EUR/USD Price Analysis: Peeps above 1.09, but range play continues

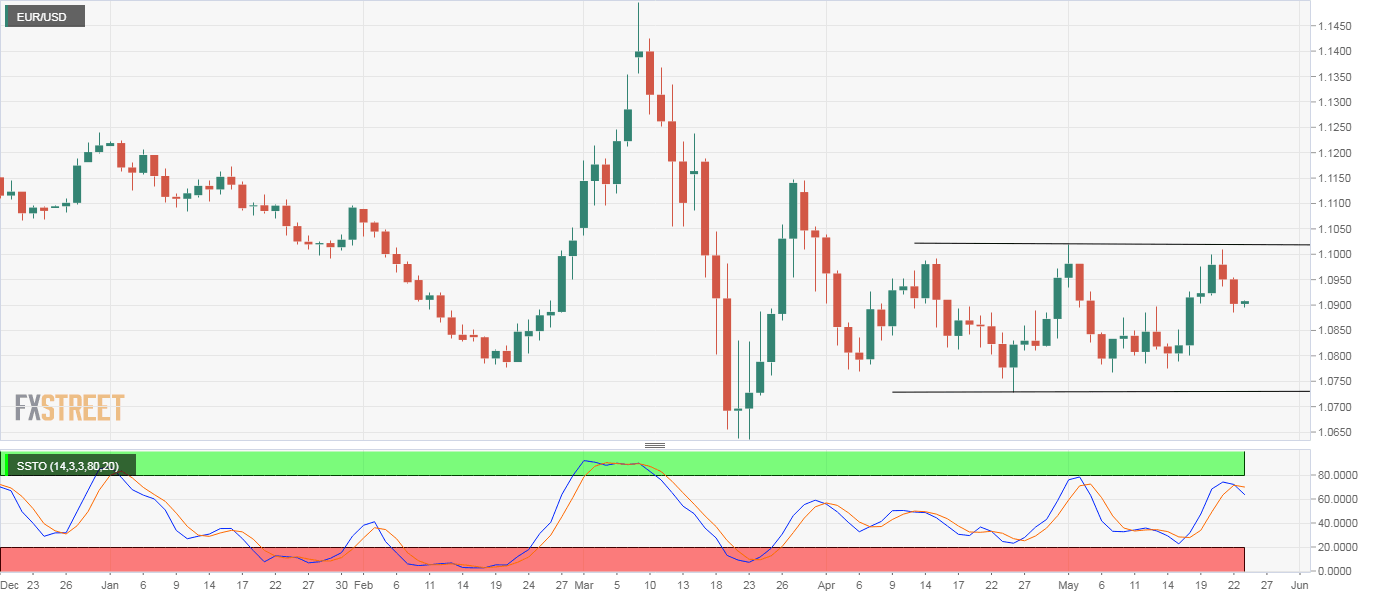

- EUR/USD's daily chart shows a sideways channel pattern.

- A key oscillator indicates the pair could revisit the channel support.

EUR/USD is looking to begin the week on a positive note. The pair is currently trading at 1.0905, representing marginal gains on the day.

However, despite the early uptick from 1.0894 to 1.0905, the bias remains neutral, as the pair remains stuck in the 7-week range of 1.1020 to 1.0730.

A close above the upper end would put the bulls into the driver's seat and open the doors to 1.1148 (March 27 high). Acceptance above that level would shift the focus to 1.1239 (Dec. 31 high).

Alternatively, a range breakdown could cause more sellers to join the market and shift risk in favor of a re-test and possibly a break below the 2020 low of 1.0636 reached on March 23.

A drop to the lower end of the trading range looks likely as the daily chart stochastic oscillator, which works ideally in a sideways or trading range market condition, has turned lower. The term "oscillate" means to move between a high and a low point on a regular basis. As noted earlier, EUR/USD has been restricted to a narrow range of 1.0730-1.1020 since early April.

Daily chart

Trend: Neutral

Technical levels

Author

Omkar Godbole

FXStreet Contributor

Omkar Godbole, editor and analyst, joined FXStreet after four years as a research analyst at several Indian brokerage companies.