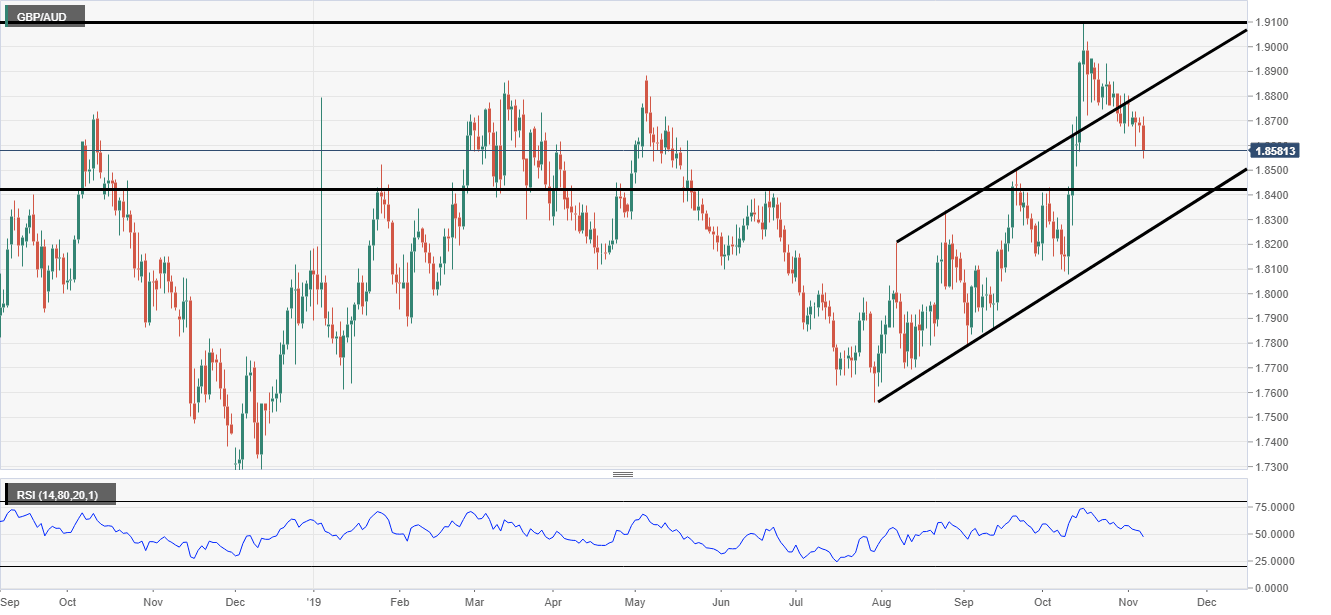

GBP/AUD technical analysis: The pair could accelerate through technical pattern

- Post BoE rate decision GBP has seen significant losses.

- The bearish technical pattern on the chart could break even lower.

After the Bank of England (BoE) rate decision where the vote split changed from 9-0 to 7-2. GBP has lost ground against all of its major counterparts. Like any other of the worlds central banks, the BoE has moved to take a more dovish stance. Looking at the technical picture now:

4-Hour Chart Analysis

There has been a strong descending wedge formation on the 4-hour GBP/AUD chart. The market has just printed below the wedge support zone but is finding it hard to hold below. The pattern is pretty steep in any case but if the price breaks lower it would be seen as another bearish acceleration.

The RSI has also moved under the 50 mid-line which also indicates bearishness. The key support zone next in line is at 1.8416, this is marked on the chart and has been well used in previous price action.

Daily Chart Analysis

The daily chart shows is that an internal trendline has been broken to the downside. The next support zone still remains the same but there is another trendline support to keep an eye on below 1,8416. The RSI looks like it preparing for a bullish failure swing. This is when the indicator makes a lower low but the price is making higher lows. This could take some time to transpire so the bullish case may have to take a backstep for now.

Author

Rajan Dhall, MSTA

FX Daily

Rajan Dhall is an experienced market analyst, who has been trading professionally since 2007 managing various funds producing exceptional returns.

-637087320177804817.png&w=1536&q=95)