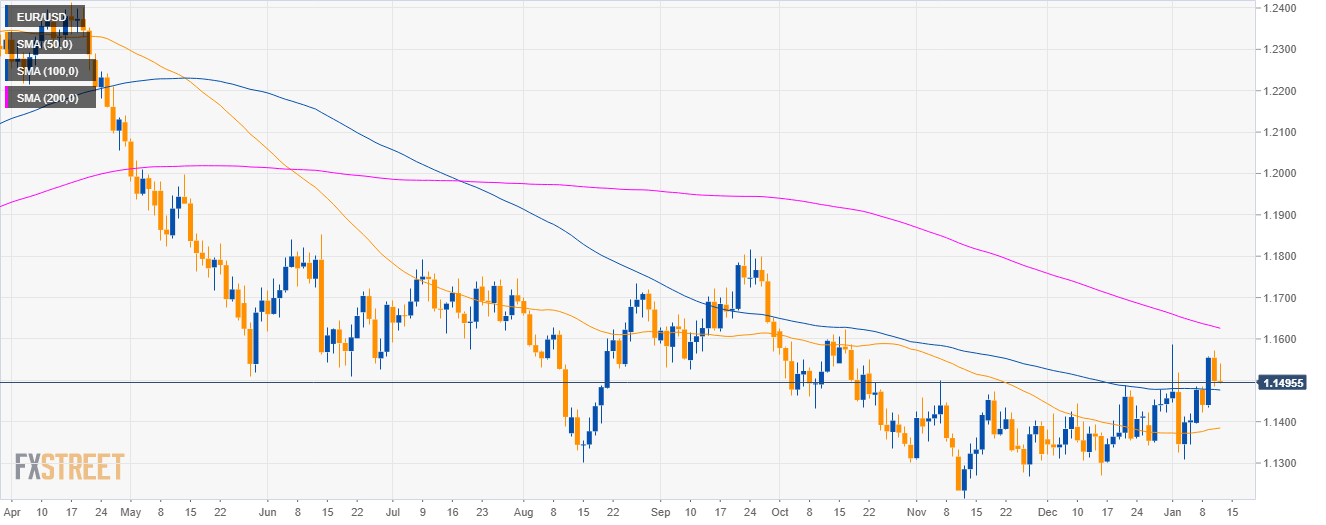

EUR/USD daily chart

- EUR/USD is trading in a bear trend below the 200 SMA.

- The US CPI (Consumer Price Index) matched market expectations at 2.2% for December y/y.

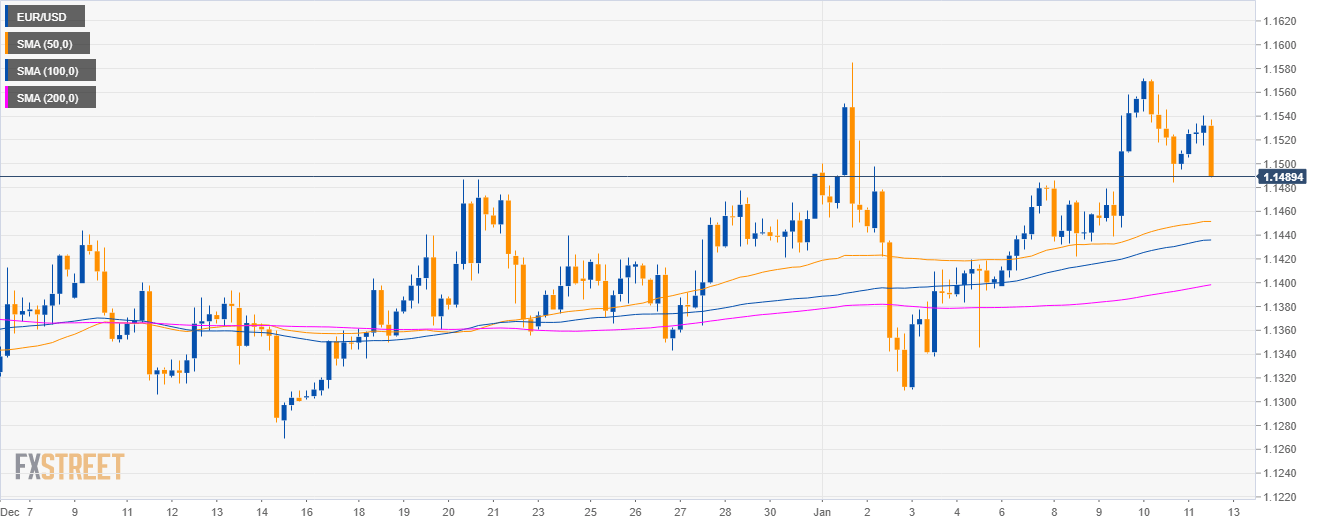

EUR/USD 4-hour chart.

- EUR/USD is trading above its main SMAs.

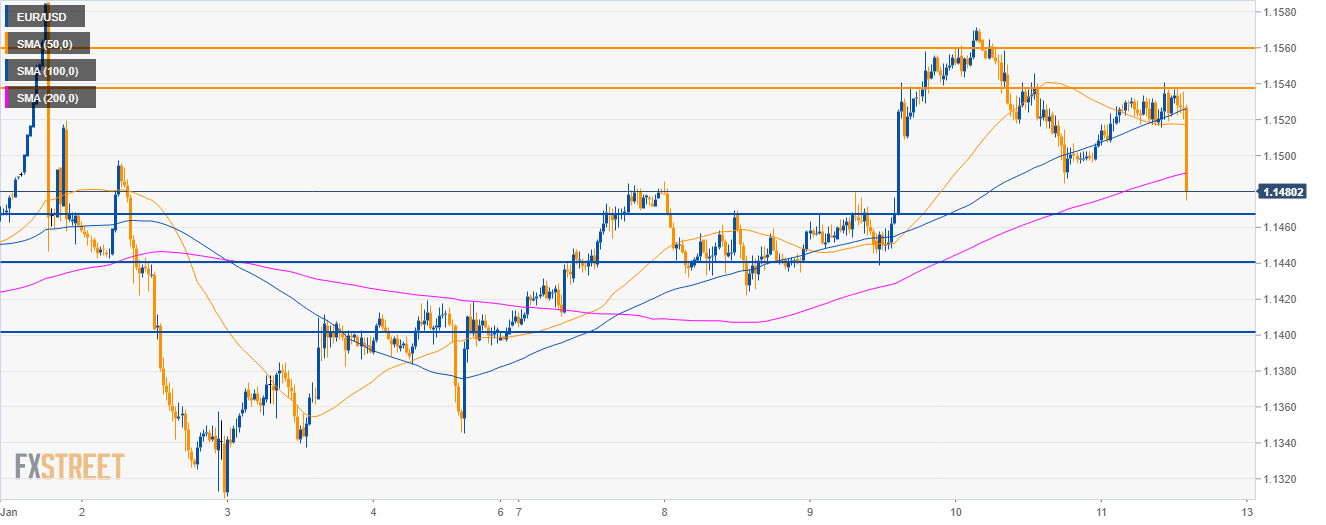

EUR/USD 30-minute chart

- Bears are now testing the 1.1500 figure and the 200 SMA.

- The next objective for sellers is most likely the 1.1470 and 1.1440 level followed by 1.1400 the figure.

Additional key levels

EUR/USD

Overview:

Today Last Price: 1.1488

Today Daily change: -10 pips

Today Daily change %: -0.0870%

Today Daily Open: 1.1498

Trends:

Previous Daily SMA20: 1.1415

Previous Daily SMA50: 1.1383

Previous Daily SMA100: 1.1478

Previous Daily SMA200: 1.1631

Levels:

Previous Daily High: 1.1571

Previous Daily Low: 1.1485

Previous Weekly High: 1.1586

Previous Weekly Low: 1.1309

Previous Monthly High: 1.1486

Previous Monthly Low: 1.1269

Previous Daily Fibonacci 38.2%: 1.1518

Previous Daily Fibonacci 61.8%: 1.1538

Previous Daily Pivot Point S1: 1.1465

Previous Daily Pivot Point S2: 1.1431

Previous Daily Pivot Point S3: 1.1378

Previous Daily Pivot Point R1: 1.1552

Previous Daily Pivot Point R2: 1.1605

Previous Daily Pivot Point R3: 1.1638

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

AUD/USD: Extra gains in the pipeline above 0.6520

AUD/USD partially reversed Tuesday’s strong pullback and regained the 0.6500 barrier and beyond in response to the sharp post-FOMC pullback in the Greenback on Wednesday.

EUR/USD meets support around 1.0650

EUR/USD managed to surpass the key 1.0700 barrier in response to the intense retracement in the US Dollar in the wake of the Fed’s interest rate decision and Chair Powell’s press conference.

Gold surpasses $2,300 as Dollar tumbles

The precious metal maintains its constructive stance and trespasses the $2,300 region on Wednesday after the Federal Reserve left its FFTR intact, matching market expectations.

Bitcoin price reclaims $59K as Fed leaves rates unchanged

The market was at the edge of its seat on Wednesday to see whether the US Federal Reserve (Fed) would cut interest rates during the Federal Open Market Committee (FOMC) meeting.

The market welcomes the Fed's statement

The market has welcomed the Fed statement, and the S&P 500 is higher in its aftermath, the dollar is lower and Treasury yields are falling. There is still only one cut priced in by the Fed.