EUR/USD Price Analysis: Battling 50-HMA after falling wedge breakout

- EUR/USD bulls await fresh impetus for the next leg up.

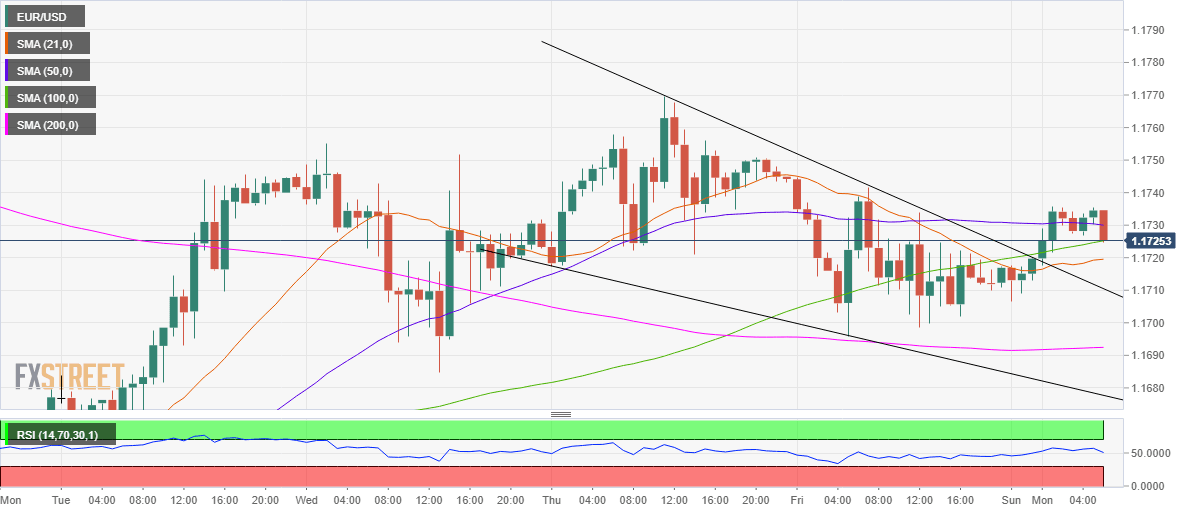

- Falling wedge breakout confirmed on the hourly chart.

- EUR bulls struggling to extend gains above 50-HMA.

EUR/USD is off the highs but remains better bid above 1.1700, as the US dollar remains on the back foot amid the upbeat market mood.

The optimism over US President Donald Trump’s potential discharge from the medical center boosts the appetite for the risk assets at the expense of the safe-haven greenback.

From a near-term technical perspective, the bulls are catching a breath following a nearly 30-pips bounce from daily lows of 1.1709, courtesy of the falling wedge breakout confirmed on the hourly chart.

Despite the bullish breakout, the spot is struggling to extend the rise above the horizontal 50-hourly Simple Moving Average (HMA) at 1.1730.

A sustained move above the latter could open doors once again towards the pattern target of 1.1793. However, the October 1 high of 1.1770 could test the bulls’ commitment en route the aforesaid pattern target.

The hourly Relative Strength Index (RSI) has turned south at 51.94, suggesting that the bullish momentum could weaken in the coming hours.

The immediate downside could be capped around 1.1725/20, which is the confluence of the 21 and 100-HMAs.

On a failure to resist above the latter, sellers could target the pattern resistance now support at 1.1710.

The horizontal critical 200-HMA support at 1.1692 is the level to beat for the EUR bears.

EUR/USD: Hourly chart

EUR/USD: Additional levels

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.