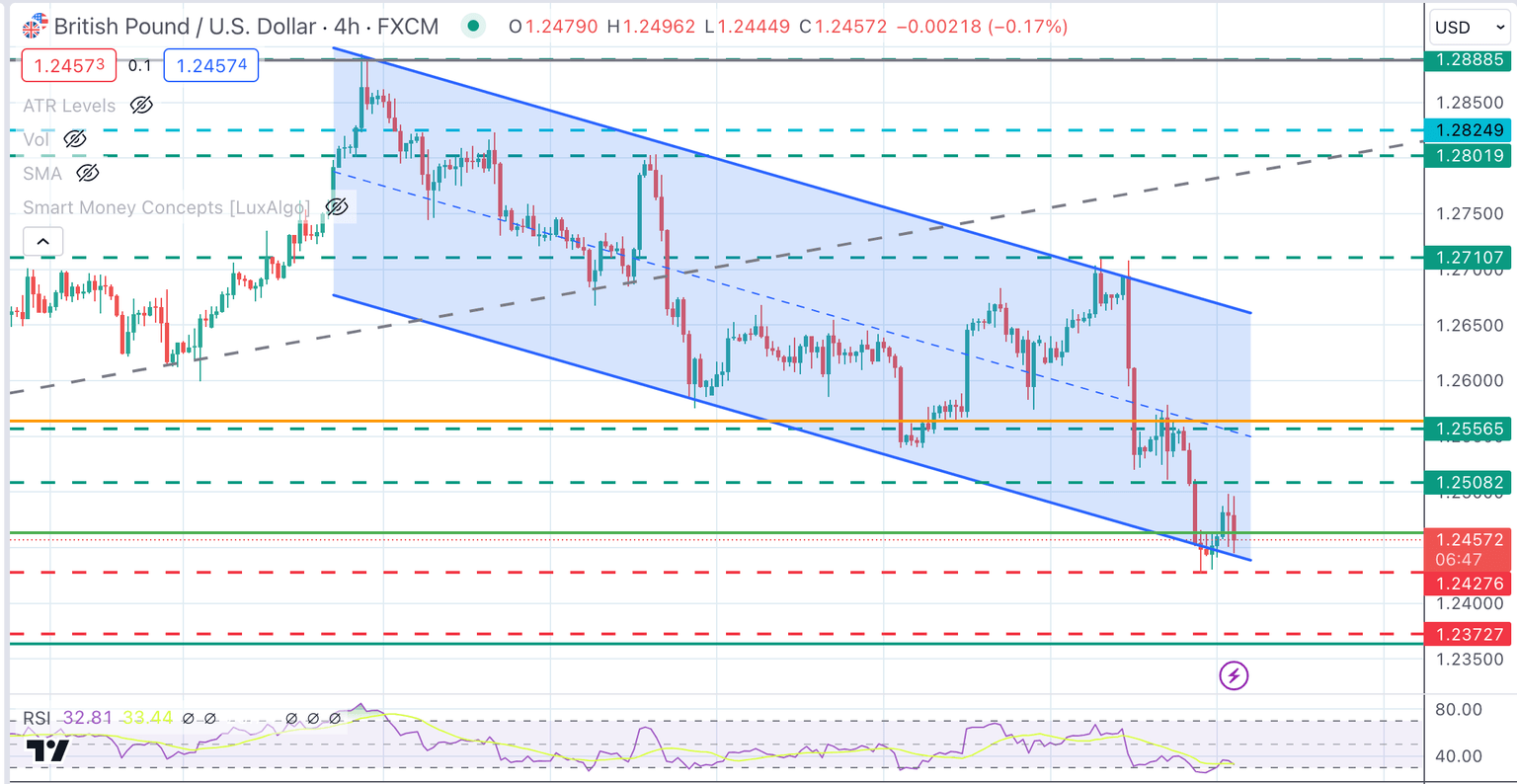

GBP/USD Price Analysis: Pound, rejected at 1.2500 pulls back to retest support area at 1.2430

- Pound’s failure to break resistance at 1.2500 leaves bears in control.

- Strong US retail sales figures have pushed the pair back to the bottom of the monthly channel, at 1.2440.

- Below 2.1430, the next support levels are 1.2370 and 1.2220.

Sterling’s recovery attempts have failed to find a significant acceptance above the 1.2500 level earlier on Monday. The pair has succumbed to the broad-based US Dollar strength after the release of upbeat US retail sales figures.

US Consumer spending has beaten expectations in MArch adding to the evidence of a strong US economic outlook. Beyond that, growing concerts about the consequences of an escalation in the Middle East conflict are additional support for the safe-haven USD.

GBP/USD Price Analysis: Technical outlook

Bears have pushed the pair back to the bottom of the monthly descending channel, at 1.2440, which is being tested at the moment. Last Friday’s low is right below there, at 1.2430. A clear break of that support area clears the path towards 1.2370. Further down there is no support until 1.2220.

On the upside 1.2505 level should be cleared to advance towards 1.2565, where an unmitigated order block may provide a fresh boost for bears.

GBP/USD 4-Hour Chart

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.