EUR/USD tumbles out of recent range, tests below 1.0770 as markets flee into safe havens

- Euro slips to near-term lows as risk-off markets bid Greenback.

- European markets will be largely dark on Wednesday.

- Midweek Fed rate call on the cards.

EUR/USD slid below the 1.0670 level on Tuesday after an unexpected uptick in US wages growth reignited fears of sticky inflation, chopping down rate cut expectations and sending investors into safe haven bids.

With European markets broadly shuttered on Wednesday for Labour Day, investors will be left to focus on the Federal Reserve’s (Fed) latest rate call. Markets are broadly expecting the Fed to hold rates steady for the time being, but market participants will be actively looking for firmer policy guidance from the US central bank as inflation fears and a steep downturn in US economic growth figures plague market sentiment.

US housing prices and wage costs for businesses both showed acceleration on Tuesday, while consumer and business sentiment surveys turn sharply lower at the same time. Investors are grappling with the prospect of a stagnant economy with too-high inflation that will hobble the Fed’s ability to cut rates at the higher pace that investors have been hoping for since the start of 2024.

According to the CME’s FedWatch Tool, rate markets now only see a single rate quarter-point rate cut from the Fed for the year, with a 54% chance of no rate cut in September and only a 57% chance of a 25-basis-point rate trim at the Fed’s November policy meeting.

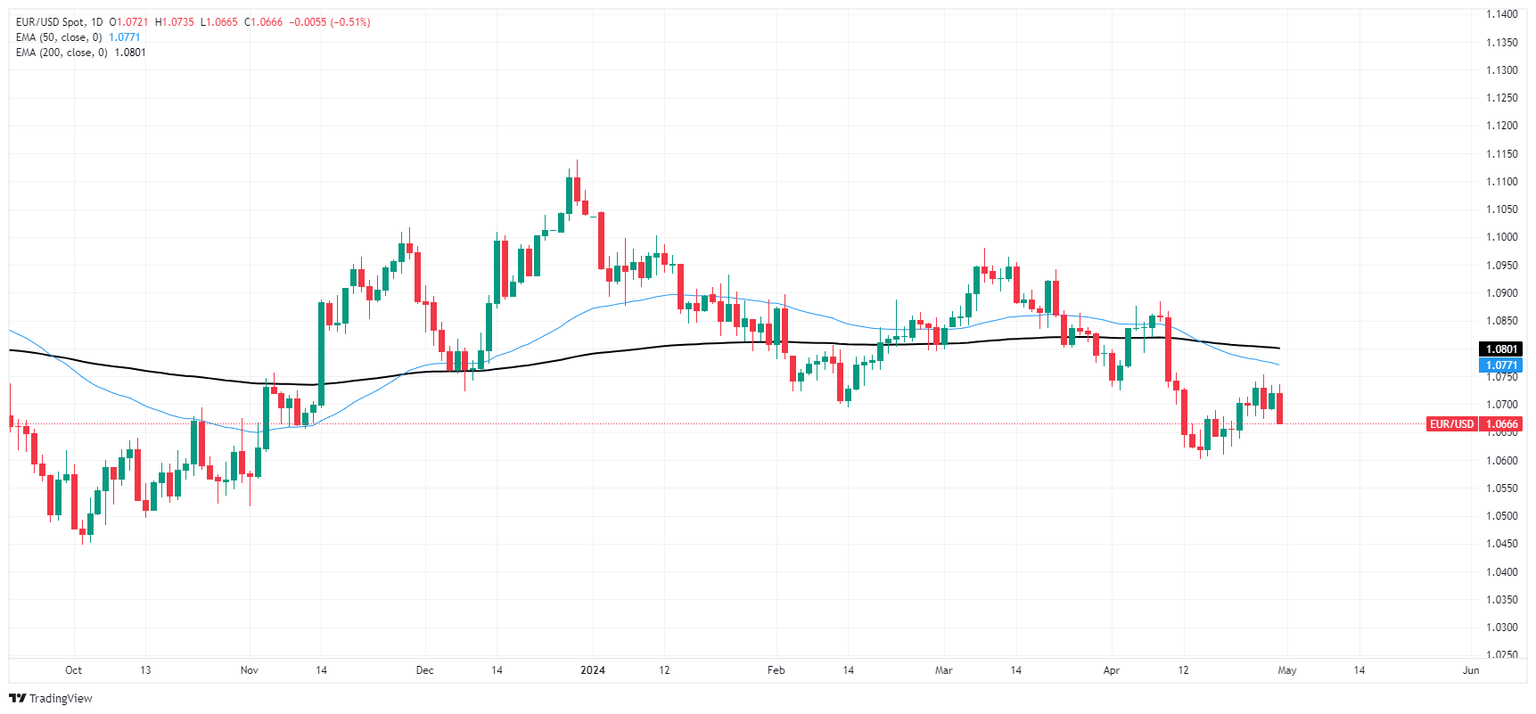

EUR/USD technical outlook

EUR/USD’s decline on Tuesday firmly knocked the pair below the 200-hour Exponential Moving Average (EMA) at 1.0800 as the pair tests into fresh weekly lows and in striking distance of a supply zone near 1.0660.

The pair is approaching April’s low bids near the 1.0600 handle, and EUR/USD is down around 2% from the last swing high at 1.0885.

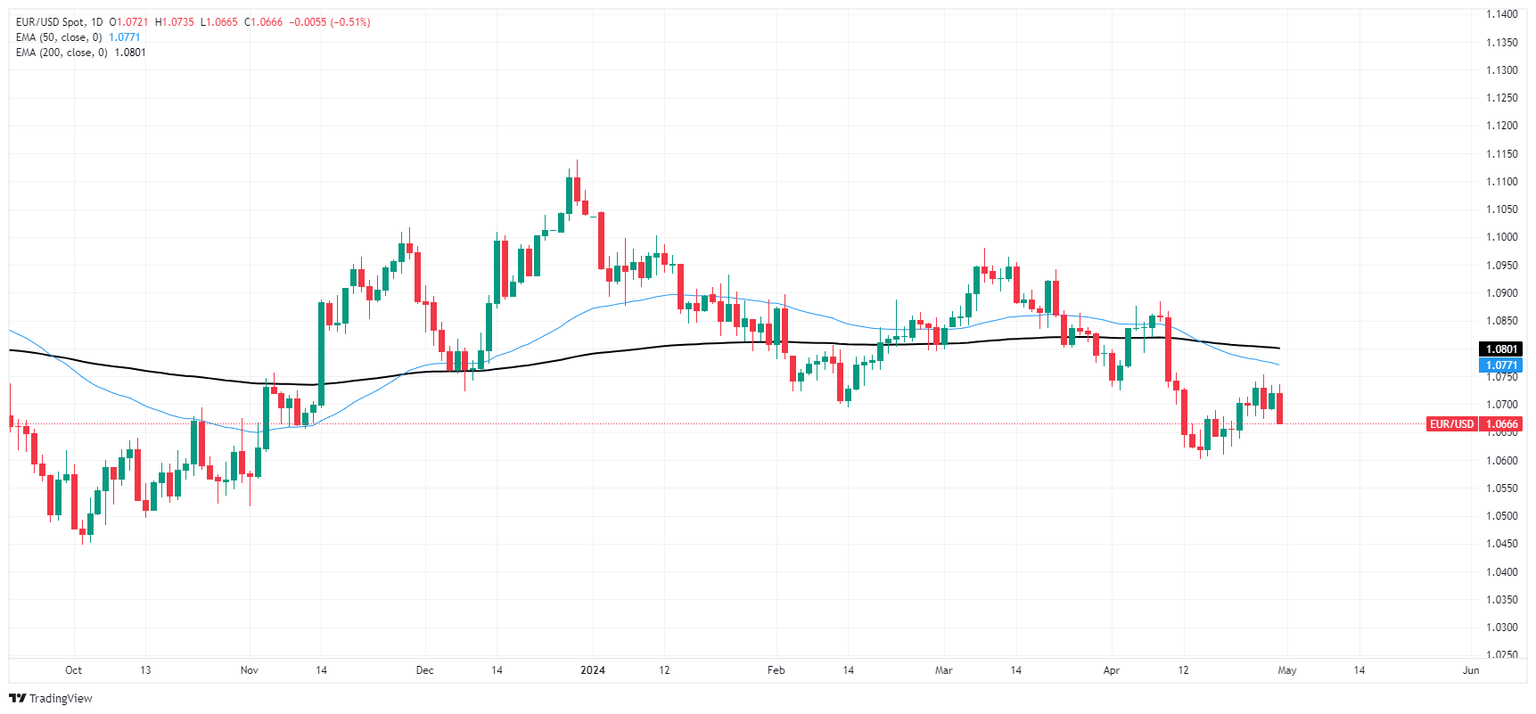

EUR/USD hourly chart

EUR/USD daily chart

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.