EUR/USD refreshes four-week low at 1.0740 amid cautious market mood

- EUR/USD has refreshed its four-week low at 1.0740 as the USD Index has shown significant strength amid a cautious market mood.

- Federal Reserve policymakers advocated that the interest rate hike in May’s meeting should be followed by a pause due to banking turmoil.

- Higher interest rates by the European Central Bank in Eurozone are having catastrophic effects on its economic prospects.

- EUR/USD has kissed the 61.8% Fibonacci retracement at 1.0738.

EUR/USD has printed a fresh four-week low at 1.0740 in the Asian session. The major currency pair has faced immense selling pressure as the market mood has remained cautious. Market sentiment has turned negative as investors are worried that if the delay in US debt-ceiling issues keeps going like this, the United States economy would be forced to default on obligated payments.

S&P500 futures are holding significant gains generated in early Tokyo led by dovish Federal Open Market Committee (FOMC) minutes. The majority of Federal Reserve (Fed) policymakers are expecting a temporary pause in the policy-tightening spell due to tight credit conditions by the US regional banks. However, the overall market mood would remain risk-averse till the White House and Republican leader don’t reach a bipartisan.

The US Dollar Index (DXY) has swiftly climbed above 104.00 and has refreshed its two-month high amid improvement in its appeal as a default by the US economy due to non-agreement for raising US debt-ceiling would have catastrophic effects. Meanwhile, fears of a US default have further weakened the demand for US government bonds. This has led to a significant jump in 10-year US Treasury yields above 3.74%.

No rate hike in June by Federal Reserve appears certain

After 10 consecutive sprees of interest rate hikes by the Federal Reserve, chances of a pause in the rate-hiking spell have soared. The release of the FOMC minutes late Wednesday indicated that several Federal Reserve policymakers advocated that the interest rate hike in May’s meeting should be followed by a pause due to banking turmoil.

Bankruptcy declared by various US banks forced regional banks to tighten their credit conditions significantly for avoiding a build-up of Non-Performing Assets (NPAs). This has led to a serious decline in credit disbursements to households and firms. Last week, Federal Reserve chair Jerome Powell in his speech also advocated for a pause in the rate hikes as an increase in filters for credit distribution by banks are significantly weighing on inflationary pressures.

US Durable Goods Orders come in spotlight

After the release of dovish DOMC minutes, investors are shifting their focus towards the release of the United States Durable Goods Orders data, which will release on Friday. As per the preliminary report, April’s Durable Goods Orders are seen contracting by 1.0% vs. an expansion of 3.2%. A contraction in the economic data indicates poor demand, which would have a ripple effect on US Consumer Price Index (CPI).

Investors should note that the US economy is facing issues of persistence in core inflation more than the headline price index. A contraction in durable goods demand would release some heat from core inflation and would be more relieving factor for the Federal Reserve.

Eurozone approaching stagnation due to higher interest rates

Higher interest rates by the European Central Bank (ECB) in Eurozone are having catastrophic effects on its economic prospects. The manufacturing sector is facing extreme heat and is showing severe contraction. Analysts at Commerzbank cited “The PMIs are already suggesting that the European Central Bank’s rate hikes will hit the Eurozone economy at some point. That means that the doves on the European Central Bank board might gain the upper hand at some stage, at which point the Euro would lose important support.”

Also, Economist Klaus Wohlrabe at the German IFO Business Survey said that the “German economy heading towards stagnation in Q2 as higher interest rates are dampening overall demand.

EUR/USD technical outlook

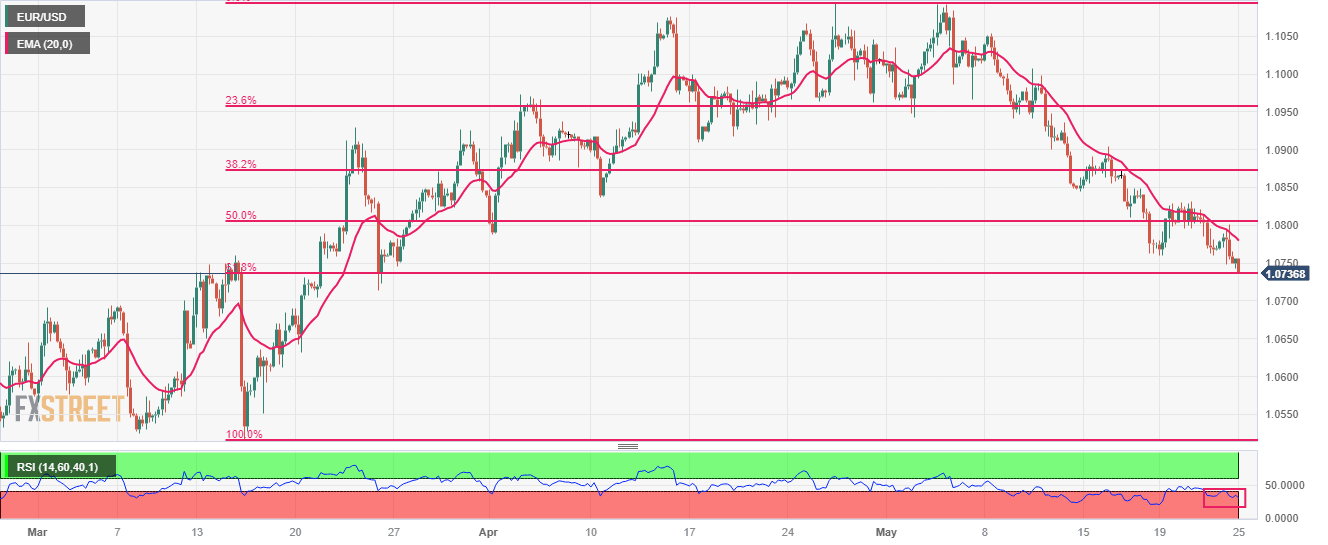

EUR/USD has kissed the 61.8% Fibonacci retracements (plotted from March 15 low at 1.0516 to April 26 high at 1.1095) at 1.0738 on a four-hour scale. The 20-period Exponential Moving Average (EMA) at 1.0780 is acting as a strong barrier for the Euro bulls.

The Relative Strength Index (RSI) (14) is oscillating in the bearish range of 20.00-40.00, indicating the continuation of the bearish momentum.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.