EUR/USD slides below 1.0500 amid rising US yields, hawkish Fed comments

- EUR/USD drops to 1.0500, down 0.69%, as rising US Treasury bond yields and expectations of additional Fed tightening weigh heavily on the pair.

- Contrasting economic outlooks with improving US business activity and decelerating Eurozone factory activity contribute to the Euro’s decline.

- The EUR/USD is bearish biased, with significant support at 1.0500 and potential further losses towards 1.0290 and 1.0222 if declines continue.

The Euro (EUR) losses traction gains the US Dollar (USD) in early morning trading during the North American session, after hitting a daily high of 1.0592 but failing to crack the 1.0600 mark, exacerbated its fall, with the EUR/USD approaching towards the 1.0400 figure, for the third time in the last couple of week. At the time of writing, the major trades at 1.0495,, down 0.77%.

Euro struggles against the US Dollar as stronger US economic data, climbing US Treasury yields, and a hawkish Federal Reserve overshadow weakening Eurozone factory activity

Market participant's mood remains mixed, with US equities registering losses, except for the Nasdaq 100. The latest round of US economic data showed that business activity is improving, as shown by two reports from S&P Global and the Institute for Supply Management (ISM). The S&P Global Manufacturing PMI rose by 49.8, above 48 expected for September, while the ISM Manufacturing PMI, the most sought by economists, witnessed an improvement from 47.9 to 49.8, exceeding forecasts of 47.8.

In the meantime, the latest round of Federal Reserve (Fed) officials crossing newswires remain hawkish, led by Michelle Bowman, who said inflation is too high, and the current jump in energy prices could reverse “some of the recent progress on lowering inflation.” Bowman added she favors another hike at a future meeting. Fed Chair Jerome Powell recently stated the economy is coming through the other side of the pandemic. and added the Fed is focused on achieving price stability.

Across the pond, Eurozone factory activity continued to decelerate, as revealed by HCOB Manufacturing PMIs for September, coming as expected at 43.4 but below August’s 43.5. At the same time, Germany, the largest economy in the bloc, appears to have bottomed after showing signs of deterioration in manufacturing activity, as its PMI came at 39.6, below forecasts of 39.8 but rose slightly above August’s 39.1.

The EUR/USD continued to drop sharply as US Treasury bond yields climbed more than 10 basis points, as shown by the 10-year benchmark note yield at 4.693%. Although advancing, the 10-year German bund yield remains heavy compared to the US one, just six bps up at 2.918%. Additionally, expectations for additional tightening by the Fed, while the European Central Bank (ECB) is seen halting its tightening cycle, could trigger further downside on the major.

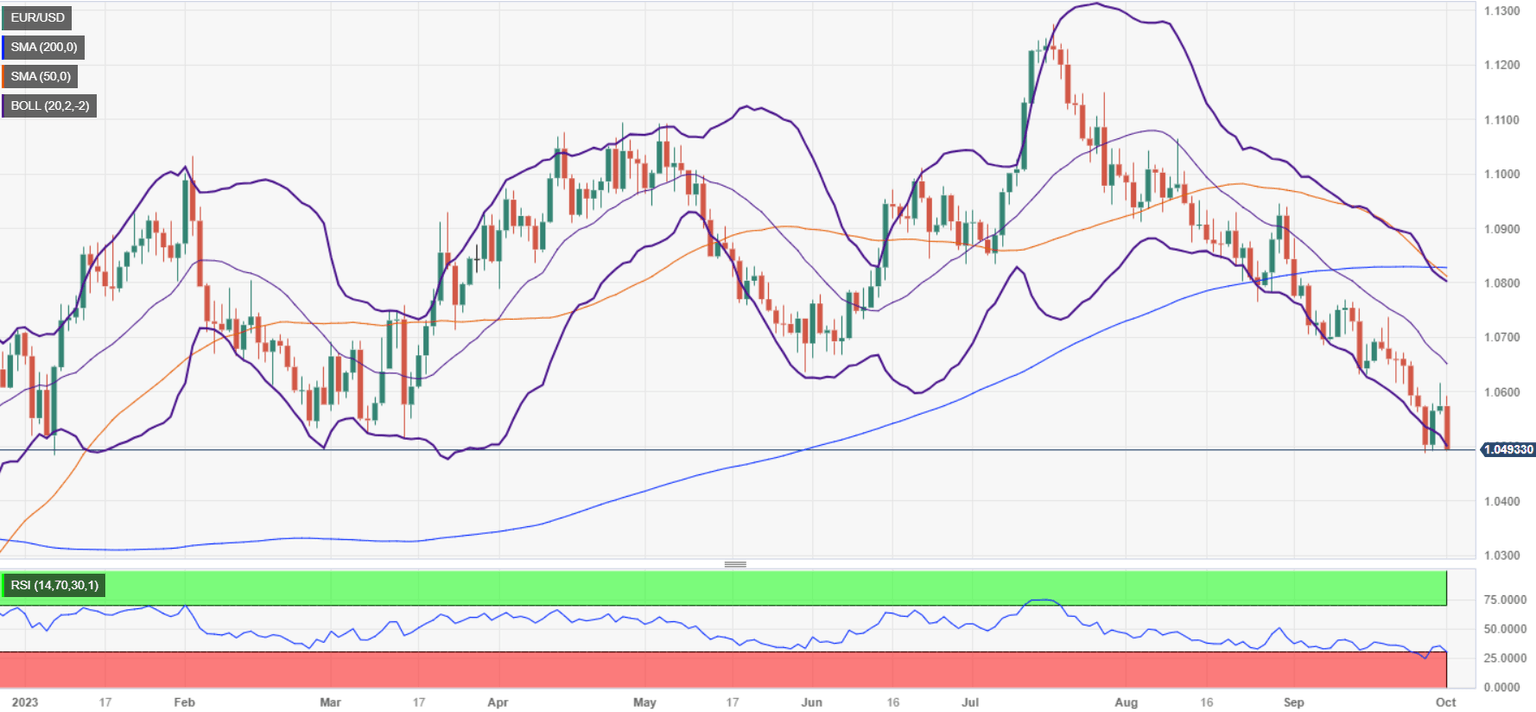

EUR/USD Price Analysis: Technical outlook

The daily chart portrays the pair as downward biased, further confirmed by a “death-cross,” with the 50-day moving average (DMA) crossing below the 200-DMA. The Relative Strength Index (RSI) dives further into oversold territory but shy of reaching the lowest level hit on September 27, which could pave the way for EUR/USD’s additional losses. First, support is seen at 1.0500, followed by the November 30, 2022, daily low of 1.0290, and the November 21, 2022, swing low of 1.0222. the pair could shift slightly neutral if it reclaims 1.0600.

EUR/USD Price Action - Daily chart

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.