EUR/USD mired near 1.0730 after choppy Thursday market session

- EUR/USD whipped on Thursday after mixed US data plagued markets.

- US GDP slowed faster than expected, but PCE inflation measures warn of still-high prices.

- US PCE Price Index figures due during Friday's US market session.

EUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

US Gross Domestic Product (GDP) eased more than expected on Thursday, with annualized Q1 growth slowing to 1.6% compared to the previous 3.4%, and well below the forecast 2.5%. Easing growth is a boon for investors hoping for an accelerated pace of rate cuts from the Federal Reserve (Fed), but too much too fast could send negative knock-on effects throughout the US economy.

Hopes for rate cuts were further eroded after US Personal Consumption Expenditure (PCE) inflation accelerated again in the first quarter, with Q1 PCE rising 3.4% compared to the previous quarter’s 1.7%. Still-high inflation is reducing market hopes for rate cuts, sending risk appetite into a tailspin during the US trading session before markets staged a determined but limited recovery.

Friday brings mostly low-tier European data, and markets will be turning to face US PCE Price Index figures for March as investors look for a more fine-tuned look at the US’ inflation outlook. Core MoM PCE Price Index figures in March are expected to hold steady at 0.3%, with the annualized figure forecast to tick down slightly to 2.6% from 2.8%.

EUR/USD technical outlook

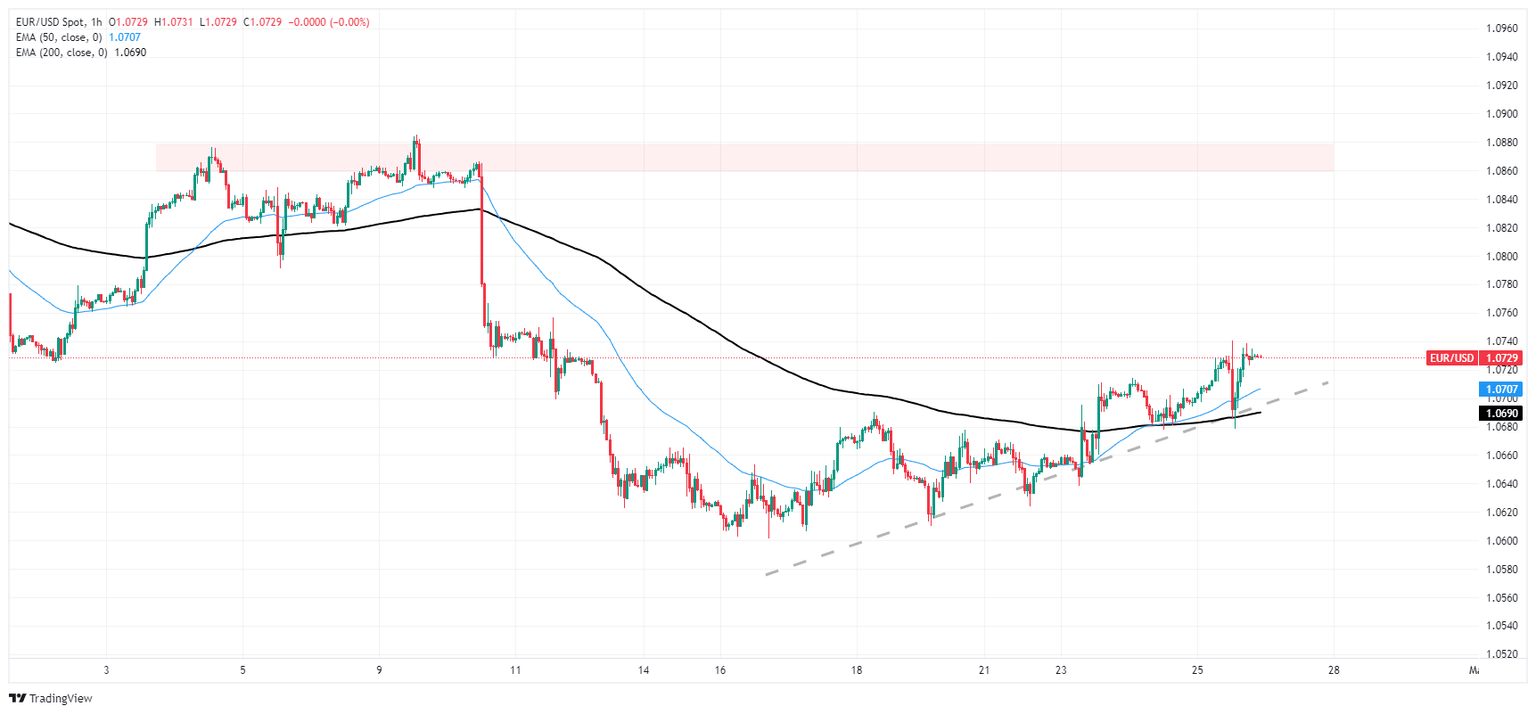

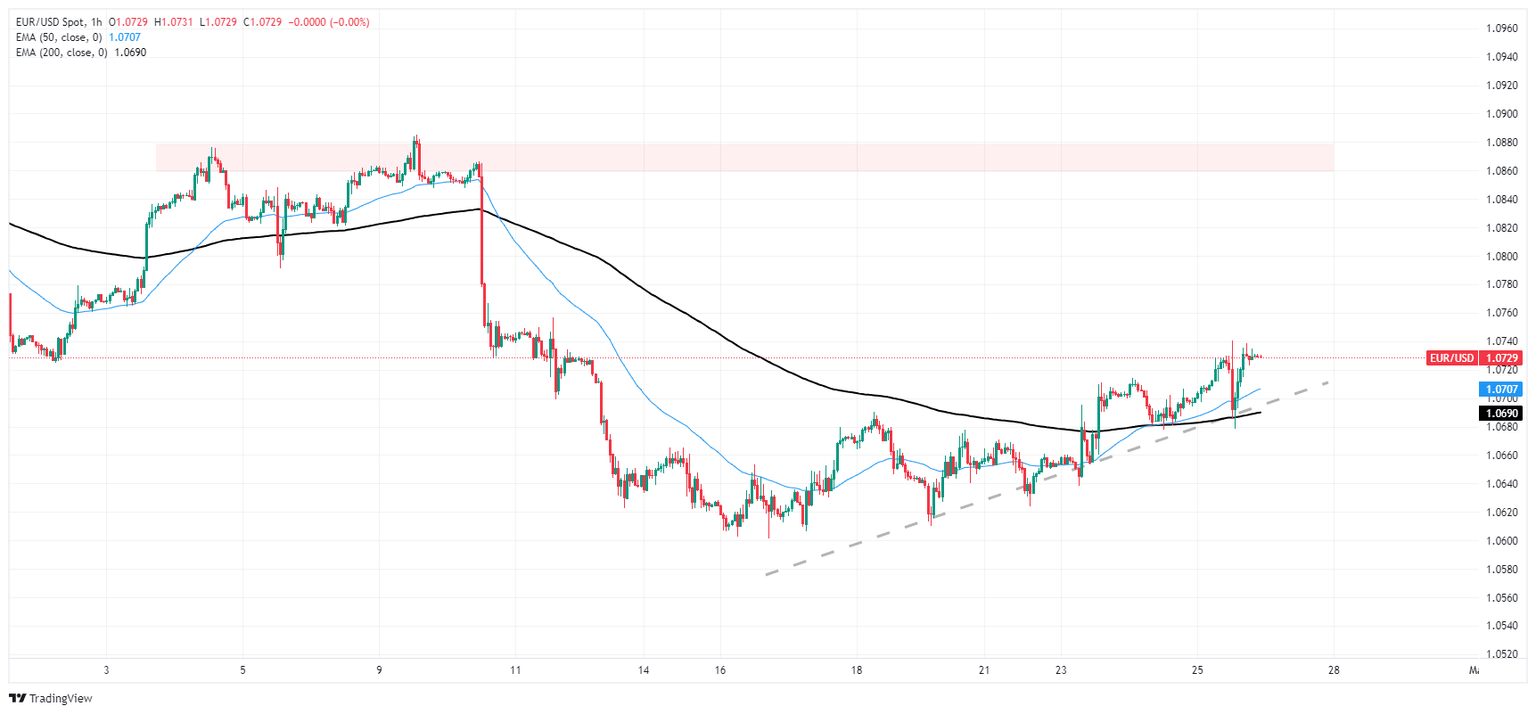

EUR/USD churns just north of the 200-hour Exponential Moving Average (EMA) at 1.0690, but Euro bidders are scrambling to keep the pair propped up beyond the 1.0700 handle. A near-term supply zone is priced in between 1.0880 and 1.0860, keeping interim bullish expectations pinned to the low side.

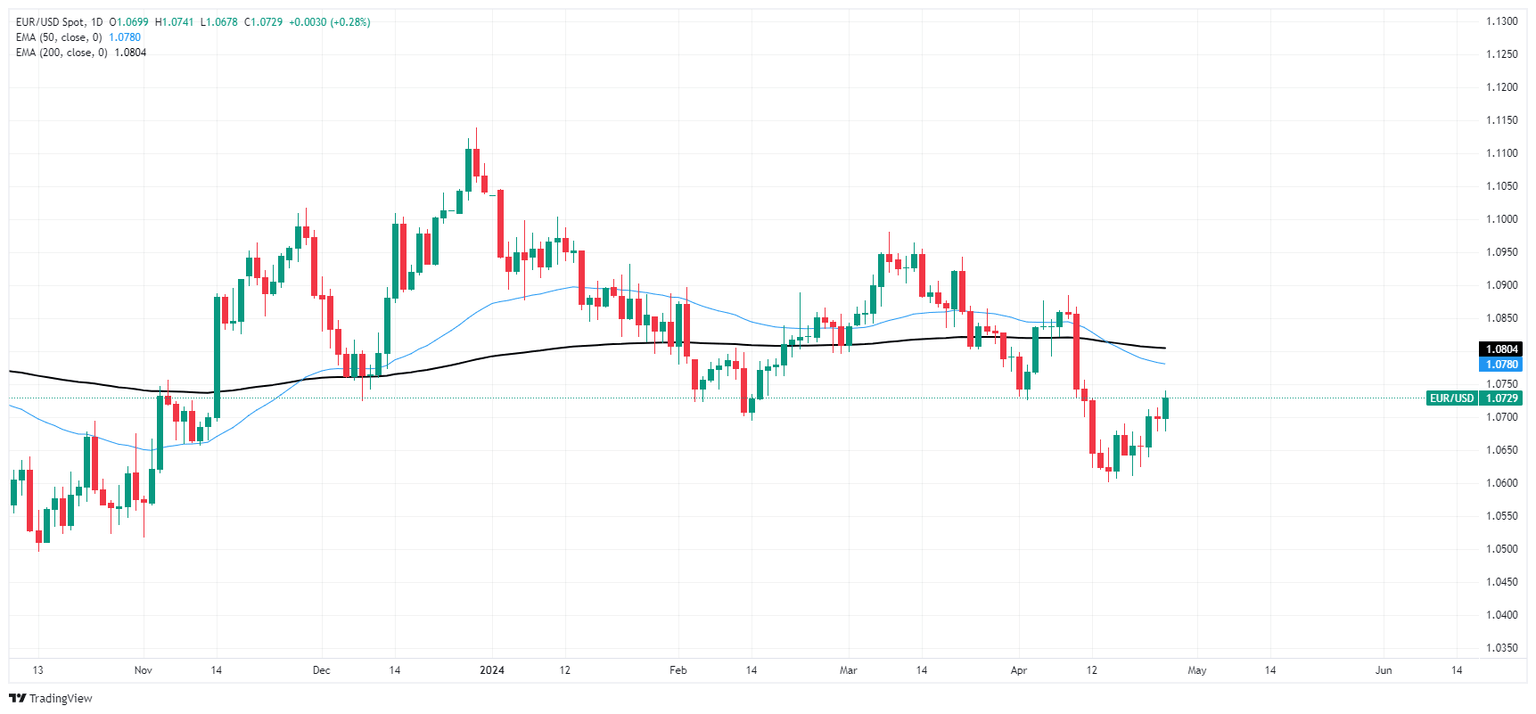

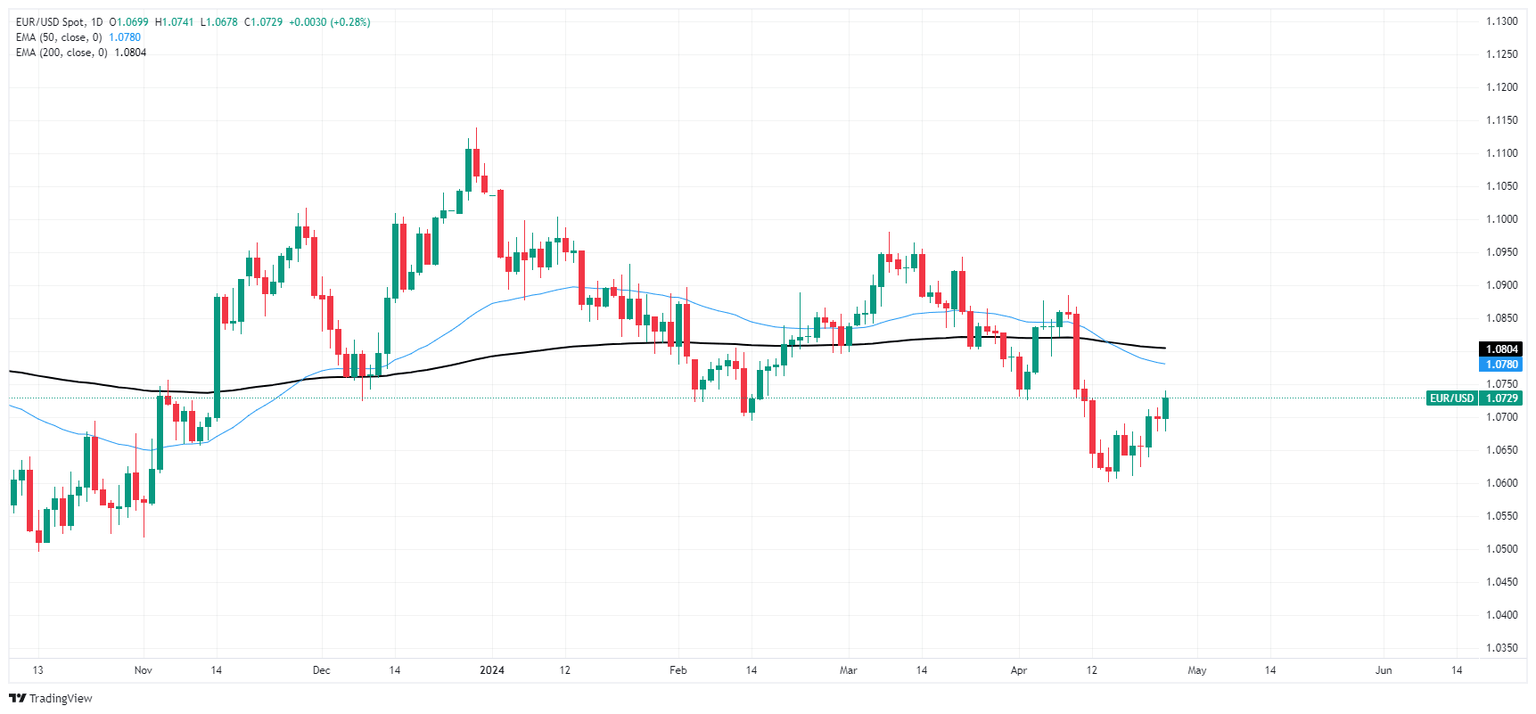

A recent drop below the 200-day EMA at 1.0795 threatens to crimp bullish sentiment despite a technical floor priced in near 1.0600.

EUR/USD hourly chart

EUR/USD daily chart

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.