EUR/USD: Euro tumbles amid slowing EU’s business activity, drops below 1.0800

- EUR/USD pair fell to 1.0726, down 0.63%, as the Eurozone Producer Price Index and PMI data weakened than expected, signaling a slowing economy.

- Despite a contraction in business activity, ECB President Christine Lagarde maintains a hawkish stance on inflation, which remains above 5% on the consumer front.

- US Factory Orders beat estimates, and Fed officials hint at room for rate adjustments as traders await key US PMI.

The Euro (EUR) extended its losses against the US Dollar in the mid-North American session on Tuesday after data revealed that business activity in the Eurozone (EU) is slowing down amid the most aggressive tightening cycle of the European Central Bank (ECB). This underpinned the Greenback, alongside Fed officials giving a green light for higher rates. The EUR/USD is trading at 1.0726, with losses of 0.63%.

EUR/USD drops 0.63% as EU’s PMI disappoints, while inflation cools down; market eyes upcoming US PMI data and Fed decisions

Risk aversion triggered flows towards the Greenback; consequently, the Euro dropped. Data-wise, the Eurozone revealed its Producer Price Index (PPI) for July, which came at -0.5% less than estimates of -0.6% contraction, though worse than June’s -0.4% plunge. Despite showing the inflation trend continues downwards, inflation on the consumer front remains above 5%.

In the meantime, the EU’s economic strength faltered after S&P Global revealed its PMI for the bloc was below estimated and the prior month’s data, well below the 50 threshold that flashes expansion or contraction.

ECB policymakers, led by President Christine Lagarde, remain hawkish regarding inflation while acknowledging that the economy in the bloc is slowing down. Yet, Mrs. Lagarde has emphasized in her speeches since Jackson Hole that inflation is too high and that it’s the central bank’s job to keep inflation expectations anchored.

Nevertheless, a recent ECB consumer survey report showed that inflation expectations are climbing. Europeans see inflation for three years peaking at 2.4% in July from 2.3% in June, while speculations for one year stood at 3.4% unchanged.

On the US front, a scarce economic agenda in the United States (US), witnessed August’s Factory Orders in the United States (US) came in at -2.1%, better than the estimated -2.5%, according to the US Department of Commerce. This follows four straight months of increases.

In central bank news, Fed Governor Christopher Waller noted that the Fed has room to pause or hike in the next interest rate decision. Later, Cleveland’s Fed President Loretta Mester said the Fed would not continue to tighten monetary policy until inflation hits 2%, nor wait until it gets there, to lower rates.

The impact of 525 bps of tightening by the Federal Reserve continues to cool the US economy. Traders expect that the Fed will not raise rates at the upcoming meeting but still see a possible increase in November.

The August US ISM Non-Manufacturing PMI release is anticipated to show a minor slowdown from 52.7 to 52.5. Similarly, the S&P Global Services PMI is likely to exhibit a comparable trend, with estimates at 51, compared to July’s 52.3. If both readings align with expectations, this could exert pressure on the US Dollar. Such outcomes might reinforce the Federal Reserve’s pause in September and diminish the likelihood of an additional interest rate increase in November.

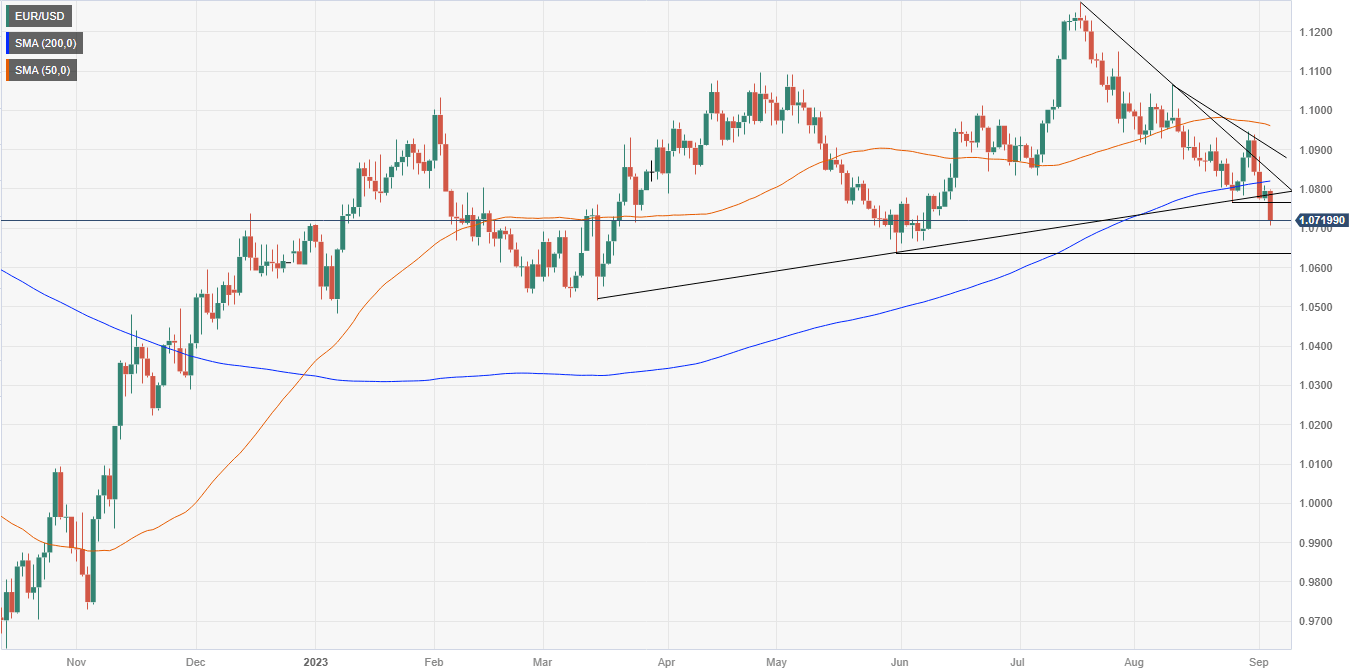

EUR/USD Price Analysis: Technical outlook

After dropping below the 200-day Moving Average (DMA) at 1.0819, the EUR/USD slipped below the 1.0800 figure, extending its losses towards a new three-month low of 1.0706. Yet, buyers stepped in and cushioned the major’s fall, which is still pressured. First support would emerge at 1.0700, the May 31 daily low of 1.0635, and the March 15 swing low of 1.0516. Conversely, upside risks would emerge above 1.0800, followed by the 200-DMA at 1.0810, before the pair challenges 1.0900.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.