GBP/USD Price Analysis: Climbs to fresh daily high, above mid-1.2400s amid weaker USD

- GBP/USD attracts some dip-buying on Thursday and turns positive for the third straight day.

- Retreating US bond yields undermine the safe-haven USD and lend support to the major.

- Bets for a 25 bps BoE rate hike in May act as a tailwind for the GBP and remain supportive.

The GBP/USD pair reverses an intraday dip to the 1.2400 round-figure mark and turns positive for the third successive day on Thursday. The pair, however, remain below the weekly high touched on Wednesday and trades around the 1.2450-1.2455 region, just below the weekly high touched on Wednesday.

The US Treasury bond yields stall the recent strong rally to a nearly one-month high, which, along with the disappointing US macro data, exerts some pressure on the US Dollar (USD). Apart from this, rising bets for another 25 bps rate hike by the Bank of England (BoE) in May underpin the British Pound and act as a tailwind for the GBP/USD pair.

That said, the prospects for further policy tightening by the Federal Reserve (Fed) should help limit the downside for the US bond yields. Furthermore, the risk-off impulse - as depicted by a generally weaker tone around the equity markets - could revive demand for the safe-haven Greenback and keep a lid on any meaningful gains for the GBP/USD pair.

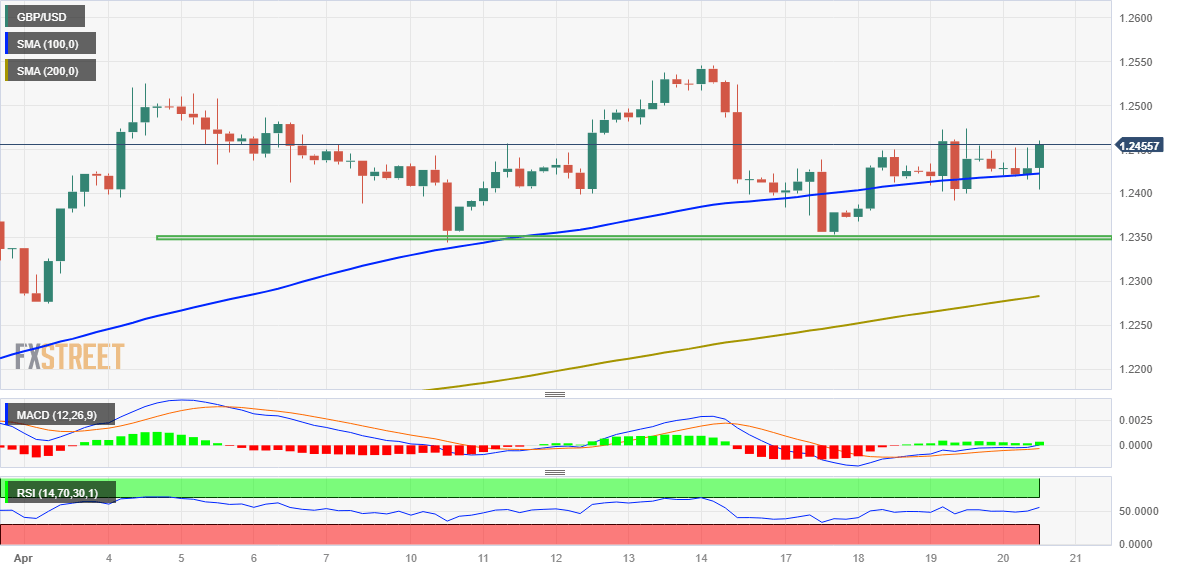

From a technical perspective, spot prices this week found a decent support near the 1.2355-1.2350 region. The said area should now act as a pivotal point, which if broken might prompt some technical selling. The GBP/USD pair could then slide to the 1.2300 mark en route to the 100-day Simple Moving Average (SMA), just below the 1.2200 round figure.

On the flip side, bulls might wait for some follow-through buying beyond the overnight swing high, around the 1.2470-1.2475 region, before placing fresh bets. The GBP/USD pair might then surpass the 1.2500 psychological mark and then aim back to retesting the monthly swing high, around the 1.2545 region touched last week.

The momentum could get extended towards the 1.2600 round figure, above which spot prices could climb to the next relevant hurdle near the 1.2660-1.2665 region.

GBP/USD 4-hour chart

Key levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.