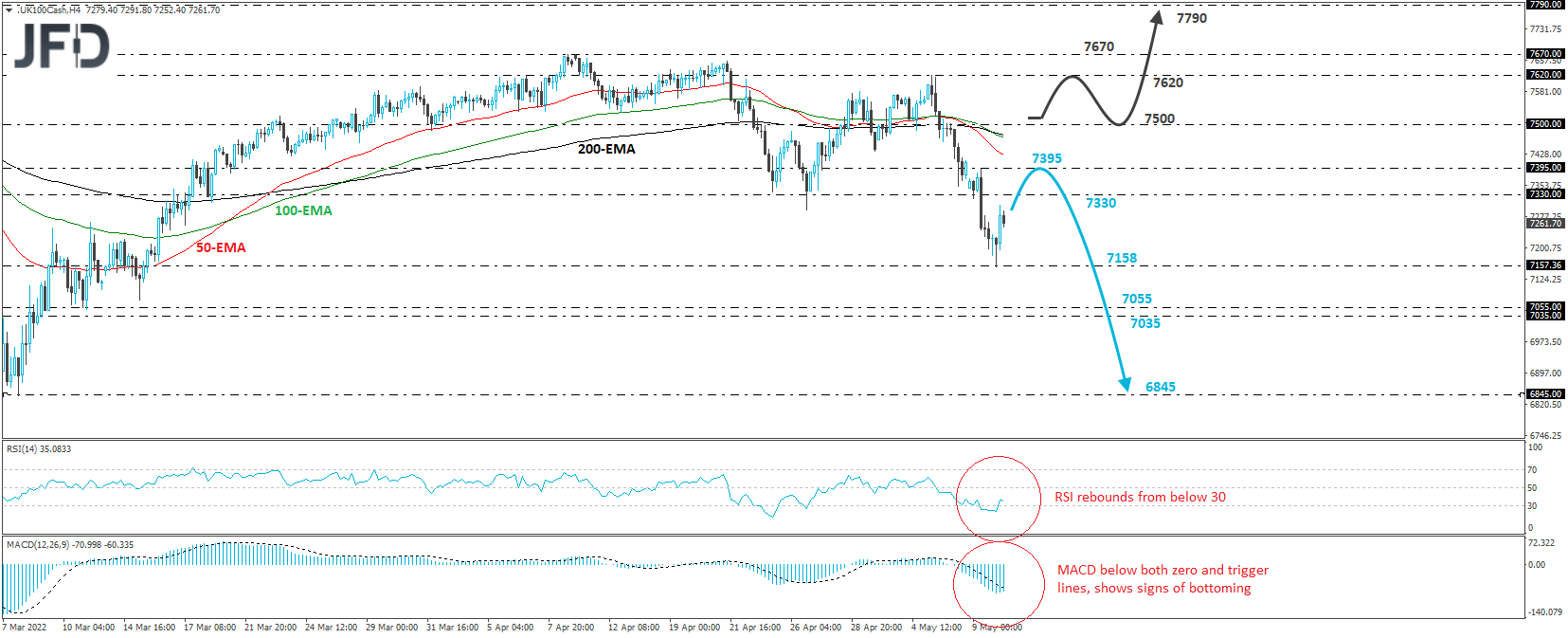

The FTSE 100 cash index traded higher on Tuesday, after it hit support at 7158. Before that though, the price had been sliding since May 5th, while yesterday, it fell below the 7330 zone, which acted as a key support on May 25th and 26th. FTSE is still below that barrier and thus, we will consider the short-term outlook to still be negative.

Even if the recovery continues for a while more, the bears could take charge again from near the 7330 zone, or even the 7395 territory, marked by yesterday’s high. The forthcoming slide could result in another test at 7158, the break of which would confirm a forthcoming lower low on the 4-hour and daily charts and may initially target the 7055 or 7035 barriers, marked by the low of March 11th and the inside swing high of March 7th. If the bears do not stop there, then we may see them diving all the way down to the 6845 barrier, marked by the low of Marc 8th.

Shifting attention to our short-term oscillators, we see that the RSI rebounded from below-30 and crossed above that 30 mark, while the MACD, although below both its zero and trigger lines, shows signs of bottoming as well. Both indicators detect slowing downside speed, which adds to the idea of seeing further recovery before the next leg south.

We will abandon the bearish case if we see a clear recovery above the 7500 zone, marked by the high of May 6th. Such a move could encourage advances towards the high of May 5th, at 7620, or the peak of April 11th, at 7670. If the bulls do not want to stop there, then we may see them climbing all the way up to the 7790 territory, marked by the highs of July 31st and August 7th, 2018.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended content

Editors’ Picks

EUR/USD trades with negative bias, holds above 1.0700 as traders await US PCE Price Index

EUR/USD edges lower during the Asian session on Friday and moves away from a two-week high, around the 1.0740 area touched the previous day. Spot prices trade around the 1.0725-1.0720 region and remain at the mercy of the US Dollar price dynamics ahead of the crucial US data.

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.