EUR/USD looks set to surpass 1.0900 as Fed signals pause in rate-hiking spell

- EUR/USD is oscillating near 1.0900 as USD Index has extended its downside after Fed signals rate pause.

- Federal Reserve sees tightening credit conditions from US banks after banking fiasco.

- European Central Bank would continue to hike rates further as global financial stability to propel inflation further.

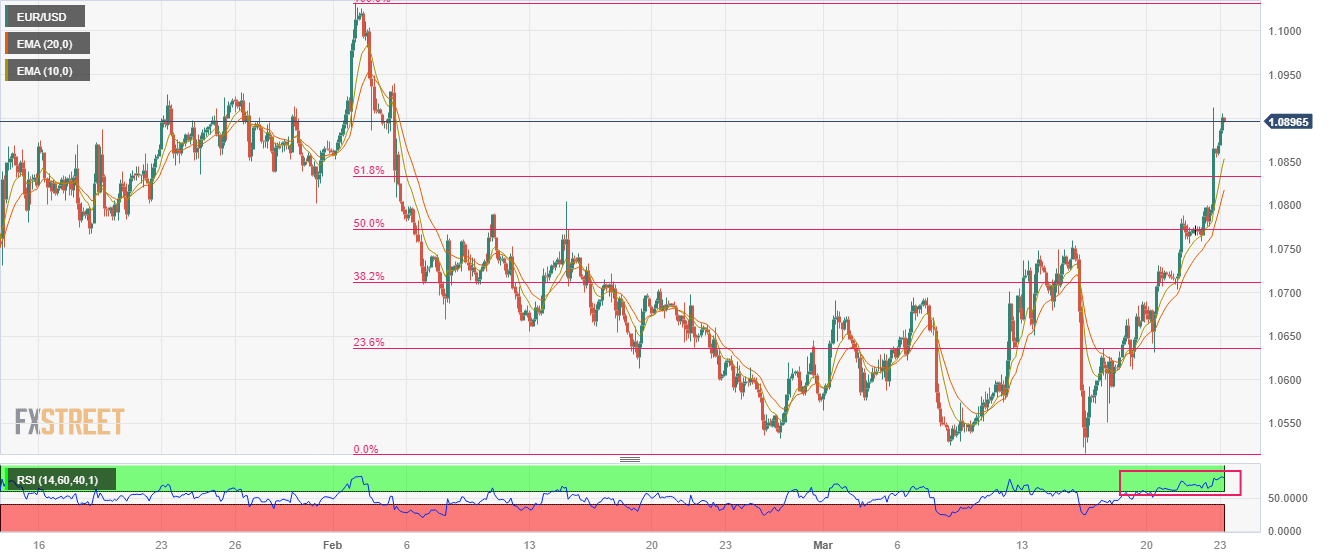

- EUR/USD has comfortably established above the 61.8% Fibo retracement, which cements more upside ahead.

EUR/USD is hovering near the round-level resistance of 1.0900 in the Asian session. The major currency pair is looking to surpass the same as the Federal Reserve (Fed) has delivered signs of pausing the policy-tightening process ahead.

The commentary from Federal Reserve chair Jerome Powell, “some additional policy firming may be appropriate” was sufficient to infuse confidence into the risk-perceived currencies. This indicates that Federal Reserve Powell is considering that the current monetary policy has come a long way and will be restrictive enough to ease the United States Consumer Price Index (CPI) to 2%.

The US Dollar Index (DXY) has refreshed its six-week low at 102.61 as investors see no further room for more rate hikes from the Federal Reserve. The USD Index is expected to continue its downside momentum further as fears of the US banking crisis have refreshed.

Treasury Yields plunge as US not assures blanket insurance for all deposits

US equities were having a ball in the first two days of the week as investors were considering that Federal Deposit Insurance Corp (FDIC) insures all consumer deposits in the First Republic, which will recede fears of the banking crisis and would restore the confidence of investors. However, US Treasury Secretary Janet Yellen commented on Wednesday that there is no discussion on insurance for all bank deposits without approval from the US Congress. She further added, the government "is not considering insuring all uninsured bank deposits."

The rollback of assurance led to a plunge in US Treasury yields and S&P500 as demand for US government bonds went rooftop. The 10-year US Treasury yields have dropped to near 3.45%. The two-year US Treasury yields that move closer to S&P500 have dropped further to near 3.89%.

Apart from the absence of insurance for all uninsured deposits, US Treasury yields have heavily plunged as Fed is considering a pause to the rate-hiking spree.

Fed confirms tight credit conditions from US banks to maintain financial stability

Federal Reserve Powell has said a big no to rate cuts in 2023 as the battle against stubborn inflation is on and will remain in effect till US inflation gets restored to desired levels. However, his commentary remained to favor extremely less room for a further rate hike. Therefore, the time has ripe now as the Federal Reserve will maintain these higher rates for a longer period.

In spite of the absence of more rate hikes, US inflation will continue to remain under pressure as US banks will tighten their credit conditions for businesses and households to safeguard themselves from delinquency. In his commentary, Federal Reserve Powell cited that US banking is sound and resilient but lends would remain cautionary while disbursing advances. This would cool off heated demand, the scale of economic activities, and inflationary pressures.

European Central Bank reiterates fears of higher inflation

A recent rise in energy costs in Eurozone is accompanying higher wage pressures in keeping inflation at elevated levels. The European Central Bank (ECB) has already pushed rates to 3.5% but has failed in bringing inflation down meaningfully. On Wednesday, Reuters reported, “The recent increase in financial market risks has made it more difficult for central banks to fight inflation,” the five “wise ones” who advise Berlin on economic policy said in their biannual report. The commentary from wise ones got strengthened after European Central Bank (ECB) President Christine Lagarde reiterated "Inflation is still high and uncertainty around its path ahead has increased."

EUR/USD technical outlook

EUR/USD has shifted confidently above the 61.8% Fibonacci retracement (placed from February 01 high at 1.1033 to March 15 low at 1.0516) at 1.0834 on a two-hour scale. Upward-sloping 10-and 20-period Exponential Moving Averages (EMAs) at 1.0854 and 1.0819 indicates that the upside momentum is extremely solid.

The Relative Strength Index (RSI) (14) is hovering in the bullish range of 60.00-80.00, which indicates more upside ahead.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.