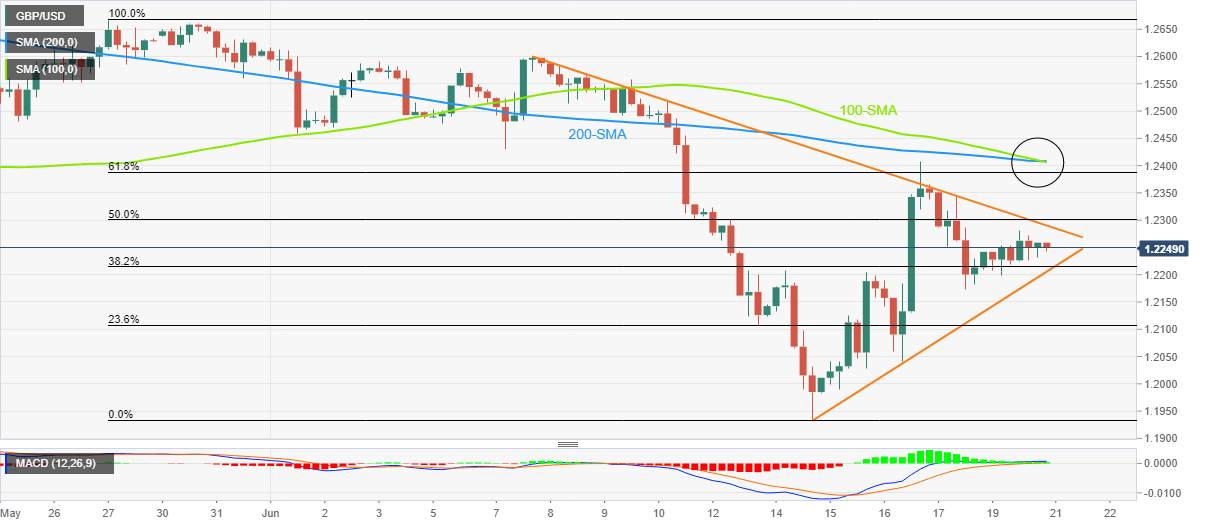

GBP/USD Price Analysis: Impending bear cross keeps sellers hopeful around 1.2250

- GBP/USD fades week-start rebound, seesaws inside short-term triangle.

- MACD signals join downbeat moving average crossover to suggest further declines, 1.2200 holds the key to welcome bears

- SMA convergence appears a tough nut to crack for buyers.

GBP/USD remains sidelined around the mid-1.2200s as it funnels down to the short-term triangle break during early Tuesday’s Asian session.

The cable pair began the week on a positive note but fails to stay firmer as the receding bullish bias of the MACD joins the looming bearish moving average crossover between the 100-SMA and the 200-SMA.

While the 100-SMA’s clear downside break of the 200-SMA from above could tease the sellers, a confirmation is needed before forming a downside bias.

As a result, a short-term triangle will be in focus and hence the GBP/USD pair’s declines below the 1.2200 become necessary for the bearish confirmation.

Following that, the cable pair could quickly drop to 1.2100 threshold before challenging the multi-month low around 1.1935 marked the last week.

Alternatively, an upside clearance of the 1.2290 hurdle could defy the bear cross and propel the quote towards the 61.8% Fibonacci retracement of May 26 to June 16 downside, around 1.2390.

However, a convergence of the stated key SMAs, near 1.2410 by the press time, appears a strong resistance to cross for the GBP/USD buyers before taking control.

GBP/USD: Four-hour chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.