GBP/USD Price Analysis: Shows some resilience below 1.2200, 50 DMA holds the key for bulls

- GBP/USD retreats further from a multi-week high set on Thursday amid resurgent USD demand.

- The technical setup still supports prospects for the emergence of some dip-buying.at lower levels.

- A sustained weakness below the 50-day SMA is needed to negate the near-term positive outlook.

The GBP/USD pair comes under intense selling pressure on Friday and extends the overnight retracement slide from the vicinity of mid-1.2300s, or its highest level since February. Spot prices, however, manage to rebound a few pips from the daily low and trade above the 1.2200 mark during the early North American session, still down nearly 0.60% for the day.

A fresh wave of the global risk-aversion trade - amid lingering concerns about a full-blown banking crisis - assists the safe-haven US Dollar (USD) to build on the previous day's solid bounce from a seven-week low. Apart from this, the weaker-than-expected release of UK PMI prints for March weighs on the British Pound and further contributes to the heavily offered tone surrounding the GBP/USD pair.

That said, the Federal Reserve's hints of a pause to interest rate hikes, along with the anti-risk flow, lead to a further steep decline in the US Treasury bond yields. Furthermore, the disappointing US Durable Goods Orders act as a headwind for the USD and lend some support to the GBP/USD pair. Spot prices, meanwhile, showed some resilience below the 1.2200 resistance-turned-support.

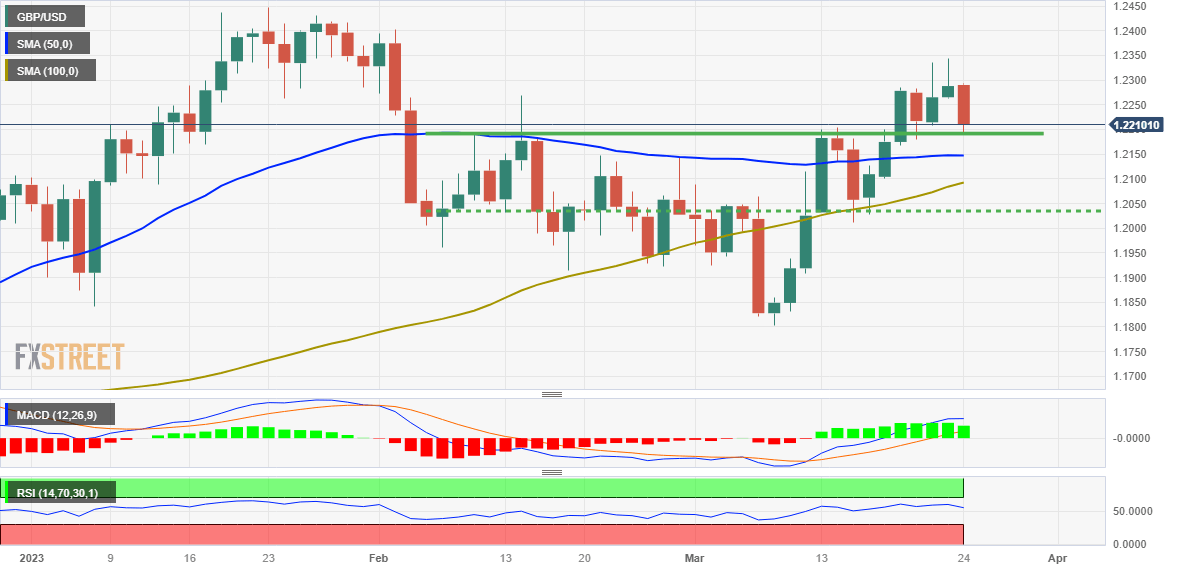

The said handle is followed by the 50-day Simple Moving Average (SMA), currently around the 1.2150-1.2145 region, which if broken decisively might prompt some technical selling and pave the way for deeper losses. The GBP/USD pair might then accelerate the fall towards the 1.2100 mark (100-day SMA) before eventually dropping to the next relevant support near the 1.2040 horizontal zone.

On the flip side, any meaningful recovery now seems to confront an immediate hurdle near the 1.2270-1.2275 region. A sustained move beyond has the potential to push the GBP/USD pair back above the 1.2300 round figure, towards resting the multi-week high, around the 1.2340-1.2345 region touched on Thursday. Bulls might then aim to reclaim the 1.2400 mark and the YTD peak around the 1.2445-1.2450 zone.

GBP/USD daily chart

Key levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.