EUR/USD cuts below 200-day average after Bundesbank President's comments

- EUR/USD pierces below the key 200-day SMA on Friday after Bundesbank's Nagel raises prospect of an early interest-rate cut.

- The pair comes off its lows in the last hour, however, supported by positive German IFO Business Sentiment data.

- EUR/USD is poised to extend breaks below key support levels as key central bank figures line up to speak.

EUR/USD is trading down almost half a percent on Friday, in the lower 1.0800s, below the 200-day Simple Moving Average (SMA), after comments from the President of the Bundesbank Joachim Nagel, suggested the European Central Bank (ECB) could be in a position to cut rates before the summer recess.

The pair continues to paint trader's screens red, and even positive German IFO data – which hit a 9-month high – only managed to administer a "band aid" temporary bounce after its release.

EUR/USD bleeds lower on Nagel statement

EUR/USD was delivered a body blow on Friday during the European session after President of the Bundesbank, Joachim Nagel said he foresaw the ECB potentially cutting interest rates before the summer recess, which was interpreted as meaning most likely in June.

"If I would put it into probabilities, definitely something in June has a higher probability than in April." Said Nagel, according to Reuters.

Markets forecast 89 basis points of rate cuts, or at least three but possibly four 25 basis-point moves, with the first coming in June or July.

The Bundesbank President stressed an initial cut would not imply subsequent moves. The ECB would make decisions on a meeting by meeting basis as fresh data became available.

His most recent comments suggested he is concerned about “Europe’s growth prospects more than his homeland” and back in February, he said the governing council should wait for Q2 wage data before deciding on whether to cut interest rates or not.

Nagel was speaking at a webcast on "monetary policy challenges and the economic outlook for the Eurozone and Germany,” according to the economic calendar.

EUR/USD comes off lows after German IFO data hits 9-month high

EUR/USD managed to stem its bleed lower on Friday, but only temporarily after strong German sentiment data improved the outlook for the country.

The headline German IFO Business Climate Index arrived at 87.8 in March, higher than the February reading of 85.5, much above the market consensus of 86.0.

Meanwhile, the Current Economic Assessment Index rose from 86.9 in February to 88.1 in the reported month, beating expectations of 86.8.

The IFO Expectations Index – indicating firms’ projections for the next six months, edged higher to 87.5 in March vs. 84.1 recorded in the previous month while surpassing the expected 84.7 figure.

EUR/USD bounced off the 1.0808 session lows after the release of the data, but only recouped losses marginally.

EUR/USD: A day of doves and hawks

The key drivers for the pair at the end of the week will probably be commentary from central bankers.

Their comments could impact the outlook for interest rates, which are set by central banks. Interest rates impact currencies because they dictate the level of foreign capital inflows from investors searching for returns. When interest rates are expected to go up it is positive for a currency; when down negative. Currently, the debate hinges around the timing of future rate cuts, with the consensus being that both the ECB and the Fed will make cuts in June. Anything that deviates from that view could cause volatility.

At 16:00 GMT, Federal Reserve Vice-Chair for Supervision Michael Barr will participate in a virtual discussion titled "International Economic and Monetary Design".

At 17:00 GMT , ECB Chief Economist and Board Member Philip Lane will deliver a policy lecture on inflation and monetary policy at the Aix-Marseille School of Economics (AMSE).

At 20:00 GMT, Federal Reserve Bank of Atlanta President Raphael Bostic will moderate a conversation about household finances at the 2024 Household Finance Conference – there is an outside chance he could mention interest rates.

Technical Analysis: EUR/USD tests trendline and 200-day SMA

EUR/USD is making volatile switches inside the 1.0800s and 1.0900s. It is currently trading back down in the 1.0800s just below the 200-day SMA at 1.0839, and a major trendline.

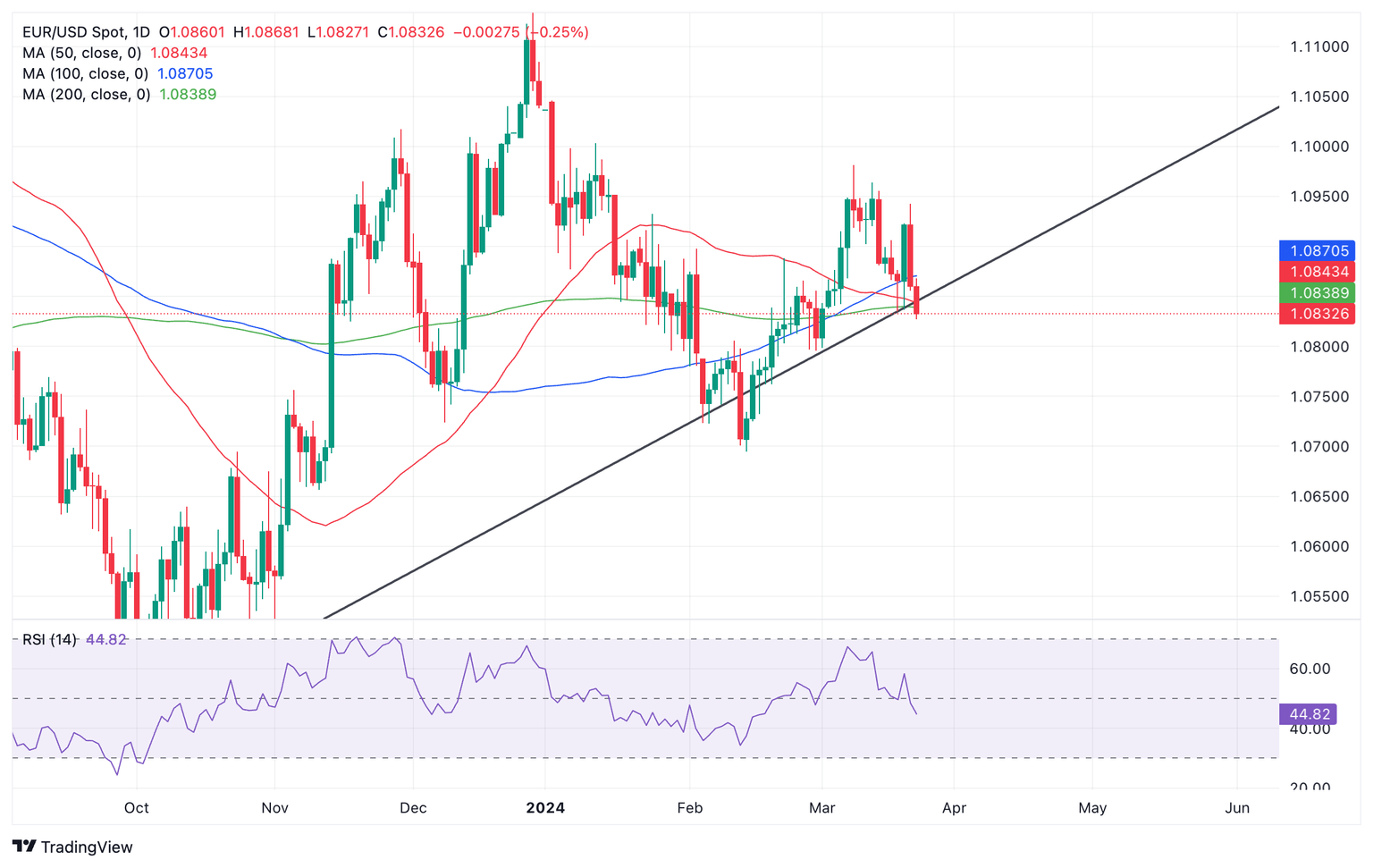

Euro versus US Dollar: Daily chart

The pair appears to be threatening to break below the trendline which could usher in a more bearish phase.

Such a move would be likely to tumble to at least 1.0775, the 0.618 Fibonacci extension of the move prior to the breakout lower, a common method of forecasting targets for trendline breaks.

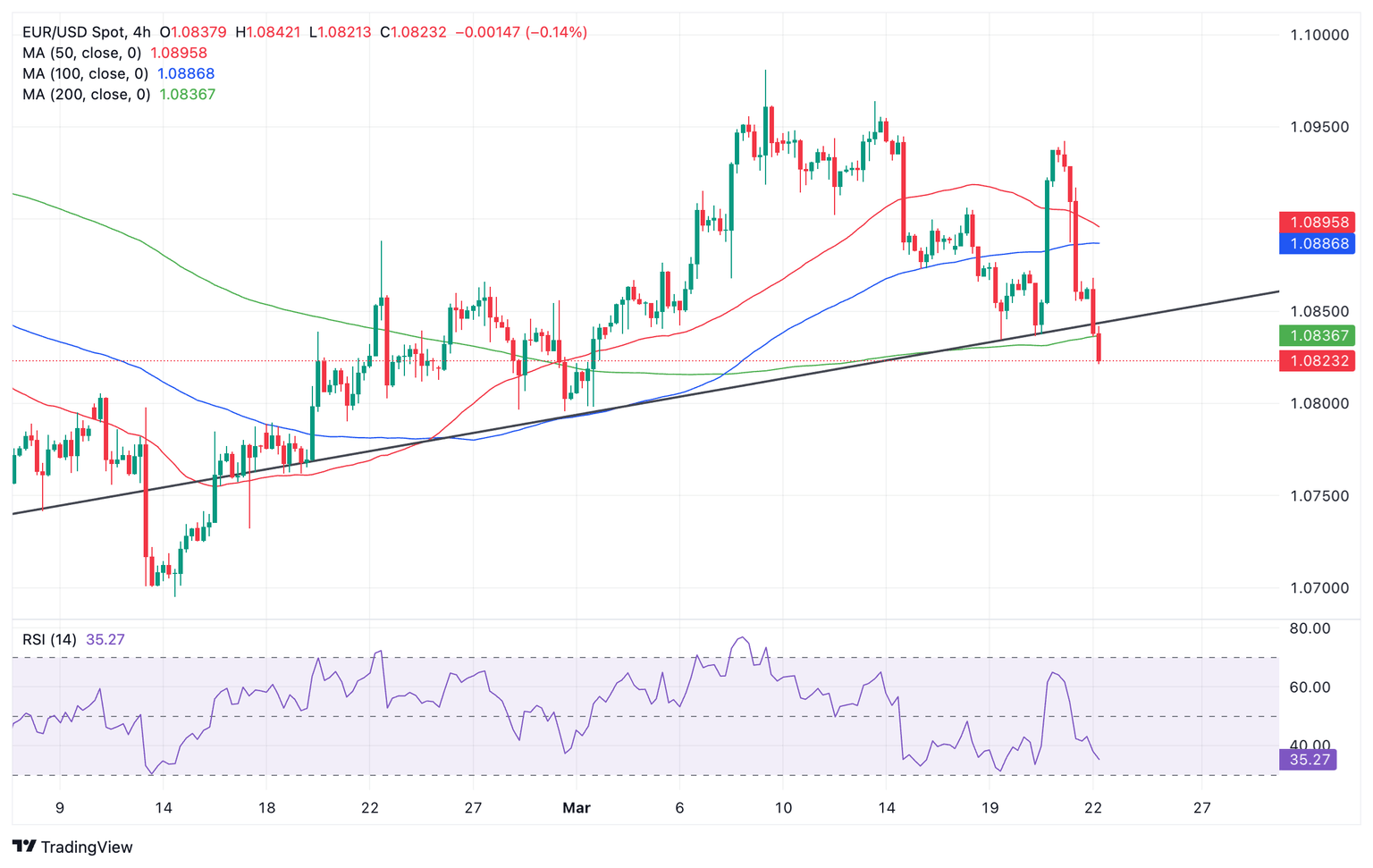

The move down lacks momentum, however, as evidenced by the Relative Strength Index (RSI) on the 4-hour chart below, which shows RSI failing to reflect price’s current move down to a lower low – a suggestion bearish conviction is lacking.

Euro versus US Dollar: 4-hour chart

Whilst the lack of momentum does not completely preclude the expectation price will fall further, it brings in a note of caution and suggests bears should be careful not to be caught in what could potentially be a false break.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.