EUR/USD gains on soft US employment data, ahead of FOMC’s meeting

- Euro gains to 1.0879 vs. Dollar, driven by disappointing US ADP Employment data and lower wage inflation.

- Fed's FOMC meeting awaited, with rate hold anticipated and Powell's remarks eyed for direction.

- Eurozone's economic slowdown hinted by German inflation, retail sales, and French inflation, stirring ECB rate cut talks.

The Euro stages a comeback against the US Dollar, rising 0.31% amid a busy economic calendar on both sides of the Atlantic. At the time of writing, the EUR/USD trades at 1.0879 after hitting a daily low of 1.0806.

EUR/USD climbs as markest digest US “dovish” data, eye Fed Powell’s speech

Data from the United States (US) featured the ADP Employment Change report, which came soft at 107K in January, below December’s 158K and forecasts of 145K. Nela Richardson, Chief Economist at ADP, said, “Progress on inflation has brightened the economic picture despite a slowdown in hiring and pay,” adding that “Wages adjusted for inflation have improved over the past six months, and the economy looks like it's headed toward a soft landing in the U.S. and globally.”

Recently, the Employment Cost Index (ECI) sought by Federal Reserve (Fed) officials as a measure of wage inflation dipped from 1.1% to 0.9% in Q4, meaning the labor market is cooling.

With economic data out of the way, EUR/USD traders' attention turns to the Federal Reserve’s (Fed) Open Market Committee Meeting (FOMC). Most analysts estimate the Fed will keep rates unchanged at 5.25%-5.50%, though most are eyeing Fed Chairman Jerome Powell's speech. Win Thin, an analyst at Brown Brothers Harriman, stated, “We believe Powell will take a much more balanced stance at this meeting, especially given how robust the economy remains.”

Across the pond, German Inflation eased to 3.1% YoY in January versus forecasts of 3.2%, fueling speculations that the European Central Bank (ECB) may cut rates sooner than expected as the Eurozone (EU) economy continued to decelerate according to Flash PMIs revealed in January. Other data from Germany witnessed Retail Sales plunging from 0.7% to -1.6% MoM figures, while inflation in France dipped from 3.7% to 3.1%.

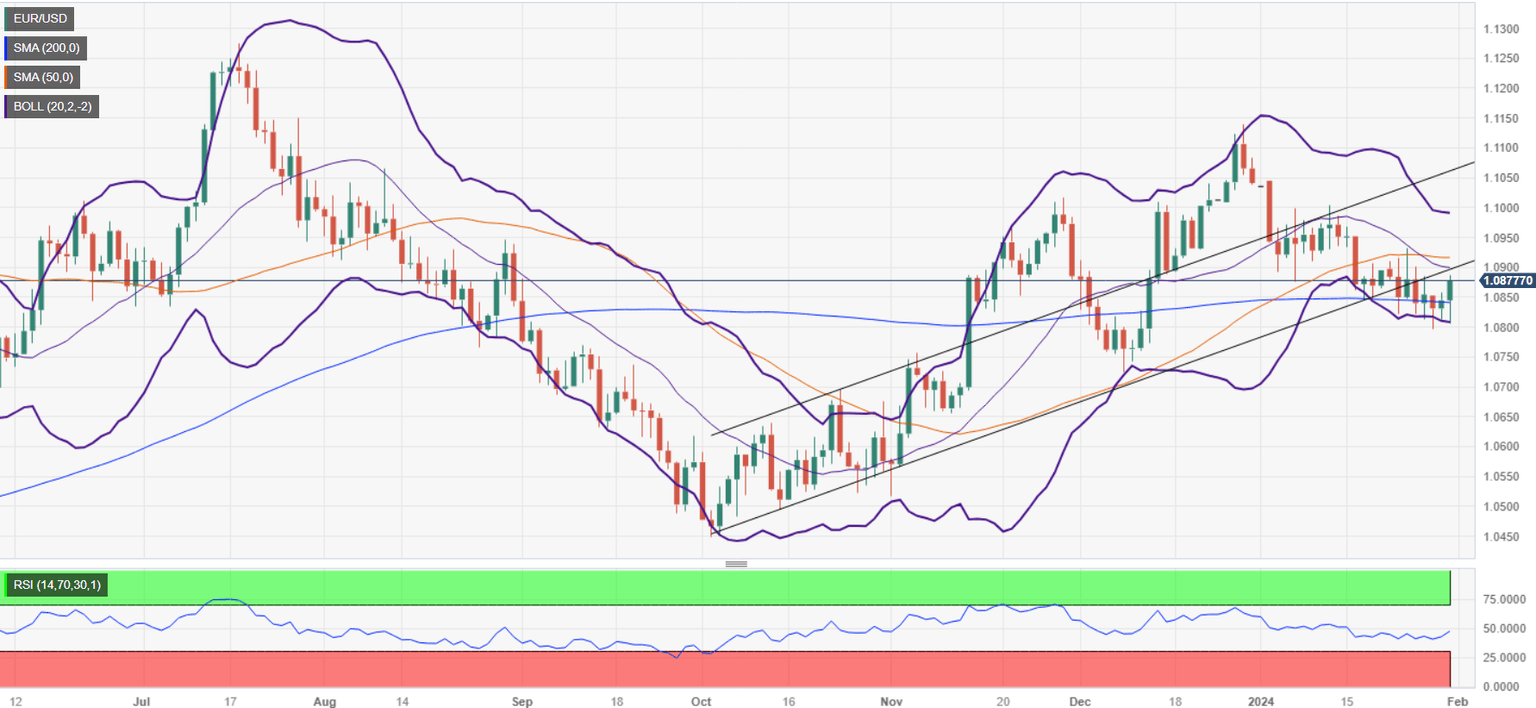

EUR/USD Price Analysis: Technical outlook

The EUR/USD tilted from bearish biased, to neutral-bearish as traders lifted the exchange rate towards the 1.0880s area. Further upside is seen if buyers reclaim 1.0900, with the next key level being the 50-day moving average (DMA) at 1.0916 before challenging 1.1000. On the flip side, if sellers keep the spot price below 1.0900, that could pave the way for a retracement, with their eyes set at the lows of the day at 1.0806.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.