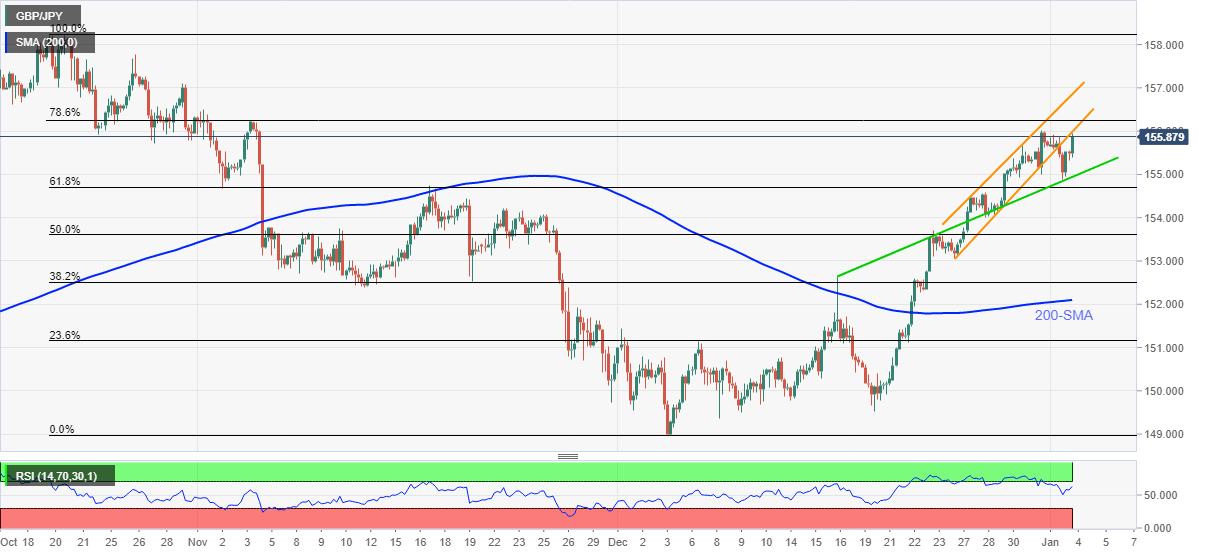

GBP/JPY Price Analysis: Pokes support-turned-resistance near 156.00, bulls stay hopeful

- GBP/JPY reverses previous day’s losses, bounces off three-week-old support line.

- Weekly ascending channel, 78.6% Fibonacci retracement guards immediate upside.

- Bearish need cautious until witnessing clear downside break of 200-SMA.

- Firmer RSI, sustained trading above key SMA favor bulls.

GBP/JPY rises 0.25% intraday around 155.86, grinding higher at the two-month top during Tuesday’s European morning.

The cross-currency pair snapped a three-day uptrend the previous before bouncing off an ascending support line from December 16. The recovery moves also take clues from firmer RSI, not overbought.

It should be noted, however, that the quote still holds the previous downside break of a one-week-long ascending trend channel, which triggered Monday’s declines.

Hence, a clear upside break of the stated channel’s resistance line, around 156.00 by the press time, becomes necessary for the GBP/JPY buyers to keep reins.

Following that, 78.6% Fibonacci retracement (Fibo.) level of October-December 2021 downside, near 156.25, may offer an intermediate halt during the quote’s rally towards the last year's top of 158.22.

Alternatively, the stated support line, previous resistance, can challenge the intraday GBP/JPY sellers around 155.00. Also adding to the downside filter is the 61.8% Fibo. level near 154.70.

In a case where GBP/JPY drops below 154.70, the early November’s swing low near 152.40 may act as an intermediate halt before directing bears to the 200-SMA level of 152.10.

GBP/JPY: Four-hour chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.