GBP/JPY pulls back after overshoot on BoE meeting outcome, UK data

- GBP/JPY pulls back from extremes after the recent bout of Yen weakness.

- The Pound Sterling weakens after the BoE distribution of voting shows no-one voted for a hike.

- Japanese PMI data shows steady progress higher, UK data is mixed.

GBP/JPY is down over half a percent on Thursday, trading in the 192.000s, after a combination of the results of the Bank of England (BoE) policy meeting and weaker-than-expected UK PMI data, weighed on the Pound Sterling (GBP).

An improvement in Japanese data, meanwhile, may have helped staunch the recent hemorrhaging experienced by the Yen (JPY). The Jibun Bank Manufacturing Purchasing Manager Indices (PMI) showed upticks in both Manufacturing and Services sectors in March.

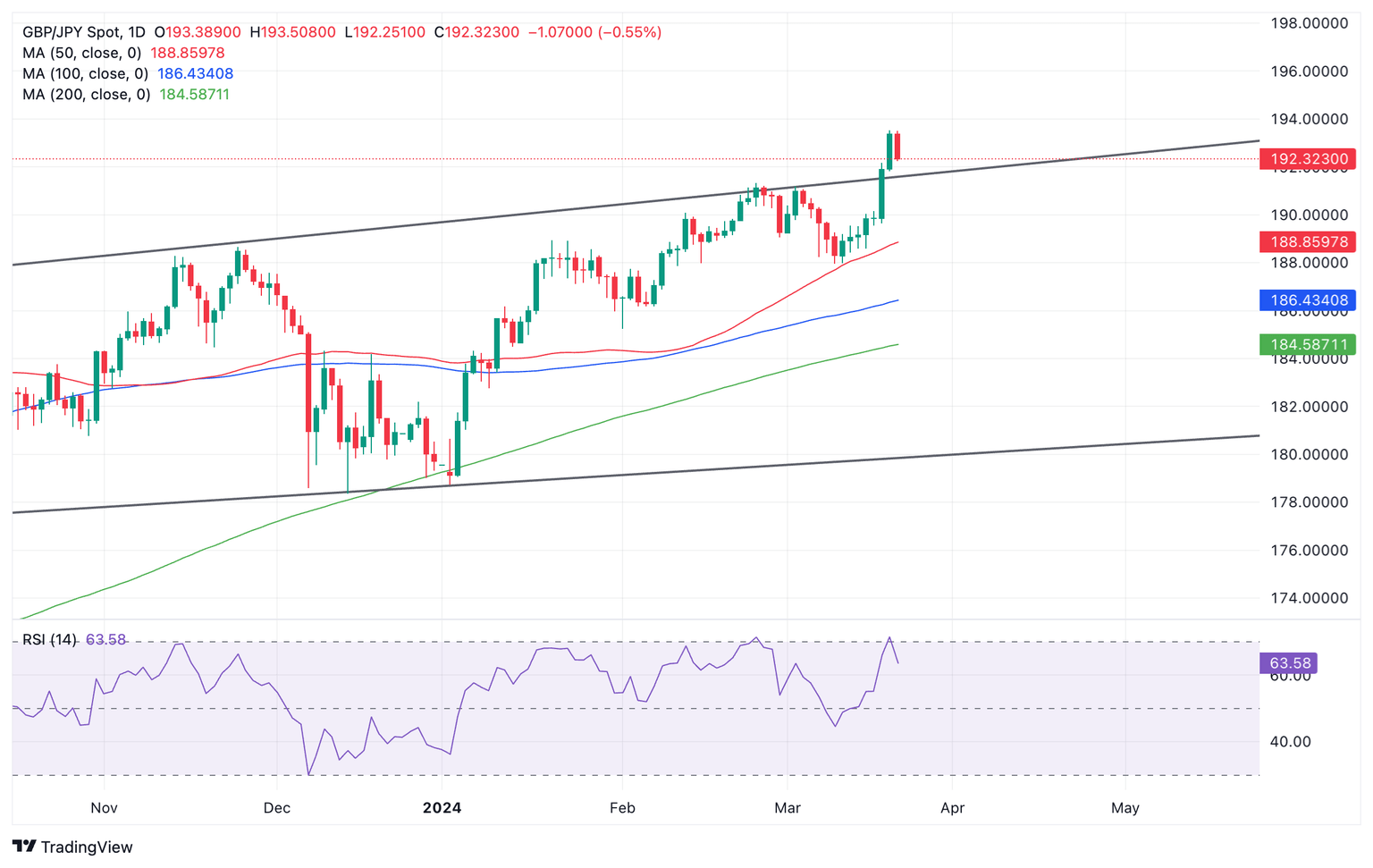

From a technical perspective, GBP/JPY looks overstretched after breaking out of the top of a Rising Wedge pattern on overbought momentum, according to the Relative Strength Index (RSI). A negative close on Thursday could signal an exit from overbought RSI, providing traders with a sell signal.

Pound Sterling to Japanese Yen: Daily chart

BoE voting distribution shows dovish shift

The Bank of England left interest rates unchanged at 5.25% at its meeting on Thursday, as was widely expected. The distribution of votes, however, changed from the previous meeting with zero officials voting for a hike instead of the one before. The majority of eight board members voted for no-change – one more than the seven of the previous meeting – and only one voted for a cut in interest rates, as before.

The Pound Sterling was hit by the lack of any BoE officials voting to raise interest rates, since higher interest rates are a positive factor for currencies because they attract greater inflows of foreign capital.

In Japan the opposite happened after the Bank of Japan (BoJ) raised interest rates, at its March meeting. Strangely the move failed to support the Yen. Reasons given were that it was widely telegraphed prior to the meeting, and that at between 0.0% and 0.1% interest rates in Japan are still very low compared to other major economies and unlikely to rise much in the future. This suggests the Yen will continue to be used as a funding currency – borrowed to purchase higher yielding peers.

Purchasing Manager Indices show mixed results

The UK S&P Global/CIPS Composite PMI in March came out lower-than-expected at 52.9 when 53.1 had been forecast, from 53.0 previously, on Thursday. The data weighed on GBP.

UK Services PMI undershot expectations of remaining at 53.8, dropping to 53.4.

Manufacturing was the bright spot, actually rising to 49.9 when 47.8 had been forecast from 47.5 previous.

In Japan the Jibun Bank Manufacturing PMI rose to 48.2 in March from 47.2 previously and Services PMI rose to 54.9 from 52.9.

Technical Analysis: Upside break seems unsustainable

GBP/JPY sees an upside break above the wedge pattern’s highs but the move looks unsustainable and price is already reversing. A bearish close on Thursday would form a Two Bar reversal pattern on the daily chart – a fairly reliable indicator of more weakness to come.

The RSI will probably exit overbought, another bearish sign. A break back inside the Wedge, confirmed by a decisive move below the upper trendline currently at 191.50, would probably signal further downside.

Pound Sterling to Japanese Yen: Daily chart

Often a reversal from an overshooting extreme, as is the case with GBP/JPY is a reliable signal to sell. When prices reach bullish extremes and overshoot their trendlines they often reverse sharply and move down quickly.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.