EUR/USD finds support near 1.0720 after slow grind on Monday

- German CPI inflation continues to rise, but below forecasts.

- Fed rate call, pan-EU GDP and HICP inflation in the mid-week.

- NFP Friday a key US datapoint this week.

EUR/USD jostled on Monday, settling near 1.0720 after churning in a tight but lopsided range as markets settle in for the wait to Wednesday’s US Federal Reserve (Fed) outing. Investors broadly expect US rates to hold steady this week, but traders will be looking for an uptick in Fed guidance for when rate cuts could be coming. As of writing, the CME’s FedWatch Tool shows rate markets are pricing in 58% odds of a first rate cut in September.

German Consumer Price Index (CPI) inflation rose to 0.5% MoM in April, up from the previous month’s 0.4% but missing the forecast 0.6%. Germany’s YoY Harmonized Index of Consumer Prices (HICP) inflation ticked higher to 2.4%, compared to the forecast hold at 2.3%. Markets will be looking ahead to Tuesday’s HICP inflation for the pan-Euro area, which is expected to stand pat at 2.4% for the year ended April.

European Gross Domestic Product (GDP) figures are also due during Tuesday’s European market session, forecast to grind higher to a scant 0.1% in the first quarter compared to the previous quarter’s flat 0.0%.

The key headlines this week will be the Fed’s latest rate call on Wednesday, followed by Friday’s NFP labor data, which is expected to show a slight easing from the previous month’s 12-month peak of 303k. Friday’s US NFP is forecast to ease to 243k net additional job growth.

EUR/USD technical outlook

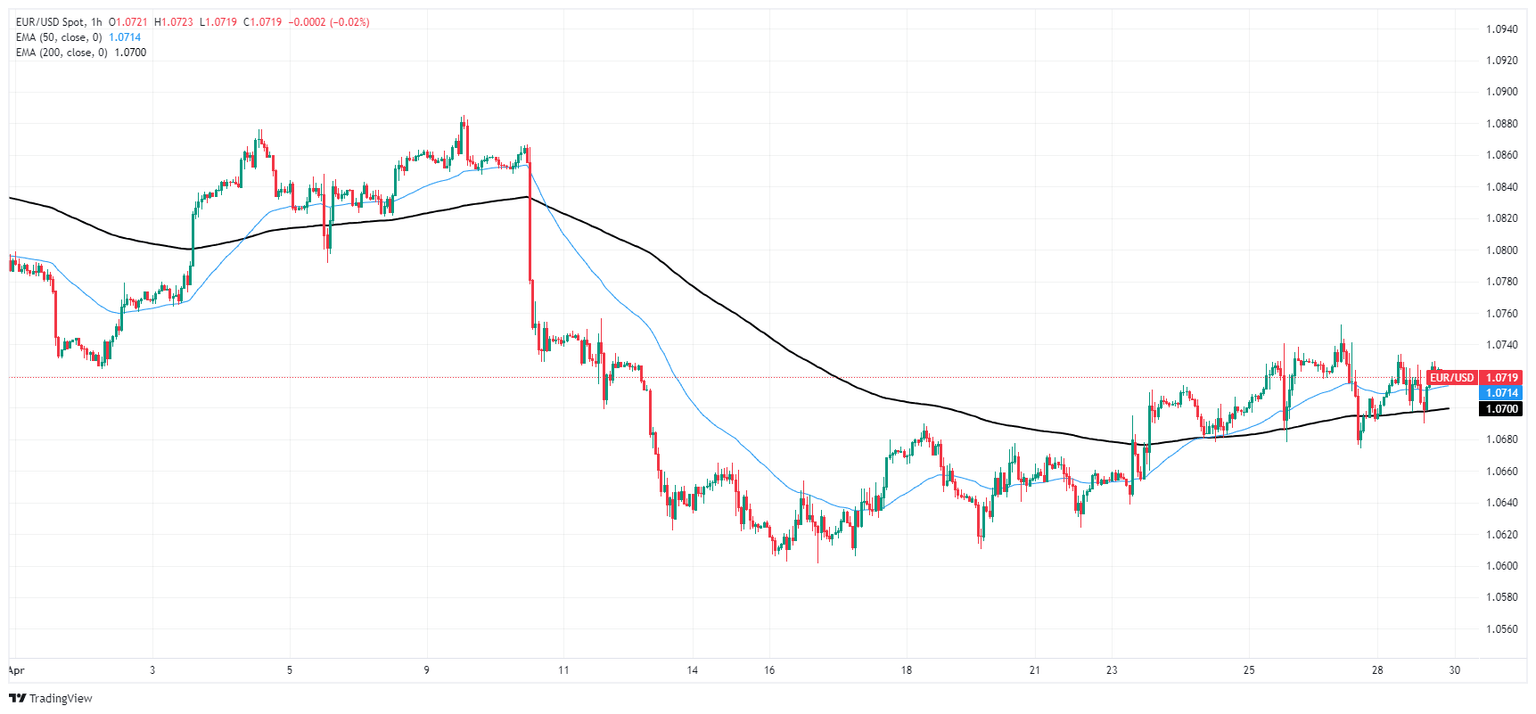

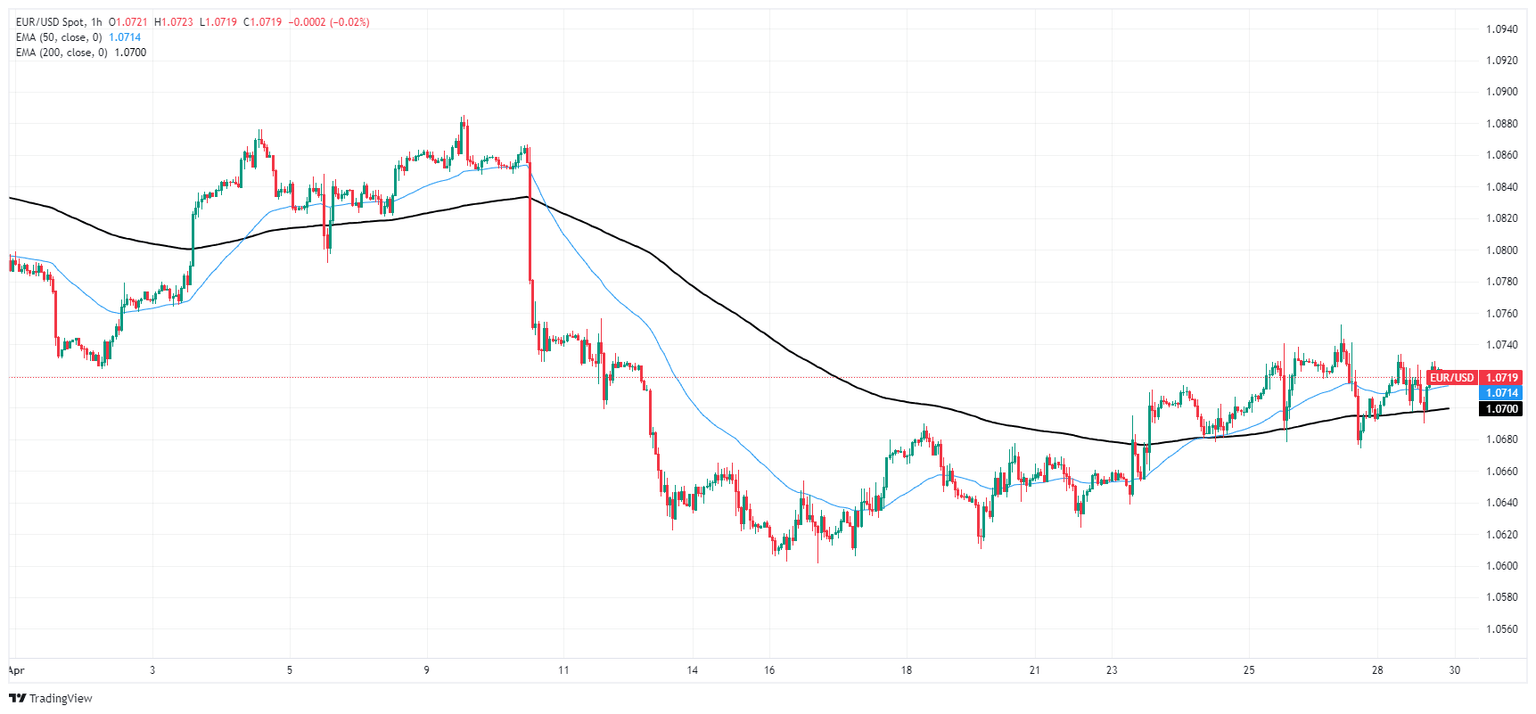

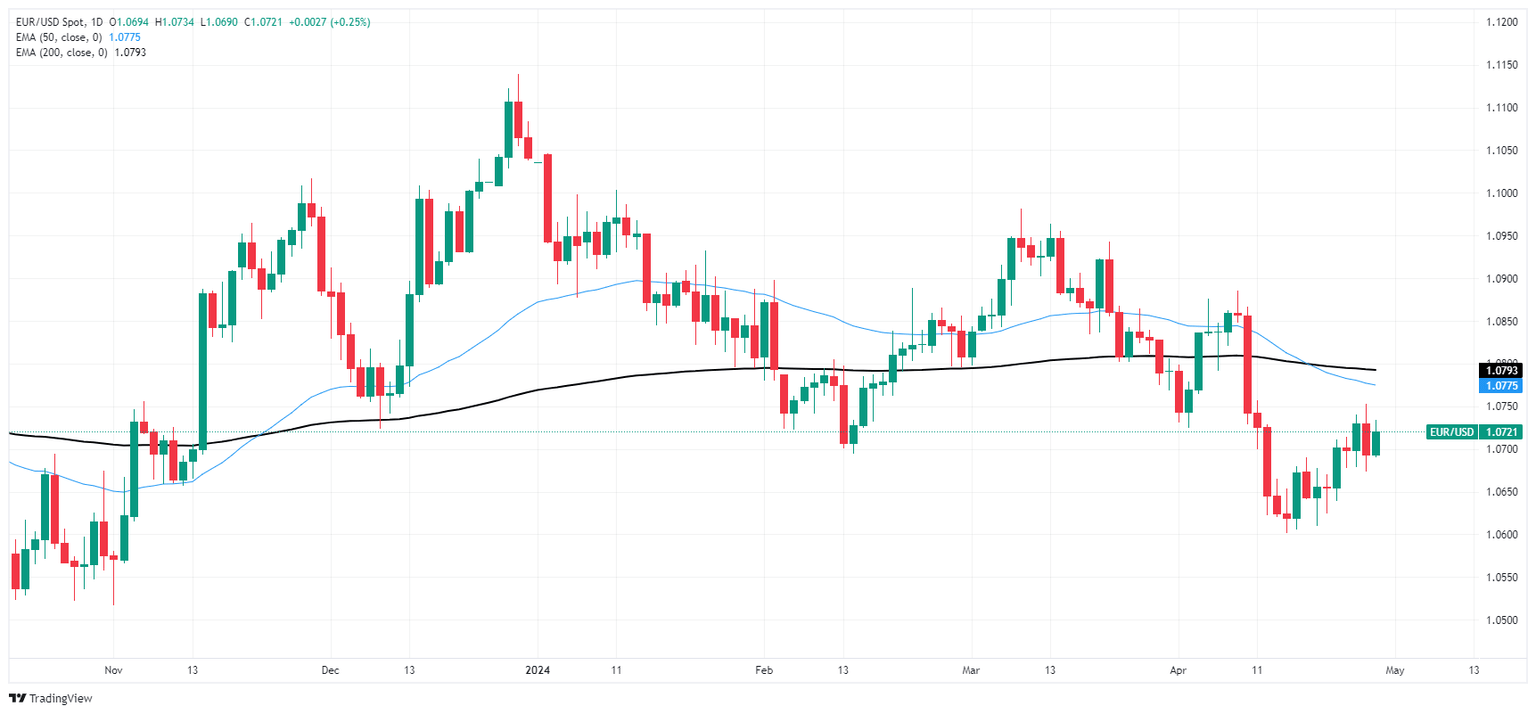

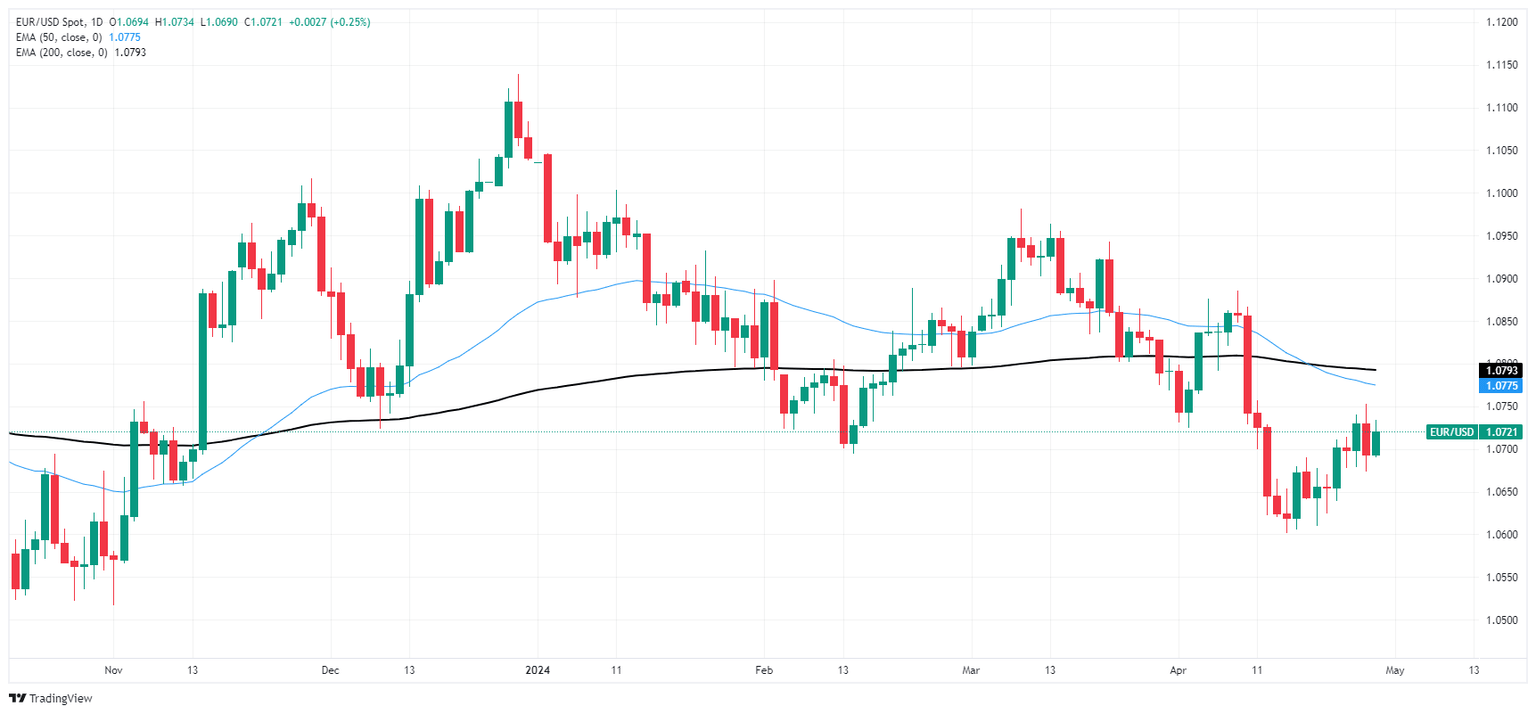

The EUR/USD churned just north of the 1.0700 handle on Monday as the pair continues to grind higher off of technical bounces from the 200-hour Exponential Moving Average (EMA) rising into the 1.0700 region. Chart paper north of 1.0750 is proving a difficult boundary to cross, and downside momentum, though sluggish, continues to keep the pair weighed down.

EUR/USD remains down 2.5% from the last major swing high into 1.0980, with a near-term price floor at 1.0600.

EUR/USD hourly chart

EUR/USD daily chart

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.