EUR/USD rises as US inflation cools down

- EUR/USD gains to near 1.1125 as the US Dollar retraces after soft US Inflation data for April.

- Fed Goolsbee still warns of a US economic slowdown and high inflation.

- An absence of progress in US-EU trade talks keeps the Euro on the backfoot.

EUR/USD moves higher to near 1.1125 in Tuesday's North American session as the US Dollar (USD) faces slight pressure after the release of the softer-than-expected United States (US) Consumer Price Index (CPI) data for April.

As measured by the CPI, the headline inflation rose at a slower pace of 2.3% year-on-year, compared to estimates and the March reading of 2.4%. In the same period, the core CPI - which excludes volatile food and energy items - grew steadily by 2.8%, as expected. Month-on-month headline and core CPI grew by 0.2%, slower than expectations of 0.3%.

Cooling consumer inflation boosts the hopes of interest rate cuts by the Federal Reserve (Fed) and eventually weighs on the US Dollar. At the time of writing, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, slides to near 101.40. The USD Index gives back some of its Monday gains, which came after the US and China agreed to avert an escalation in the trade war and reduce tariffs substantially on Monday.

The impact of the soft US inflation data is expected to be limited on market expectations for the Fed's monetary policy outlook, as officials are more concerned about consumer inflation expectations in the wake of the trade war between the US and China. Though the US and China have agreed to lower tariffs for 90 days, Fed officials are still concerned about the inflation outlook as import duties are still higher.

On Monday, Chicago Fed President Austan Goolsbee stated that the impact of the US-China tariff war will be lower than they had anticipated earlier. "It is definitely less impactful stagflationarily than the path they were on,” Goolsbee said, Reuters reported. However, he warned that fears of high inflation and economic slowdown are still intact. “Tariffs are still three to five times higher than what they were before, so it is going to have a stagflationary impulse on the economy. It’s going to make growth slower and make prices rise," Goolsbee said.

Daily digest market movers: EUR/USD rises at US Dollar's expense

- EUR/USD moves higher from the month-low of 1.1100 during North American trading hours on Tuesday as the US Dollar corrects after a strong upside move the previous day. The major currency pair plunged on Monday as the US Dollar rallied after a temporary US-China trade truce.

- On Monday, Washington and Beijing lowered tariffs by 115% for 90 days after a two-day meeting in Geneva over the weekend, resulting in a decline in the additional levy to 10% on the US and 30% on China. The burden of the fentanyl levy of 20% on China remained intact, while Washington has assured that there have been “constructive discussions” to resolve it. However, the Chinese Foreign Ministry stated during European trading hours that the fentanyl issue is a US issue and not their responsibility.

- The announcement of a temporary truce resulted in a sharp upside in the US Dollar and a rally in US equity indices, which signals that investors have regained confidence in the US economic outlook. The imposition of significantly higher reciprocal tariffs by the US on China led to a substantial decline in the US Dollar and demand for US assets. Market experts and Fed officials painted a grim picture of the US economy in the wake of the US-China trade war.

- Though investors have underpinned the Euro (EUR) against the US Dollar on Tuesday, its outlook has weakened as the European Union (EU) and Canada seem to be the only major economies that have not reported any meaningful progress in trade discussions with the US since President Donald Trump's announcement of reciprocal tariffs.

- Additionally, the EU has prepared countermeasures if trade talks with the US don’t conclude positively, a move that could lead to trade tensions. On Thursday, the European Commission launched a public consultation paper that contained countermeasures on up to €95 billion of US imports if trade talks fail to deliver a satisfactory result for the bloc.

- Another factor behind the gloomy outlook of the pair is the solid European Central Bank (ECB) dovish bets. Traders have become increasingly confident that the ECB will cut interest rates again in the June meeting as officials have signaled that the disinflation trend is intact and price pressures will return to the 2% target by the year-end.

Technical Analysis: EUR/USD returns above 1.1100

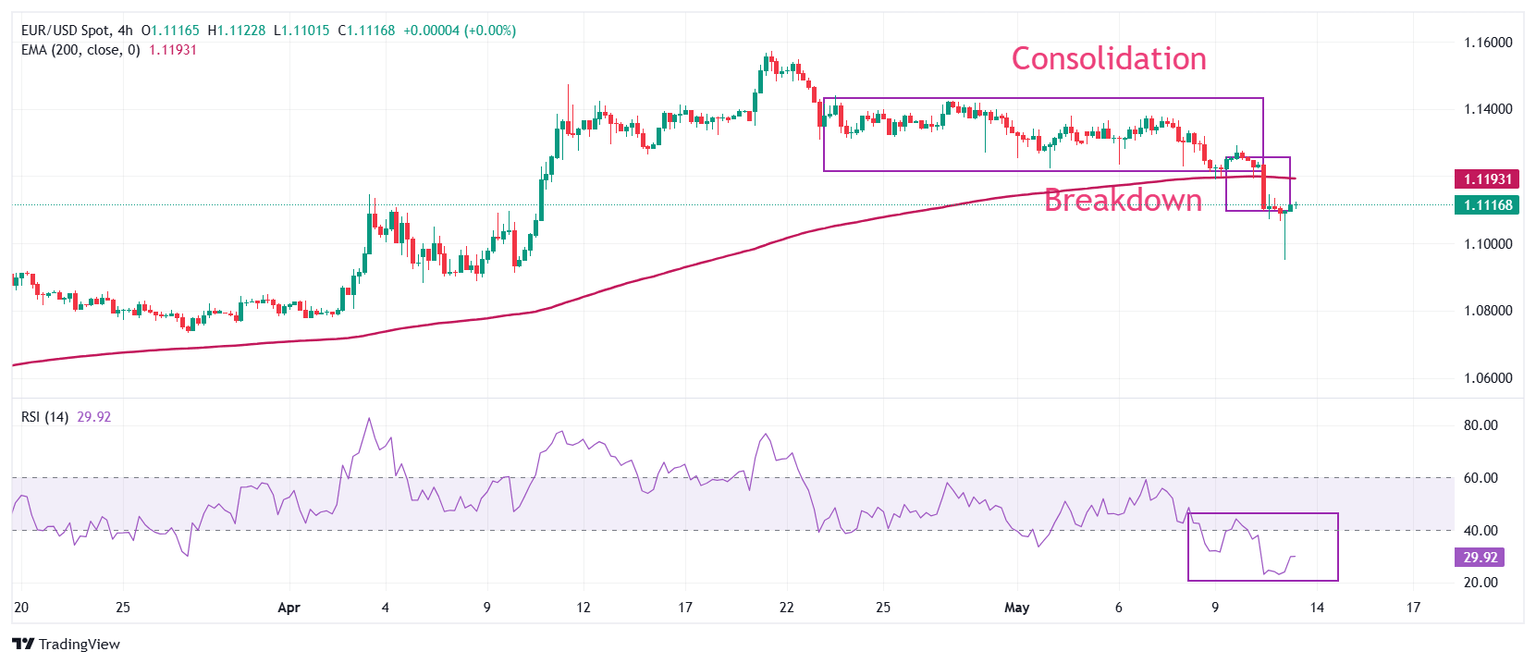

EUR/USD gains temporary ground below 1.1100 on Tuesday after a sharp sell-off the previous day. The pair plunged on Monday after a breakdown of the 1.1200-1.1440 range formed in the prior 20 trading days. The major currency pair extends its downside move below the 200-period Exponential Moving Average (EMA), which is around 1.1200, indicating a bearish trend.

The 14-period Relative Strength Index (RSI) slides below 40.00, suggesting that a fresh bearish momentum has been triggered.

Looking up, the April 28 high of 1.1425 will be the major resistance for the pair. Conversely, the March 27 low of 1.0733 will be a key support for the Euro bulls.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.