GBP/JPY bulls coming up for their last breath?

- Pound collects the market's flow as optimism grows for a faster UK economic recovery.

- GBP/JPY longer-term technical analysis remains bearish.

GBP/JPY has rallied on the day as the US dollar proves to be well and truly out of favour at the start of the week as the pound collects the market's bid.

At the time of writing, the cable is trading at 1.3985 having travelled between a low of 1.3809 and a high of 1.3992.

The cross is trading at 151.20 and up 0.5%.

DXY is down 0.55% despite a bid in the US ten-year yield which is stabilising from the weekly support.

However, sterling is the market's favourite and the poster child for a post covid world in the forex space.

Data over the weekend showed Britain had recorded just 10 COVID-19 deaths in a day, its lowest since September.

Forecasters expect that additional easing of lockdown restrictions will see the UK economy first out of the block on economic recovery expectations due to a fast roll-out of vaccinations against COVID-19 across Britain.

Moreover, the dwindling expectations of negative interest rates at The Old Lady as well as a Brexit trade deal with the EU have supported such a notion in recent weeks.

Also, encouragingly for the pound, data from CFTC showed that speculators' net long futures positions in cable have rebounded in the week to April 13 after dropping to the lowest since February in the previous week.

The week ahead

It is the start of a data-heavy week and investors are anticipating that it will provide extra evidence that the UK's economy is rebounding from its deepest recession in 300 years.

March Consumer Price Index on Wednesday is expected to bounce back from February's low reading.

On Friday, the focus will turn to the April PMI Services.

Given the optimism about reopening, the reading is expected to be encouraging.

Before then, the focus will also be on Jobs data (Tue) and Retail Sales (Fri).

The question is whether the dollar can continue its decline even in the face of stabilising US yields.

GBP/USD technical analysis

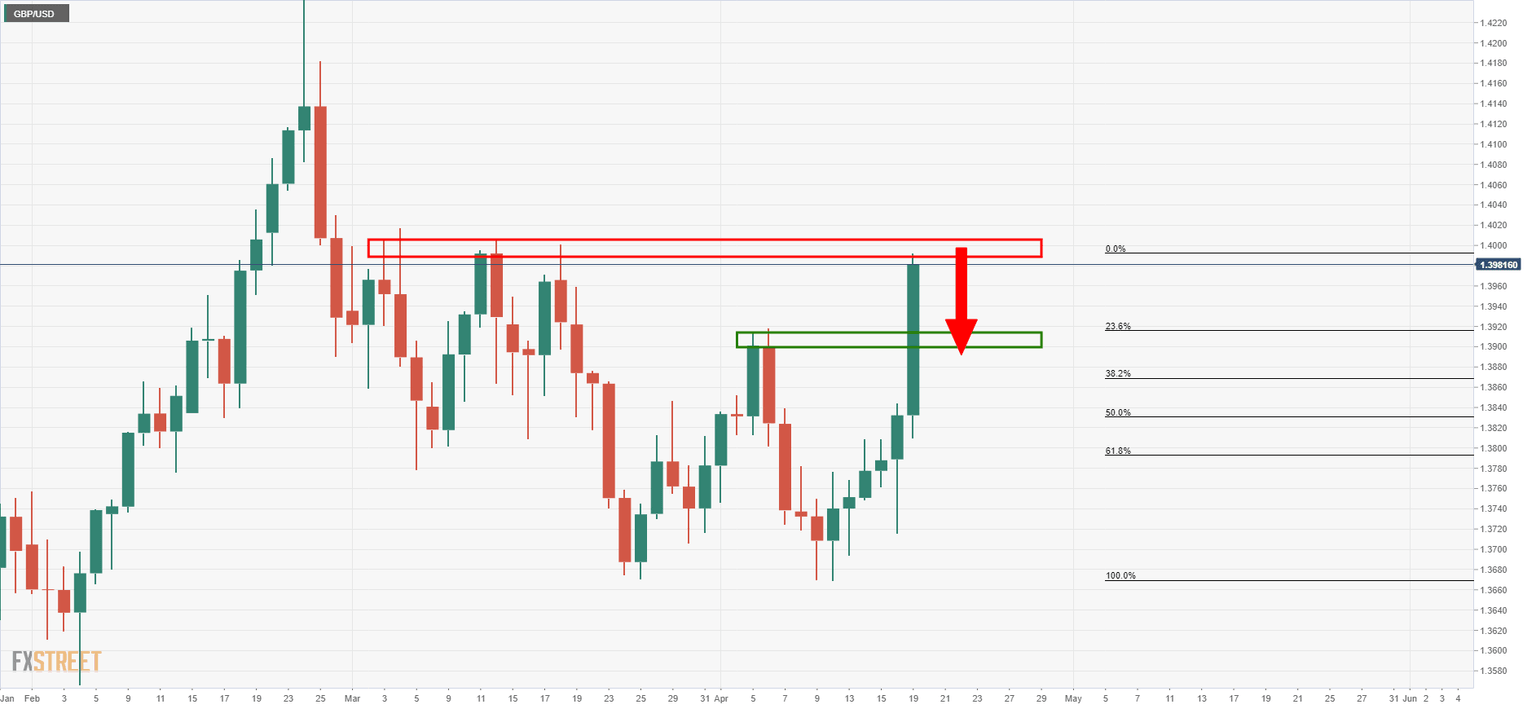

1.4000 is an important level vs the US dollar, but we may see the bottom of 1.39 before enough demand will commit to such a feat given there has been no meaningful offer this month so far:

GBP/JPY technical analysis

However, regardless of whether 1.40+ is achieved or not, a downside correction would be expected in due course from within the supply zone which would equate to downside risk in GBP/JPY.

As per the prior analysis and laws of gravity (overextended monthly and weekly trend), GBP/JPY Price Analysis: Bears in control, target significant downside levels, the path of least resistance while below 151.35 is to the downside:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.