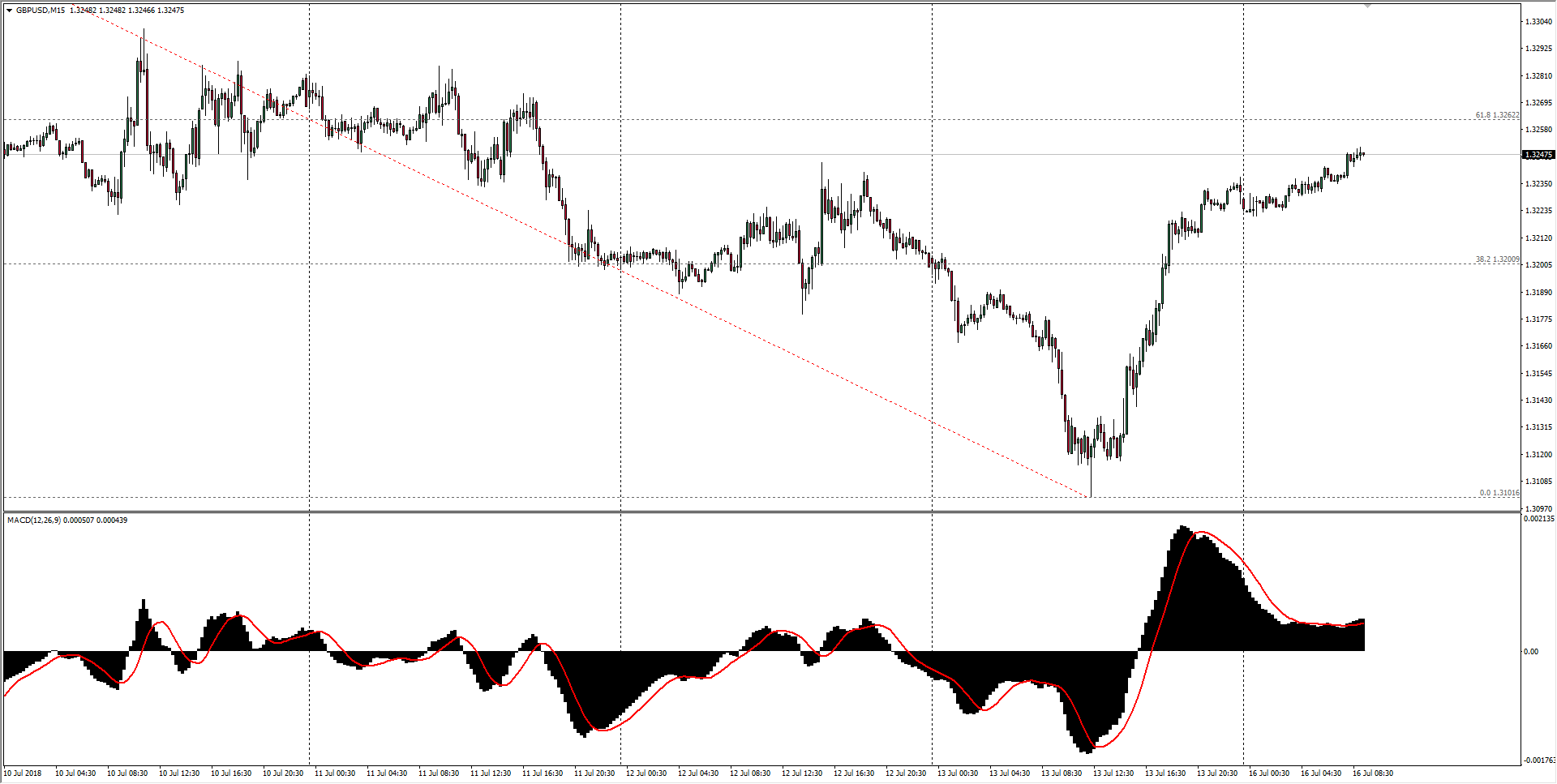

GBP/USD Technical Analysis

Light trading through the Asia session saw the GBP catch some minor lift into the 1.3250 level, and Monday's London session will see the next stage of PM May's latest Brexit proposal as the British parliament, and May's own party, will vote on whether or not to make changes to the PM's strategy. Broader markets turned bullish late last week, and the bullish trend for the Sterling has carried over into the new week as traders await fresh news.

GBP/USD Chart, 15-Minute

| Spot rate: | 1.3247 |

| Relative change: | 0.13% |

| High: | 1.3250 |

| Low: | 1.3221 |

| Trend: | Bullish |

| Support 1: | 1.3221 (current day low) |

| Support 2: | 1.3101 (previous week low) |

| Support 3: | 1.3049 (2018 low) |

| Resistance 1: | 1.3262 (61.8% Fibo retracement level) |

| Resistance 2: | 1.3361 (previous week high) |

| Resistance 3: | 1.3446 (June 14th swing high) |

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD retargets the 0.6600 barrier and above

AUD/USD extended its positive streak for the sixth session in a row at the beginning of the week, managing to retest the transitory 100-day SMA near 0.6580 on the back of the solid performance of the commodity complex.

EUR/USD keeps the bullish bias above 1.0700

EUR/USD rapidly set aside Friday’s decline and regained strong upside traction in response to the marked retracement in the Greenback following the still-unconfirmed FX intervention by the Japanese MoF.

Gold advances for a third consecutive day

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Bitcoin price dips to $62K range despite growing international BTC validation via spot ETFs

Bitcoin (BTC) price closed down for four weeks in a row, based on the weekly chart, and could be on track for another red candle this week. The last time it did this was in the middle of the bear market when it fell by 42% within a span of nine weeks.

Japan intervention: Will it work?

Dear Japan Intervenes in the Yen for the first time since November 2022 Will it work? Have we seen a top in USDJPY? Let's go through the charts.