- UK budget report scheduled on Tuesday at 11.30 GMT.

- SNB rate decision on Thursday at 8.30 GMT .

The GBP/CHF is currently trading at around 1.3118 virtually unchanged on Monday so far. Last week the GBP/CHF appreciated more than 290 pips and is now trading less than 40 pips away above its daily 100-period simple moving average.

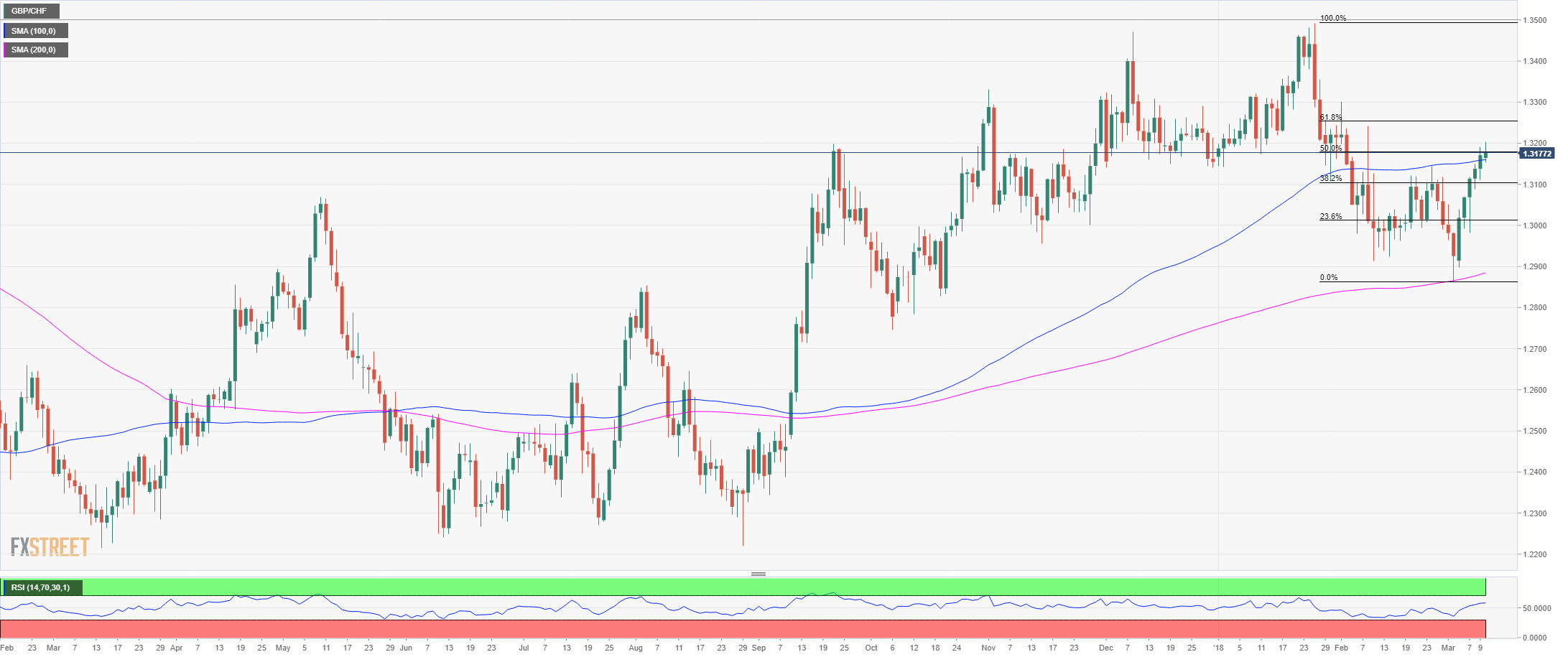

GBP/CHF daily chart

The GBP/CHF found resistance at 1.3180 which is the 50% Fibonacci retracement. Previously the 1.3180-1.3200 has been an important supply/demand zone.

The UK budget report is scheduled on Tuesday at 11.30 GMT. Market participants will get more details over GDP estimates, fiscal stimulus and spending and borrowing forecasts. However, the main risk event for the UK is likely going to be on March 22nd at the European summit where a conclusion on the EU-UK trade deal should be announced.

Thursday will see the Swiss National Bank interest rates decision and quarterly bulletin. The SNB is expected to keep interest rates unchanged according to Danske Bank. More info here.

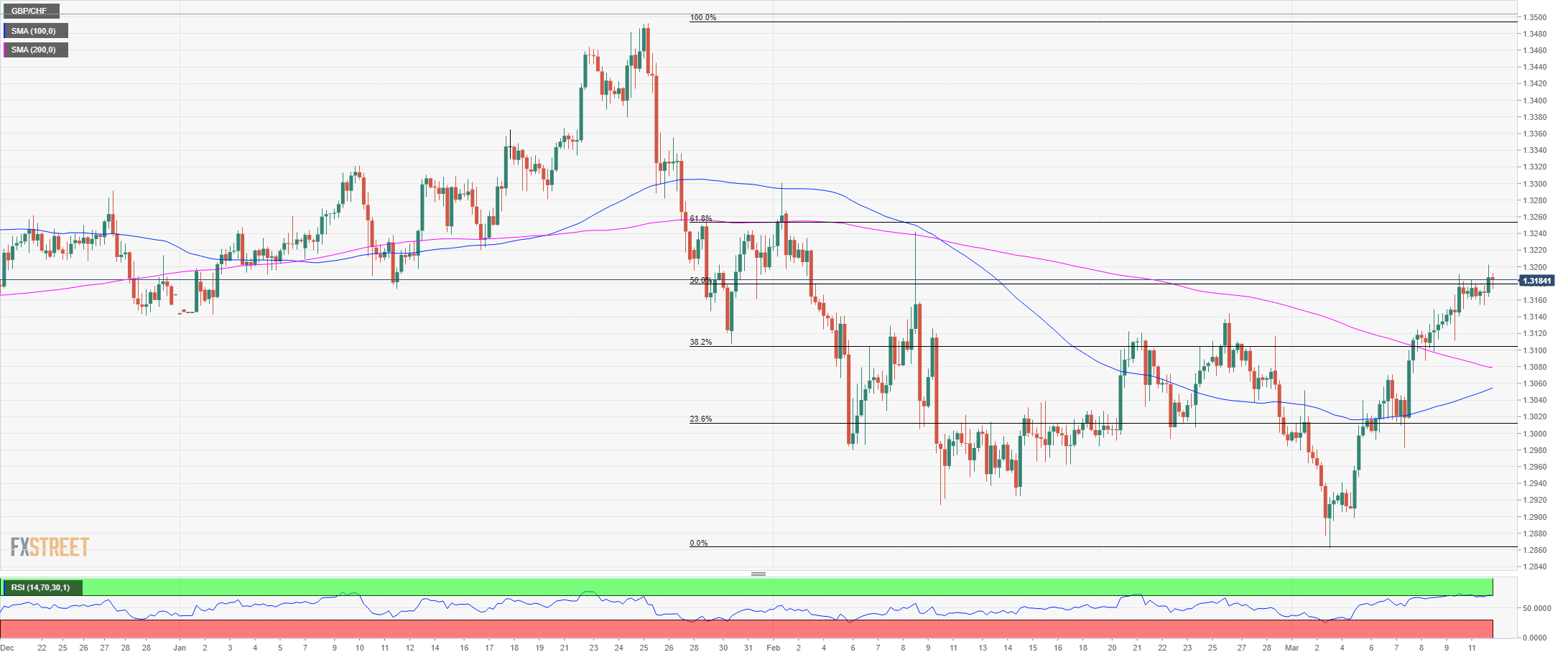

GBP/CHF 4-hour chart

Intraday resistance is seen at 1.3200 which is the current high of the day. Further up, resistance is seen at 1.3260 which is the 61.8% Fibonacci retracement of the 1.3483/1.2861 decline. To the downside, intraday support is seen at 1.3154 which is close to the low of the day. Further down, support is seen at 1.3100 which is the 38.2% Fibonacci retracement followed by 1.3020 which is the 23.6% Fibonacci retracement.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.