From $100 to $20: Could Doximity (DOCS) stock reverse pump and dump lead to a major rebound? [Video]

![From $100 to $20: Could Doximity (DOCS) stock reverse pump and dump lead to a major rebound? [Video]](https://editorial.fxstreet.com/images/TechnicalAnalysis/ChartPatterns/Candlesticks/stock-market-graph-and-bar-chart-price-display-75053099_XtraLarge.jpg)

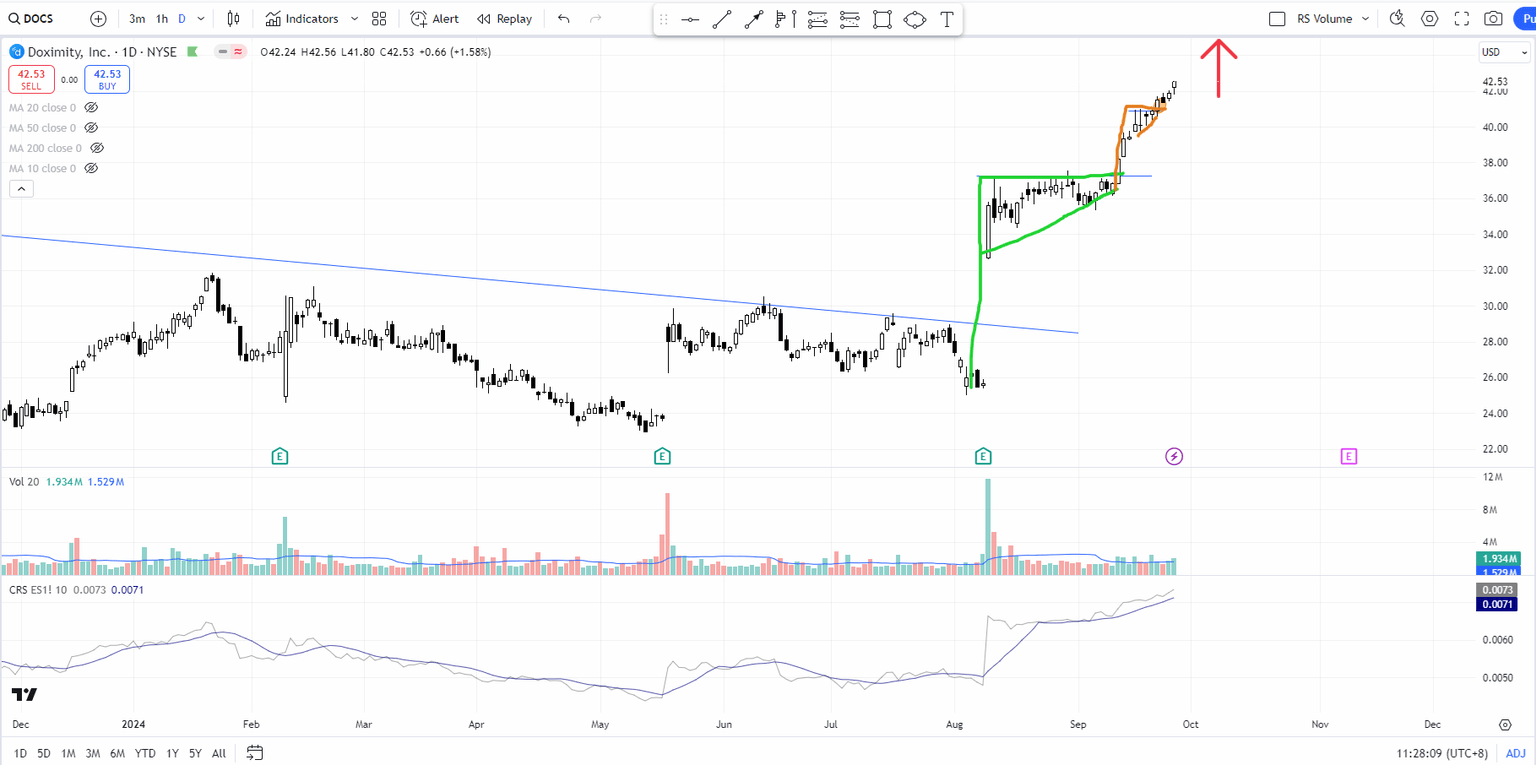

There is a "reverse pump and dump" unfolding in Doximity (DOCS). The recent breakout from the bottoming accumulation structure on top of the setup is based on a post-earnings trade, showing a power earnings gap followed by a flag formation. The stock recently broke out of this flag structure, with a potential upside target around $48.

Doximity (DOCS)

Trading plan for Doximity (DOCS) [Video]

Author

Ming Jong Tey

Independent Analyst

Ming Jong Tey has been trading since 2008. He started his learning journey from technical analysis (indicators, Fibonacci, etc...) to value investing. Throughout his journey, he develops an interest in price action with chart pattern trading.