GBP/USD Price Analysis: A strong open targets 1.1400

- GBP/USD bulls move in at the start of the week in bullish gap.

- Bulls eye the 1.1500 area for the days ahead.

GBP/USD starts where it left off the week, bid. The US dollar has been pressured following a report in the WSJ that said some Fed officials have signalled greater unease with big interest rate rises to fight inflation. In politics, UK Boris Johnson and Rishi Sunak did not strike a deal this weekend putting Sunak firmly on course for the leader. Cable has consequently penetrated a key resistance as follows:

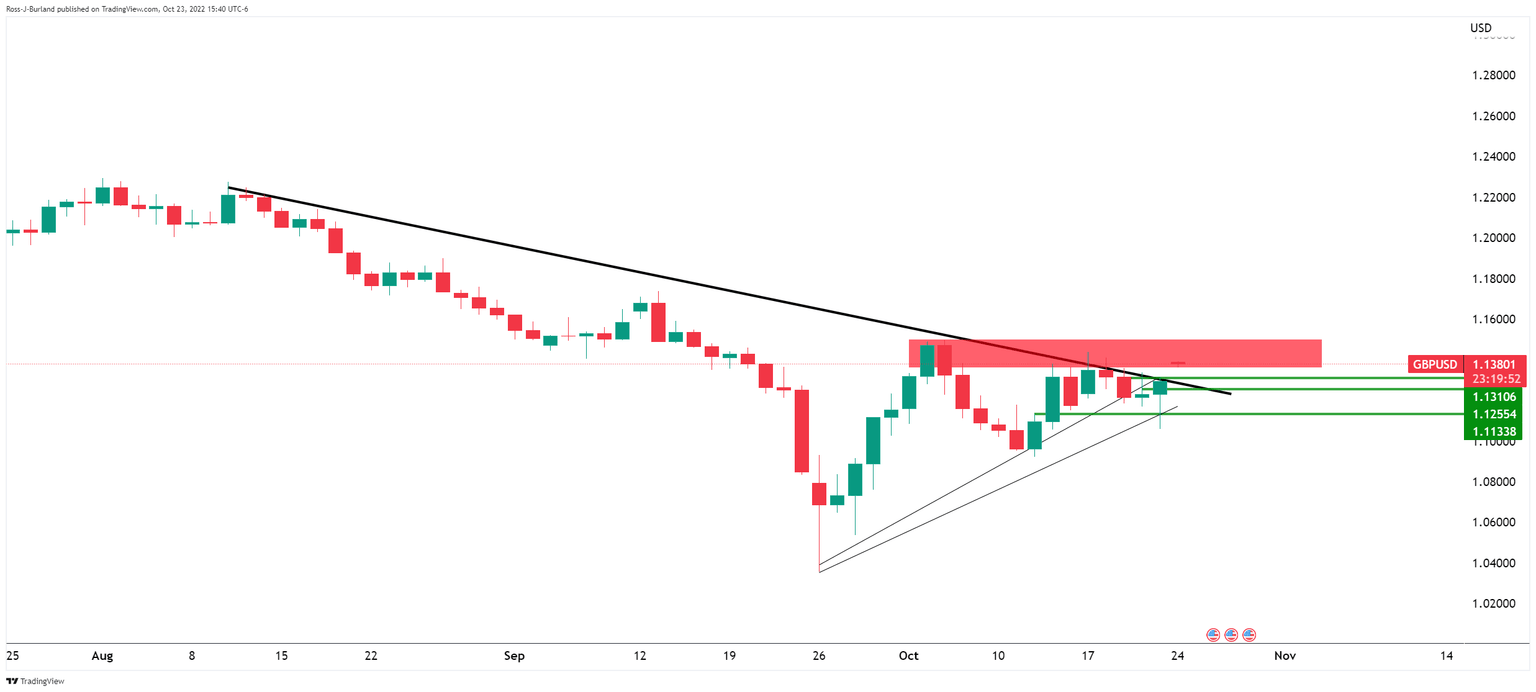

GBP/USD daily chart

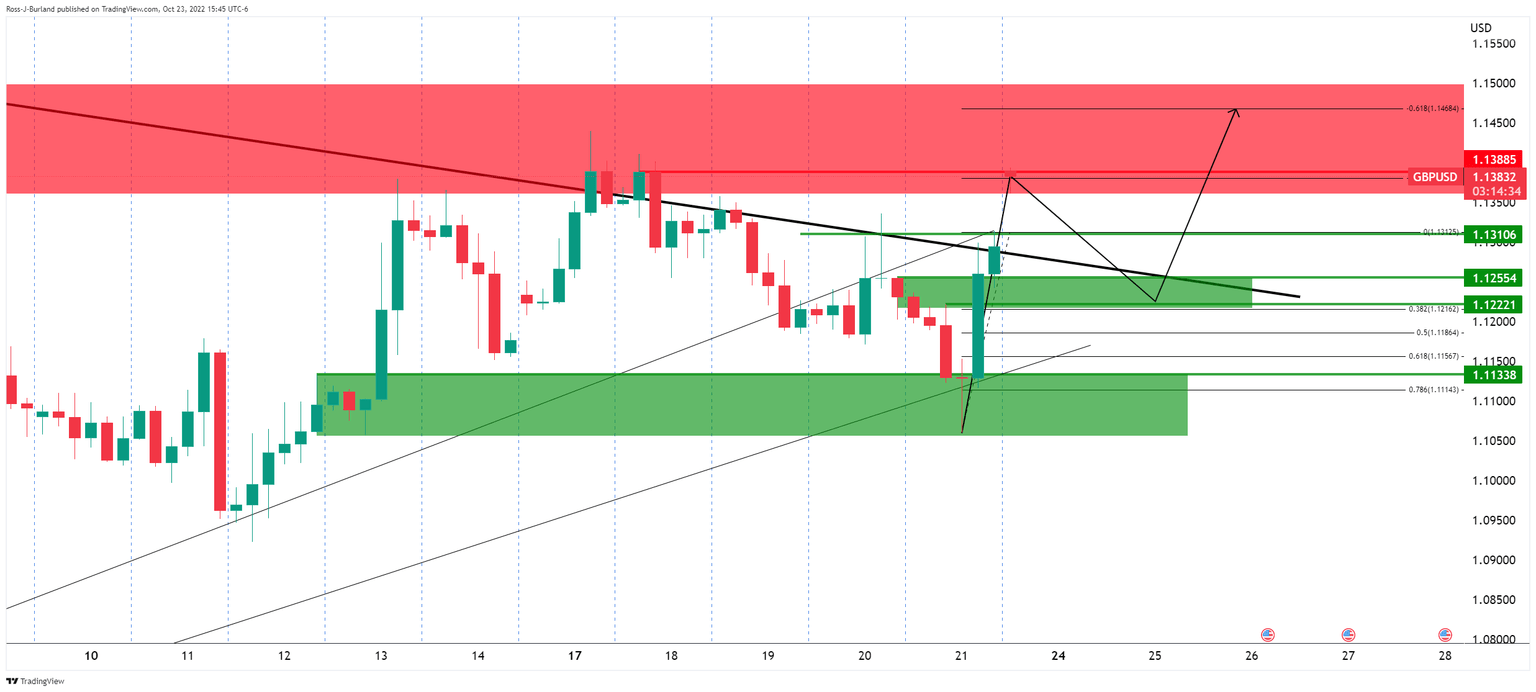

GBP/USD H4 chart

The price has carved a bullish scenario on the daily and 4-hour charts whereby a correction of the open could see support come in between 1.1300 and 1.1250. Resistance is marked just below 1.1400 which guards a break towards 1.1500 and early October highs.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.