GBP/USD: Bears back in town, but an upside correction is on the cards

- GBP is under pressure on Thursday and has run through stops to test a 50% mean reversion of prior bullish impulse.

- US dollar firm on stabilising US yields, traders hitting the bid on Wall Street and positive growth outlook and job creation prospects.

At the time of writing, GBP/USD is down 0.64% to 1.3835. Cable fell on Thursday from a high of 1.3949 to a low of 1.3826 printed at the start of the North American session.

The move, however, started in Europe when the pound fell across the board. The move was a bit of a head-scratcher as there was little in the way of domestic fundamental news to move the price.

However, the technical landscape has been bearish for the price considering the market's structure and how far the pound has come from over the course of the week.

The UK has merged from out of a tight COVID-19 lockdown and the data is starting to reflect the economic recovery.

On a key data week, cable hit a six-week high in prior sessions after Britain's unemployment rate unexpectedly fell for the second month in a row in the December to February period.

Additionally, the pound has enjoyed a slump in US Treasury yields coming down from their recent highs and prompting the dollar to weaken.

However, 1.50% in the US 10-year Treasury yield was being eyed in the market but it has yet to be tested and we have seen a rebound from a low of 1.5310% to a high of 1.5870 on the day so far.

This has fuelled a bid in the US dollar and the recent reaction to US President Joe Biden's proposal to almost doubling the capital gains tax rate for wealthy individuals to 39.6% has sent stocks sharply lower assisting the greenback higher as illustrated in the following price comparison chart between the S&P 500 and DXY:

Looking ahead

Meanwhile, the pound should find solace in forthcoming sessions on positive UK data outcomes.

For instance, UK Retail Sales data is due on Friday, along with flash PMIs which are expected to be strong, especially in Sevices.

''Non-essential shops in England and Wales re-opened on April 12, as part of a plan to ease the COVID-19 restrictions. The number of people going to shops in Britain jumped 87.8% last week, data on Monday showed,'' Reuters reported.

Moreover, Reuters also reported that ''British manufacturers' expectations of an economic rebound rose to their highest since 1973 this month as the country began to recover from the slump caused by the COVID-19 pandemic, the Confederation of British Industry said.''

As for the greenback, it will continue to fid demand on recovering yields and the negative correlation to the stock market should also be noted, as illustrated above.

Next week's US Federal Reserve will be important and possible comments about how it views future changes in its easy monetary policy, especially in light of the recent hawkishness at the Bank of Canada and a subtle change in tone from the European Central Bank today.

However, the report from the government that US weekly jobless claims declined further is welcome news, strengthening expectations for blockbuster US job growth in April.

Over the longer term, the outlook remains positive for the greenback due to a strong US economy and more coronavirus vaccinations.

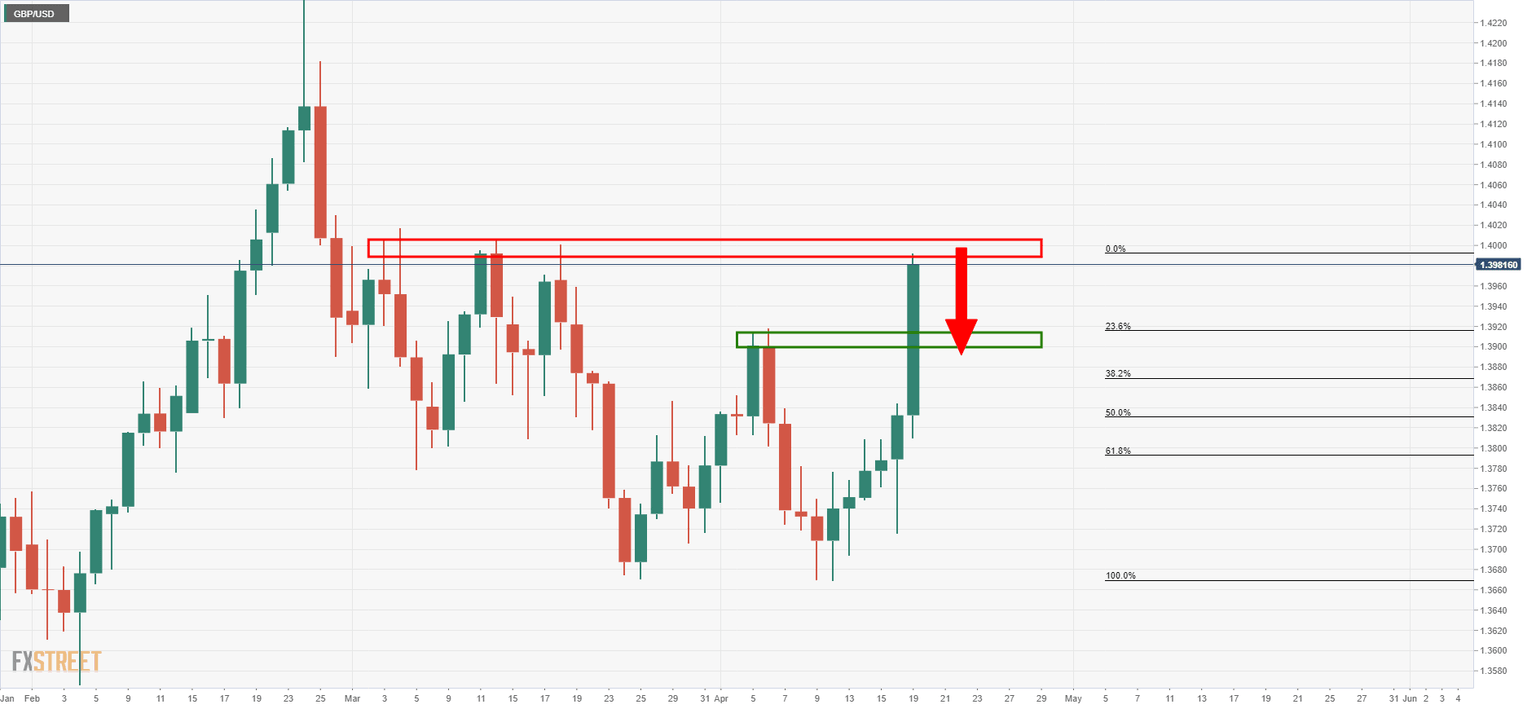

GBP/USD technical analysis

As per the prior analysis, GBP/USD bears set on a 38.2% Fibo 1.3880 target, the price to only achieved the target but it has gone on to test the next area of market structure in a 50% mean reversion of the prior bullish impulse.

Prior analysis

As per prior analysis, as illustrated in the chart below, the area of resistance was cited as follows:

Old live market analysis

There are now expectations of a significant correction to test the prior resistance which has a semi-confluence with a 38.2% Fibonacci retracement level near to 1.3880.

Current live market analysis, daily chart

As illustrated, the price has made a 50% mean reversion and is testing old daily support.

Significantly, the price is meeting an interruptive old resistance candle in from 2 April business. Habitually, such candles act as a firm support or resistance.

At this juncture, an upside correction would be expected prior to the next leg to the downside.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.

-637547115431294610.png&w=1536&q=95)