GBP/MXN Price Prediction: Bullish Pennant pattern suggests rally to continue

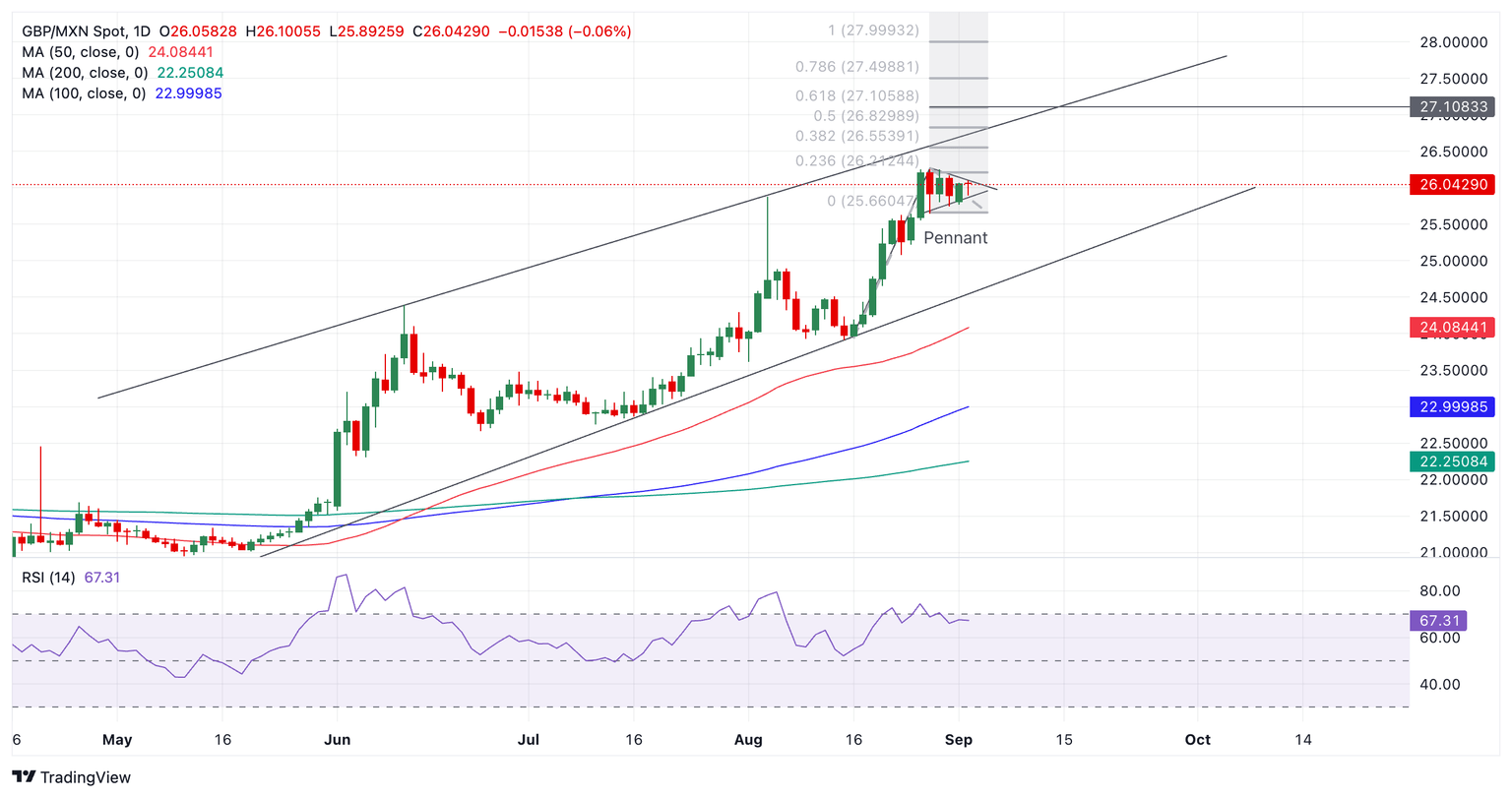

- GBP/MXN has formed a bullish Pennant pattern with an upside target in the 27.00s.

- The pair is in an uptrend within a rising channel with odds favor a continuation higher.

GBP/MXN has formed a bullish Pennant continuation pattern during its uptrend within a rising channel.

The pattern indicates that a breakout higher would probably lead to substantial further gains, probably all the way up to the upper channel line of the ascending channel.

GBP/MXN Daily Chart

The Pennant probably began at the August 16 low, with the long line of up days during the second half of August comprising the pattern’s “pole” with the actual triangular “pennant” currently unfolding.

A break above the top of the pattern at 26.25 would confirm a continuation higher to a conservative target at the 0.618 ratio of the length of the pole extrapolated higher. This suggests an upside target at 27.11.

The Relative Strength Index (RSI) momentum indicator is below the overbought level, suggesting the pair has more upside potential before it becomes overbought again.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.