- EUR/USD eyes 1.21 after Tuesday's bullish marubozu candle.

- Momentum studies are also aligned in favor of the bulls.

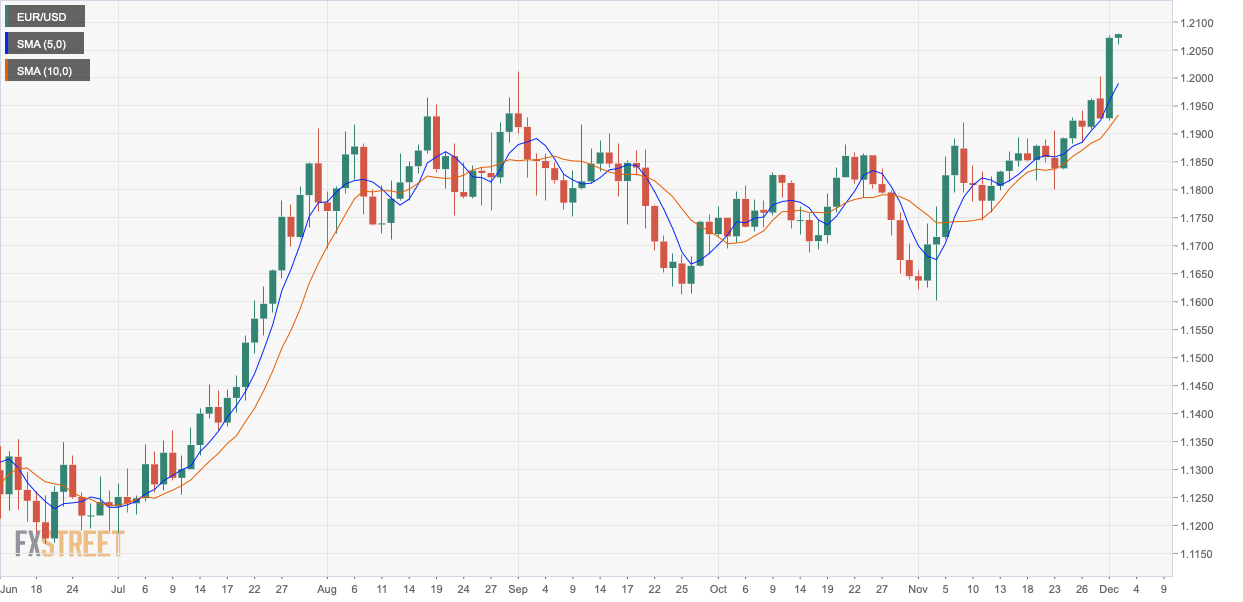

EUR/USD closed well above 1.20 on Tuesday on a broad-based dollar sell-off. That's the first daily close above the psychological hurdle since April 30, 2018.

The breakout above 1.20 looks sustainable, as Tuesday's big green marubozu candle shows sentiment is quite bullish. The 5- and 10-day Simple Moving Averages are trending north, indicating the path of least resistance is to the higher side.

As such, the psychological hurdle of 1.21 could soon come into play. At press time, the pair is trading largely unchanged on the day near 1.2075.

A close below the 10-day SMA would abort the bullish view.

Daily chart

Trend: Bullish

Technical levels

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

USD/JPY rebounds above 156.00 after probable Japan's intervention-led crash

USD/JPY is staging a solid comeback above 156.00, having lost nearly 450 pips in some minutes after the Japanese Yen rallied hard on another suspected Japan FX market intervention in the late American session on Wednesday.

Gold price stalls rebound below $2,330 as US Dollar recovers

Gold price is holding the rebound below $2,330 in Asian trading on Thursday, as the US Dollar recovers in sync with the USD/JPY pair and the US Treasury bond yields, in the aftermath of the Fed decision and the likely Japanese FX intervention.

Solana price dumps 21% on week as round three of FTX estate sale of SOL commences

Solana price is down almost 5% in the past 24 hours and over 20% in the last seven days. The dump comes as the broader crypto market contracts with Bitcoin price leading the pack as it slides below the $58,000 threshold to test the Bull Market Support Band Indicator.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.