GBP/CAD Price Forecast: Nearing upper channel line, bearish divergence

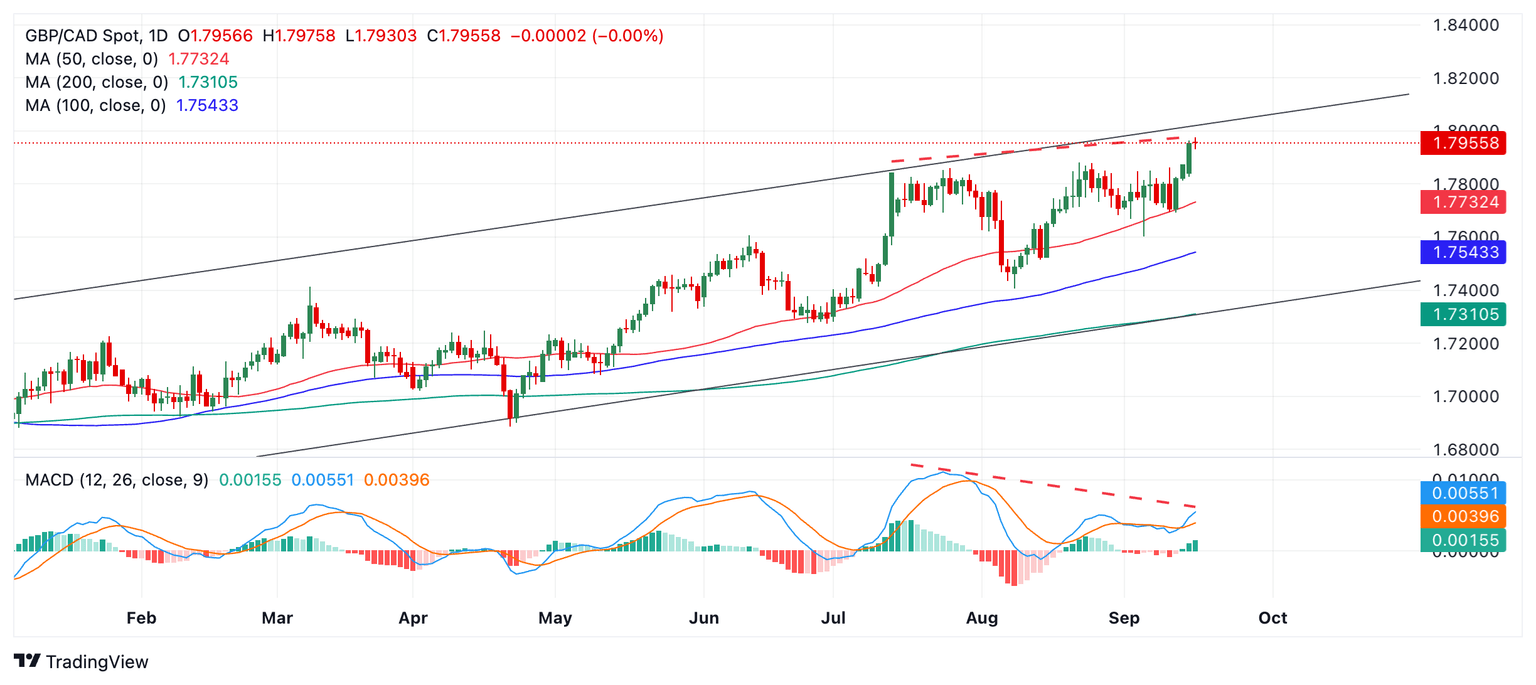

- GBP/CAD is closing in on the upper channel line of a rising channel.

- It is likely to meet firm resistance at the line and price is diverging bearishly with MACD.

GBP/CAD is trending higher in a rising channel, however, it is close to touching the upper trendline of the channel where it is likely to meet firm resistance and will probably pull back down as a consequence.

GBP/CAD Daily Chart

GBP/CAD is showing bearish divergence with the Moving Average Convergence Divergence (MACD) momentum indicator (red dashed lines). This means that although price has risen to a higher high compared to the July 12 high, MACD is actually lower than where it was on July 12. This is a bearish sign and suggests a higher chance of a pull back evolving.

Taken together with the looming overhead channel line it indicates a risk of price correcting back down within the channel. An initial target for a pull back would be the 50-day Simple Moving Average (SMA) at 1.7733.

Price itself has not formed a reversal pattern yet. If it does form a candlestick reversal pattern such as a Shooting Star, Bearish Engulfing or Hanging Man, for example, then that will be even more evidence of a correction unfolding.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.