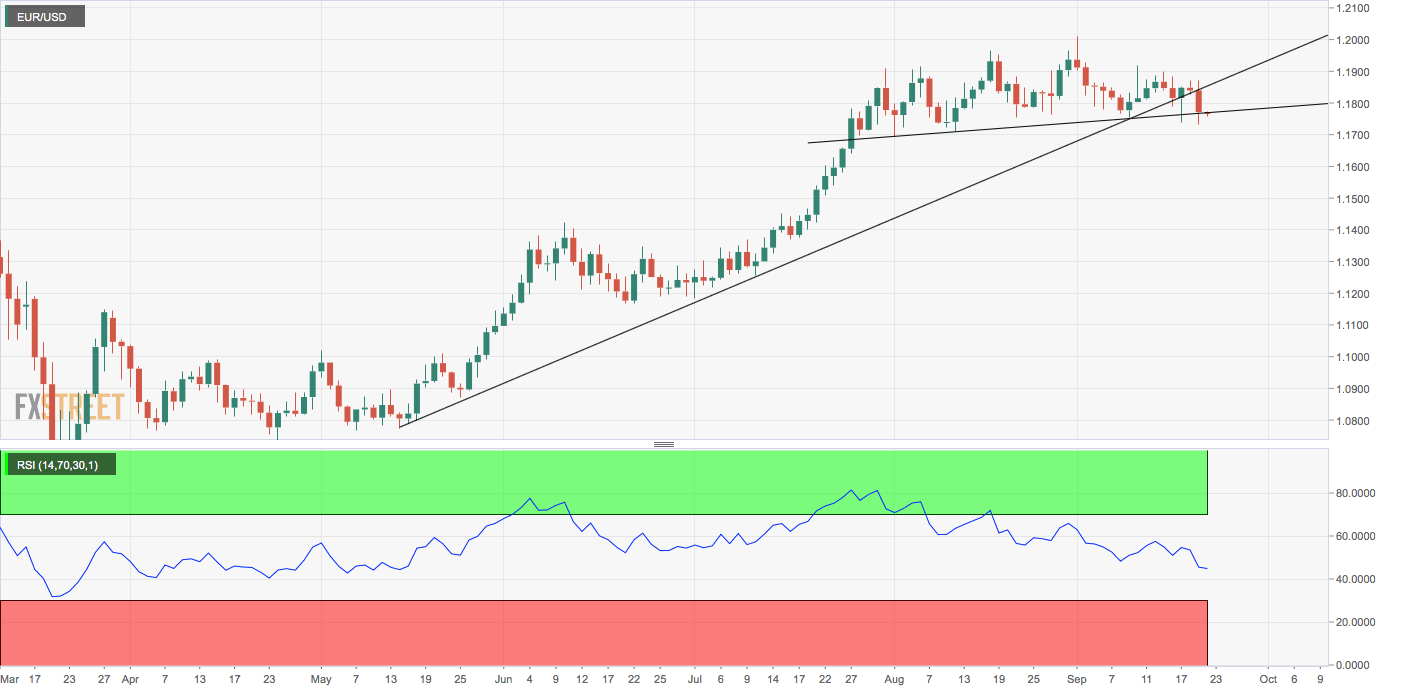

EUR/USD Price Analysis: Teasing head-and-shoulders breakdown

- EUR/USD has charted a bearish reversal pattern on the daily chart.

- A close below 1.1770 would confirm the trend change.

EUR/USD is trading near the head-and-shoulders (H&S) neckline support of 1.1770 at press time.

A close below the support line would confirm H&S breakdown or a bullish-to-bearish trend change and open the doors for 1.1530 (target as per the measured move method).

The pair has already dived out of a trendline rising from May 14 and July 10 lows. The bullish trendline's downside break is backed by a below-50 or bearish reading on the 14-day relative strength index.

As such, a head-and-shoulders breakdown looks likely. The bias would turn bullish if the pair rises above 1.1918 (Sept. 10 high).

Daily chart

Trend: Bearish

Technical levels

Author

Omkar Godbole

FXStreet Contributor

Omkar Godbole, editor and analyst, joined FXStreet after four years as a research analyst at several Indian brokerage companies.