GBP/USD retreated before reaching 1.3200 towards 1.3170s as market sentiment improves

- The British pound trimmed some of the last week’s losses, finished up 1.07%.

- Russia – Ukraine peace talks slowed amid failure to reach an agreement.

- US President Biden and China’s Xi talked about Russia – Ukraine.

- Fed’s Bullard, Waller, and Kashkari crossed the wires.

- GBP/USD Price Forecast: The bias is downwards unless GBP bulls reclaim 1.3300.

GBP/USD erased some of earlier weekly losses after the Bank of England (BoE’s) decided to increase borrowing costs for the third time, in the same number of monetary policy meetings, since December of 2021. At the time of writing, the GBP/USD is trading at 1.3176.

Wall Street’s closed the week with gains, reflecting the sudden improvement in risk appetite. Peace talks between Russia and Ukraine would continue; however, there have been mixed signals from both sides of the conflict that do not allow to reach an agreement that could trigger a truce or ceasefire.

Late in the New York session, US President Biden and Chinese President Xi Jinping held a videoconference reunion. China expressed its posture on the Russia-Ukraine conflict to the US. Chinese President Xi said that the invasion “is not something we want to see” and that “the events again indicate that countries should not come to the point of meeting on the battlefield.”

Elsewhere, once the Federal Reserve hiked rates on Wednesday, 0.25% for the first time in three years, the Fed speakers parade began.

The first official to cross the wires was St. Louis Fed President Bullard, who dissented in the meeting because he wanted the Fed to follow a balance sheet reduction plan, alongside a 50 bps increase. In the same tone, Fed’s Waller commented that the US central bank should consider a 50 bps rate hike at a certain point, while added that he expects to begin QT by July.

Late in the day, Minnesota Fed’s President Neil Kashkari said that the central bank should begin lowering its balance sheet as soon as the next meeting.

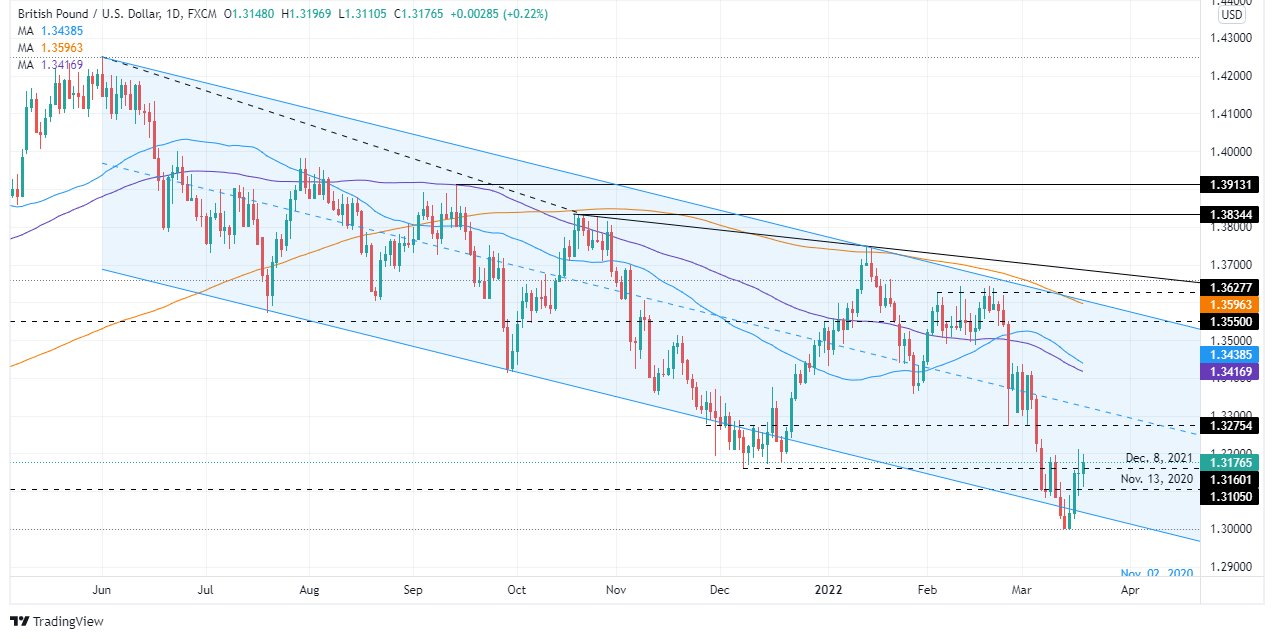

GBP/USD Price Forecast: Technical outlook

Overnight, the GBP/USD seesawed in a mid-size range, between the 1.3110s-1.3200 area, though as the New York session ends, cable stabilized around 1.3176.

The GBP/USD bias is down, as the daily moving averages (DMAs) reside above the exchange rate. Even though cable has reclaimed to trade within the lower boundaries of the descending channel, it remains vulnerable unless the GBP/USD pair achieves to reclaim the 1.3300 mark. If that scenario plays out, then a GBP/USD upward move to the 1.3415-40 area, where the 50 and the 100-DMA’s sit, is on the cards. However, the path of least resistance is downwards.

The GBP/USD first support would be December 8, 2021, at 1.3160. Breach of the latter would expose November 13, 2020, at 1.3105. Once cleared, the GBP/USD’s next support would be the bottom-trendline of the descending channel around 1.3040 ahead of the 1.3000 mark.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.